Posted on January 17, 2024 by Nicholas McMurray

Below is my testimony before the House Financial Services Subcommittee on Non National Security, Illicit Finance, and International Financial Institutions on January 17, 2024 in a hearing titled, “International Financing of Nuclear Energy.”

Watch Niko’s Opening Remarks

Read Niko’s Full Testimony as Seen Below

Good morning, Chairman Luetkemeyer, Ranking Member Beatty, and Members of the Committee. My name is Nicholas McMurray. I am the Managing Director of International and Nuclear Policy at ClearPath, a 501(c)(3) organization that develops and advances policies that accelerate innovations to reduce and remove global energy emissions. To further that mission, we provide education and analysis to policymakers, collaborate with relevant industry partners to inform our independent research and policy development, and support mission-aligned grantees. An important note: we receive zero funding from industry. We develop and promote solutions that advance a wide array of low-emissions solutions — including advanced nuclear energy – that must be brought to bear to achieve our climate and development goals.

I appreciate the opportunity to address the Committee today regarding the crucial role of United States leadership in the international deployment of nuclear energy. The U.S. has a long, proud history of global leadership in nuclear technology. In 1951, the National Reactor Testing Station (forerunner to the Idaho National Lab) produced the first electricity powered by atomic energy. In 1955, the U.S. Navy launched the first nuclear-powered ship, the submarine USS Nautilus. Two years later, the first full-scale commercial power reactor was built in Pennsylvania. In response to oil price shocks and supply insecurity, in the 1970s, the United States initiated one of the largest deployments of nuclear reactors in history, reaching a peak of over 100 operating units in the 1990s.

Today, the U.S. aims to renew its global leadership. Recently, the U.S. and over 20 allies pledged to triple global nuclear energy capacity by 2050. This commitment recognizes reliable energy, like nuclear energy, is a necessary component to reduce global emissions while meeting economic development goals.

The International Energy Agency’s (IEA) 2023 World Energy Outlook shows that existing policies will leave the world a far cry from the goal of tripling global nuclear capacity. In particular, the IEA projects that existing policies will only increase global nuclear energy capacity by about 48% between 2022 and 2050. Tripling global nuclear capacity will be a significant undertaking that not only involves deploying new nuclear power plants domestically but also revitalizing the U.S. approach to building American reactors abroad.

I am excited to see this Committee address this monumental issue at such a timely moment. Achieving the global pledge to triple nuclear energy requires significant improvements to U.S. institutions as well as the modernization of the regulatory environment and export controls to reduce unnecessary red tape. This Committee plays a vital role in ensuring financing is available, especially to the developing world, for the global deployment of American clean energy technologies. Targeted investments in clean, reliable, affordable nuclear energy will contribute to enhanced energy security, geopolitical stability, and emissions reductions. With this in mind, I am going to highlight four important topics today:

Today, state-based actors like China and Russia are constructing more reactors each year, both domestically and internationally, and establishing more leadership in the global nuclear market. Although the U.S. still has the world’s largest domestic operating nuclear fleet, China is on its way to passing us. China currently has 55 reactors in operation and plans to build 23 new reactors across the entire country. In contrast, the U.S. has 93 in operation and only one under construction and nearing operational status – Vogtle Unit 4 in Georgia.

Recognizing the strategic advantage, these competitors are actively developing export markets for their domestic reactor technologies, a cornerstone of Russia’s foreign policy and likely to become one for China as well. When China or Russia sells a reactor to another country, the state-owned enterprise is the vendor, which receives significant diplomatic support and its deals are nearly fully financed by state banks on generous terms. For example, Russia provided Egypt with $25 billion – around 85% of the full cost – in financing on generous terms. Russia loaned Bangladesh 90% of the full cost of the Rooppur project with a cap on the interest rate. China recently announced it would provide the full cost, $4.8 billion, of a reactor it is building in Pakistan, and even gave a $100 million discount on the construction. Besides the geopolitical influence and economic value, these export markets play a crucial role in sustaining domestic industries.

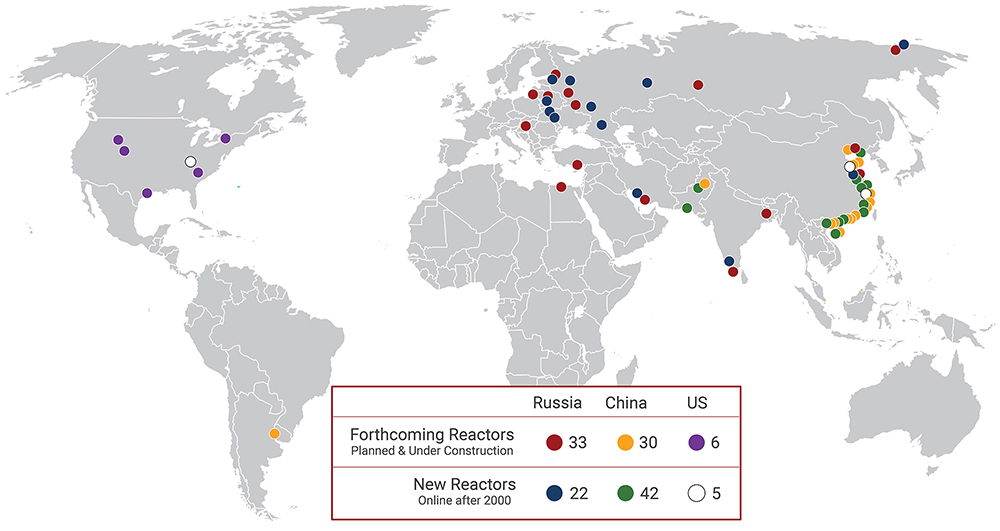

Globally, Russian and Chinese reactors are in development in NATO-ally countries like Hungary and Turkey, as well as in significant U.S. partners like Egypt, Pakistan, and Argentina. Since 2000, Russia and China have collectively constructed 64 new reactors abroad, whereas the U.S. has built only five. As of March 2023, only six reactors were under development abroad by U.S. nuclear companies. Recent announcements to build three U.S.-designed reactors in Poland and three more reactors in Canada bring that total to 12 U.S.-designed reactors under development today.

New and forthcoming reactors worldwide (as of March 2023)

Competitor dominance of the civil nuclear export market challenges nuclear safety and safeguards standards, as well as undermines diplomatic partnerships and various U.S. geopolitical and economic priorities. The longevity of nuclear power plants, which can operate for 60 years or more, are a strong tool to secure our own partnerships for energy diplomacy. China and Russia offer a full-service suite of options, including construction, fueling, operation, waste disposal, and decommissioning. This approach can create decades-long dependencies for each reactor built by China and Russia. However, thanks to our strong civil nuclear industry, American companies can still provide services in a country that has a foreign reactor. For example, Ukraine’s fifteen nuclear reactors are of Russian design, and provide about half of the country’s electricity. This creates a significant dependence on Russia for nuclear fuel. However, a few months ago, Westinghouse manufactured and delivered new non-Russian fuel for Ukraine.

The last several years brought significant upheaval to global energy markets. Disruptions related to COVID, the Russian invasion of Ukraine, and escalating tensions with China underscore the critical importance of energy security, not only for the United States but also for allies and partners worldwide. In the aftermath of the shortages of natural gas in 2022, many countries are cautious about making substantial commitments that would tether their energy security to Russia. For example, in 2022 Finland canceled a deal for a Russian-built reactor. Additionally, the escalating debt crisis stemming from Chinese investments may prompt countries to seek new partners.

Fortunately, the United States is well-positioned to seize this opportunity. Innovative companies are developing cutting-edge advanced nuclear technologies, and the U.S. remains a global leader in nuclear operations. This mirrors the success the U.S. is having in the natural gas sector. Public-private partnerships created the innovation in hydraulic fracturing that drove the massive shale boom. Today, the U.S. is by far the world’s leading producer of natural gas and exporter of liquified natural gas (LNG). This is a boon for the U.S. economically and geopolitically and drives significant emissions reductions. This dynamic could repeat itself in the advanced nuclear market, where a vibrant and dynamic advanced nuclear industry, led by innovative private companies and supported by public-private partnerships, is emerging in the United States.

For many countries, the United States continues to be the partner of choice. Initiatives at the U.S. Department of State and Department of Energy (DOE), such as the Foundational Infrastructure for Responsible Use of Small Modular Reactor Technology (FIRST), have expanded the U.S. footprint of nuclear cooperation agreements. The global economic and policy landscape is primed for the United States to rapidly demonstrate and deploy these clean, reliable, and U.S.-made technologies.

While the U.S. and its allies have publicly committed to tripling global nuclear energy capacity, realizing this goal requires more than pledges alone. The U.S. must modernize its approach to keep pace with the global market to gain a competitive advantage. Congress can provide further direction to various government agencies by focusing on three major topics: 1) The U.S. needs an export strategy; 2) Supercharge U.S. export finance tools; and 3) Remove red tape that prevents scaling up nuclear technology.

The expansion of China’s Belt and Road Initiative and Russia’s invasion of Ukraine have underscored the enduring need for the U.S. to be the global leader in energy exports. This leadership is essential not only for domestic energy security and achieving climate objectives but also for those of U.S. partners. Effectively countering China and Russia in this arena will require coordinated action by EXIM, the DFC, and others working in conjunction with partners and allies.

Unfortunately, the United States’ current approach to commercial diplomacy and export support for nuclear energy is fragmented and lacks cohesion. The process of exporting a nuclear reactor involves coordination among multiple entities, including Departments of State, Energy, Commerce, the Nuclear Regulatory Commission, EXIM, DFC, the U.S. Trade Representative, the National Security Council (NSC), and others. While some initiatives, like the FIRST program, have attempted to coordinate these agencies and advance commercial cooperation with U.S. allies abroad, they are tied to individual Presidential administrations. Actions like institutionalizing the FIRST program would codify these gains and create a platform to improve upon. Ultimately, for U.S. companies to compete with the state-backed Chinese model, organized support across the federal government and the private sector is crucial.

Legislation has been introduced, such as the bipartisan International Nuclear Energy Act (H.R. 2938), sponsored by Representatives Donalds (R-FL) and Clyburn (D-SC) to address these challenges. This legislation aims to formulate a civil nuclear export strategy to counter the growing influence of Russia and China. The proposed solution involves developing a national strategic plan that advocates for partnerships with allied nations and encourages coordination among civil nuclear nations in areas such as financing, project management, licensing, and liability. The bill emphasizes the importance of prioritizing safety, security and safeguards as foundational elements for a successful and competitive nuclear export program. Additionally, the legislation establishes an Office of the Assistant to the President and Director of Nuclear Energy Policy to oversee the implementation of the strategy to ensure cohesion and coordination.

Currently, the World Bank and other similar IFIs lack expertise in nuclear energy projects and, consequently, refrain from funding them. The U.S. Secretary of the Treasury serves as a Governor of the World Bank, providing the U.S. with an opportunity to leverage this influence. The International Nuclear Energy Financing Act, introduced by Representatives McHenry (R-NC) and Hill (R-AR), would require the United States Executive Director at the World Bank to advocate and vote for financial assistance for nuclear energy. The bill would also permit U.S. representatives at other international financial institutions – including regional development banks for Asia, Africa, Europe, and Latin America – to push for nuclear projects. The World Bank and other multilateral development banks play a significant role in infrastructure planning around the world, so getting them engaged in nuclear energy will be instrumental in increasing global deployment.

Since 2000, China has rapidly ascended as a pivotal financier in global energy, committing more than $234 billion to some 68 strategically significant nations. China channeled a staggering 75% of these investments toward projects in coal, oil, and gas. Between the years 2016 and 2021, China’s financing of global energy initiatives outpaced the combined contributions of all major Western-backed Development Banks. Chinese authorities have expressed their intent to construct up to 30 nuclear reactors abroad by 2030, with agreements already finalized in Argentina and ongoing negotiations with Saudi Arabia, Kazakhstan, and other nations.

Once China nears completion of its ambitious domestic nuclear buildout, it is reasonable to expect to see a sharp pivot abroad and a surge of Chinese nuclear reactor exports, complete with predatory lending practices and coercive, non-market tactics. Generous state-sponsored financing is likely to support these projects. Earlier this year, China and Pakistan celebrated the completion of the Karachi Huanglong One 1.1 GW nuclear power plant, backed by Chinese financing at a cost of $2.7 billion. Unfortunately, this is a more competitive price point than comparable U.S. commercial ventures, so the U.S. needs to compete in other areas – such as operations, safety, security, technical and regulatory expertise, and fuel.

The dynamic and innovative U.S. nuclear technology companies are not operating in a fair and open market. It is imperative that the U.S. level the playing field for its clean energy exports by advancing thoughtful reforms to existing agencies. As two of ClearPath’s advisors — DJ Nordquist, Former World Bank Group Executive Director, and Jeffery Merrifield, Former NRC Commissioner — noted in a Foreign Affairs piece, last year, an Egyptian presidential advisor told a group of U.S. lawmakers that countries like hers want dependable energy financing and would welcome American investment, but the U.S. hasn’t been showing up to meet that demand. That’s why Egypt, a major non-NATO ally of the U.S., instead selected Russia’s Rosatom to finance and construct its new nuclear plant. The El Dabaa nuclear power plant is already under construction and will likely lock Egypt into a relationship with Russia for decades.

Improvements to existing agencies are needed to compete globally. EXIM is designed to enhance the competitiveness of U.S. exporters in the global marketplace. In the December 2019 reauthorization of EXIM (P.L. 116-94), Congress directed EXIM to establish a “Program on China and Transformational Exports” (see Sec. 402) with the intention of countering China’s state corporations’ business practices by expanding EXIM’s mandate to support exports in transformational sectors; however, it currently excludes nuclear technologies.

Proposed legislation such as the Civil Nuclear Export Act of 2023 (CNEA), sponsored by Senators Manchin (D-WV) and Risch (R-ID), seeks to address this gap by including nuclear projects in the “Program on China and Transformational Exports.” CNEA introduces several measures aimed at enhancing the ability to provide competitive financing options and compete effectively in emerging markets globally. This adjustment is expected to provide additional support to nuclear projects facing competition from Chinese state corporations. This legislation would also raise EXIM’s default rate limit from 2% to 4%, which would allow EXIM extra flexibility to support larger nuclear power projects.

Similarly, the DFC plays a pivotal role in bolstering U.S. clean energy exports by providing finance for highly developmental projects, including energy infrastructure. Established by the bipartisan BUILD Act of 2018 and formally incorporated in late 2019, Congress envisioned the DFC as a powerful successor to the Overseas Private Investment Corporation (OPIC), equipped with broader authorities and a greater capacity to invest in burgeoning foreign markets. These unique authorities include the ability to make long-term loans, take equity investment positions, and exhibit more flexibility than EXIM regarding the types of projects it can support. Notably, in 2020, the Trump Administration lifted the DFC’s ban on supporting nuclear energy projects, highlighting its evolving role in facilitating the advancement of clean energy initiatives.

Until now, the DFC has only engaged with U.S. nuclear export projects on a preliminary basis. The corporation lacks nuclear-specific operational experience and dedicated staff with expertise on projects in the nuclear sector. This limitation hampers its ability to assess the technology risk and intricacies of these complex projects. The DFC’s CEO, Scott Nathan, recently highlighted another significant constraint; the current budgetary scoring system fundamentally undermines the equity investment tool granted to the DFC by Congress, preventing the agency from providing more flexible financing options. Lastly, DFC’s cap of $1 billion for individual investments may impede the agency from supporting larger nuclear projects. While DFC has signaled support for the Romanian and Polish nuclear power projects, the cap restricts the level of support to significantly below the likely project cost.

The DFC is due for reauthorization in the Fall of 2025. This presents an opportune moment to reassess, refine, and enhance the corporation, its tools, and its mandate to better align with U.S. strategic energy objectives. Without strengthening entities like DFC, the U.S. puts itself and its private-sector innovators at a strategic disadvantage against foreign state-owned enterprises looking to build abroad.

Tripling the world’s nuclear capacity is a massive undertaking that will require constructing hundreds of new reactors. This could entail obtaining numerous regulatory approvals and licenses in the United States alone. However, challenging regulatory barriers, lengthy licensing and permitting timelines, and bureaucratic inefficiencies have proven to be significant obstacles to the development and deployment of advanced nuclear reactors here in the United States. Overcoming these challenges is crucial for successfully implementing ambitious nuclear energy expansion.

Introducing innovative U.S. nuclear technologies to the world is essential for fulfilling the tripling pledge and aligning with geopolitical security goals. The Nuclear Regulatory Commission (NRC) will almost certainly need to license a reactor design in the U.S. before a country would be willing to build it. Especially for countries looking at nuclear energy for the first time, they are likely inclined to prefer designs with a proven safety track record in the U.S. An efficient and agile U.S. regulator is therefore fundamental, not only for domestic deployment but also for ensuring the competitiveness of the U.S. nuclear industry in the international market. The NRC anticipates at least 13 current and potential applications by 2027, and it’s important that these move forward expeditiously.

The NRC is responsible for overseeing the safe operation of nuclear power in the United States. To achieve ambitious goals, it is vital for the NRC to attract and retain the right staff and capabilities. Additionally, modernized structures, processes, and policies need to be established to efficiently and effectively review and license the diverse array and volume of new nuclear technologies. This modernization aims to provide a predictable regulatory environment while maintaining reasonable assurance of adequate protection of public health and safety.

Even after the NRC licenses a reactor design and the reactor is constructed and safely operated, it then still must receive export approvals, and be licensed by the other country’s regulator. A company seeking to export a reactor to a partner country faces a multi-step process. It must obtain export licenses or authorizations to export the reactor, fuel, and other related equipment from the NRC under 10 CFR Part 110, from the Bureau of Industry and Security at the U.S. Department of Commerce for equipment subject to EAR (Export Administration Regulations), and then by the DOE’s National Nuclear Security Administration under 10 CFR part 810. Furthermore, a corporation can only transfer nuclear technology to countries in which the Department of State has negotiated a “123 Agreement.” This intricate regulatory framework underscores the complexity involved in exporting nuclear technology and highlights the necessity of complying with various governmental entities.

It is essential for nuclear reactors to be well-regulated to prioritize safety, security, and non-proliferation. Modernizing the NRC is a critical initial step. Yet, beyond that, there is a need for harmonizing and streamlining international regulatory processes to facilitate the efficient and expeditious deployment of nuclear reactors on a large scale.

The NRC can contribute to the goal of tripling nuclear energy worldwide by taking on greater international cooperation and relationship-building activities. The NRC could conduct joint reviews of regulations with international partners to allow for better alignment between U.S. and foreign regulatory bodies. The NRC could also incorporate and leverage harmonized license reviews performed by non-U.S. regulators into its reviews, and lay the groundwork for other regulators to do the same. New nuclear energy will have a global impact, and regulatory practices can be shared to strengthen international partnerships, accelerate the learning curve of global regulators to improve safety and security, and ease the burden on U.S. innovators deploying internationally. Further Congressional action and direction is needed to undertake a full-scale international initiative to lower regulatory barriers to export markets.

An all-of-the-above clean energy strategy is the only viable path for achieving global emissions reduction targets, which means the world needs to quickly deploy clean, reliable, affordable energy like nuclear power. At a time when China and Russia are ramping up financial support, the U.S. needs to reinvigorate not only its own financing tools, but also call upon IFIs like the World Bank to reassess their nuclear energy policies, including opportunities and challenges, rather than simply defaulting to “no.”

Thank you again for the opportunity to testify today. ClearPath is eager to assist the Committee in developing innovative policy solutions to ensure U.S. leadership in international clean energy financing. We applaud the Committee for taking on this critical task to help ensure the appropriate action, including policies that will help advance innovative technologies to provide clean, reliable, and necessary energy to the United States and the world.