Metals are the backbone of society used in buildings, bridges, cars and more. Within metals, steel is a major focus area because steel is the most widely-used metal in the world, with nearly 2 billion tons of steel manufactured globally each year and more than 3,500 different types or grades. In addition, every ton of steel produced generates, on average, 1.85 tons of carbon dioxide. Due to its volume and carbon intensity, steel represents approximately seven percent of global emissions.

Global demand for steel is expected to increase significantly over the next several decades, driven by rapid urbanization in nonindustrialized countries and the shift to adopt clean technology. Each new megawatt of solar requires approximately 35 to 45 tons of steel while each new megawatt of wind requires 120 to 180 tons of steel. Based on projected renewable energy growth, this conservatively translates to 74 million tons of new international steel demand and 163 million tons of carbon emissions if we stick to dominant production methods. Considering the amount of clean power and clean technology we need to deploy by 2050 to meet private and public decarbonization goals, steel will be the backbone of the U.S., and global, clean technology transition.

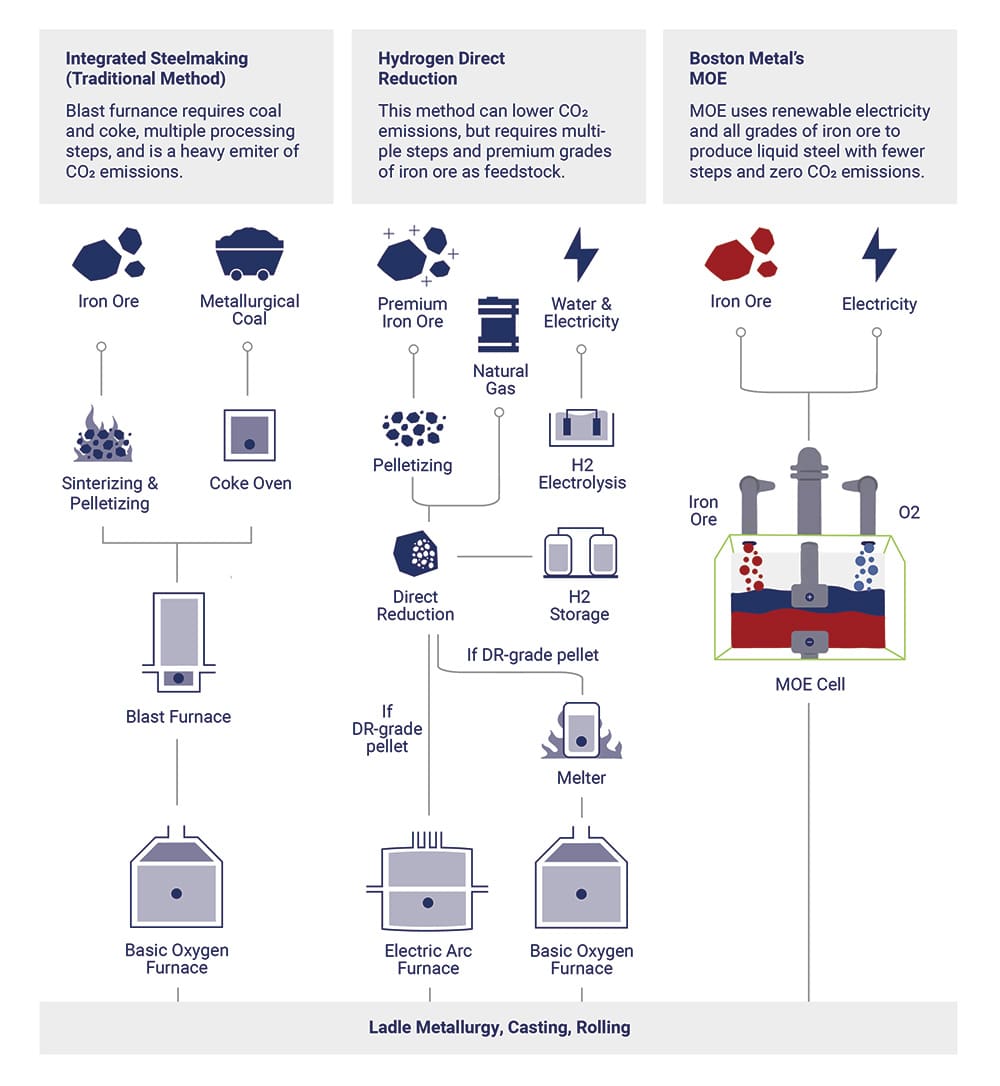

Steel’s carbon intensity is primarily driven by its use of heating coal in a furnace to create “coke,” which is then used by a traditional blast furnace-basic oxygen furnace (BF-BOF). In this production process, iron ore, limestone, and coking coal are fed into blast furnaces to provide ultra-hot heat. Then oxygen is injected to reduce the carbon content and remove impurities – producing a significant amount of waste gas containing carbon dioxide. While BF-BOF steelmaking only represents 30% of U.S. steel production, it represents roughly 75% of global steel production, especially in China and India, which are major demand centers for steel.

Alternatives to BF-BOF steelmaking include using natural gas as a chemical agent to produce direct reduced iron (DRI) and producing steel in electric arc furnaces (EAF) using recycled steel. However, these production methods still lag behind BF-BOF steelmaking — EAF-produced steel only makes up roughly 25% of global production. These pathways do offer material emissions reductions: EAF steel production can lower emissions by two-thirds, while natural-gas powered DRI can reduce steel emissions by about half.

Demonstrate Carbon Capture for Steel & Ironmaking At Scale- Steel manufacturers and technology developers are actively exploring how to implement carbon capture and storage (CCS) at steel facilities. According to the DOE, CCS on existing BF-BOF facilities and DRI facilities powered by natural gas is a key lever for emissions reduction from now through to 2040. Large-scale demonstrations are required to reduce the cost of CCS on BF-BOF facilities by $75 per ton of carbon.

Implement Recently Enacted Policies- The federal government has already opened the door for manufacturing facilities to benefit from capturing carbon through the federal carbon capture tax credit 45Q. Continued research and development, in both retrofits and new steel manufacturing processes, can improve the efficiencies and drive down the cost of carbon capture technologies. In addition, the 48C tax credits also should be geared to advance steel carbon capture through Treasury guidance that does not discriminate against steel carbon capture projects. Furthermore, the Office of Clean Energy Demonstrations (OCED) in the U.S. Department of Energy (DOE) is responsible for administering the Advanced Industrial Facilities Program, and should fund steel CCS projects to drive costs down and mature the technology.

Implement The SUPER ACT To Pilot New Technologies And Promote Deployment Partnerships- There are still other process improvements and alternative technologies that hold potential. Funding towards further research and demonstration is needed to determine the viability of these technologies and has been authorized through the Steel Upgrading Partnerships and Emissions Reduction (SUPER) Act, a bipartisan provision enacted as part of the CHIPS and Science Act of 2022. Policymakers can further advance steel innovation by supporting and directing the DOE to implement SUPER according to Congressional intent and at the speed and pace required.

Bolster and Expand Research, Development, and Demonstration (RD&D) Efforts in Iron and Steelmaking- The Advanced Research Projects Agency-Energy (ARPA-E) in the DOE announced the ROSIE program: a $35M effort to research technologies that can enable zero process emissions iron-making and low-emissions steelmaking. Efforts like ROSIE should be extended and bolstered and are crucial to seed technologies that can fundamentally shift iron and steelmaking towards clean methods, especially iron-making which has so far required coking coal as a key component of the manufacturing process. Efforts like ROSIE should also focus on R&D to expand EAF production to all flat steel products. Currently 50% of flat steel products are made using low-carbon EAF methods and 50% are produced using higher-polluting BF-BOF methods. Expanding flat steel to EAF methods will reduce emissions in sectors like auto and defense industries that are currently made using BF-BOF.

Encourage A Transparent Supply Chain- With increased interest from the steel industry to decarbonize, cleaner, low-emission technologies would be able to benefit from disclosures that stimulate market-based procurement of steel. Lifecycle assessments (LCA) and environmental product declarations (EPD) are a few of the widely-accepted tools for reducing the embedded emissions of products.

Pilot Demand-Side Programs for Low-Carbon Steel- One type of demand-side incentive includes advanced market commitments (AMCs). AMCs are price and/or volume guarantees that the federal government can offer to producers of low-carbon steel prior to production, reducing investor risk and catalyzing investment. AMCs have been successfully implemented by NASA to develop a private spaceflight industry in the US and reshore rocket re-supply capabilities, and by private companies to jump-start the carbon removal industry. AMCs are well-suited to advance technology-neutral innovation by maximizing ‘shots on goal’ through funding a portfolio of technology and project types. AMCs function as fiscally responsible policies if fund disbursement is tied to projects reaching technical and commercial milestones or delivering products of the required quality on time. Demand-side support can also come from federal construction materials procurement of low-carbon steel. Federal agencies such as the Department of Transportation (DOT) or the General Services Administration (GSA) already spend billions on steel annually. Their purchasing power can be leveraged to procure low-carbon steel.

Source: Boston Metal