In an era defined by rising global competition, rapid technology deployment and the insatiable demand for abundant, reliable power, American innovators need the Department of Energy’s Office of Energy Dominance Financing (EDF) – formerly known as the Loan Programs Office (LPO) – to play an integral role in scaling innovations of the future and providing access to capital not otherwise available to early-stage technologies. EDF helps ensure access to reliable, secure and affordable supplies of American energy technologies.

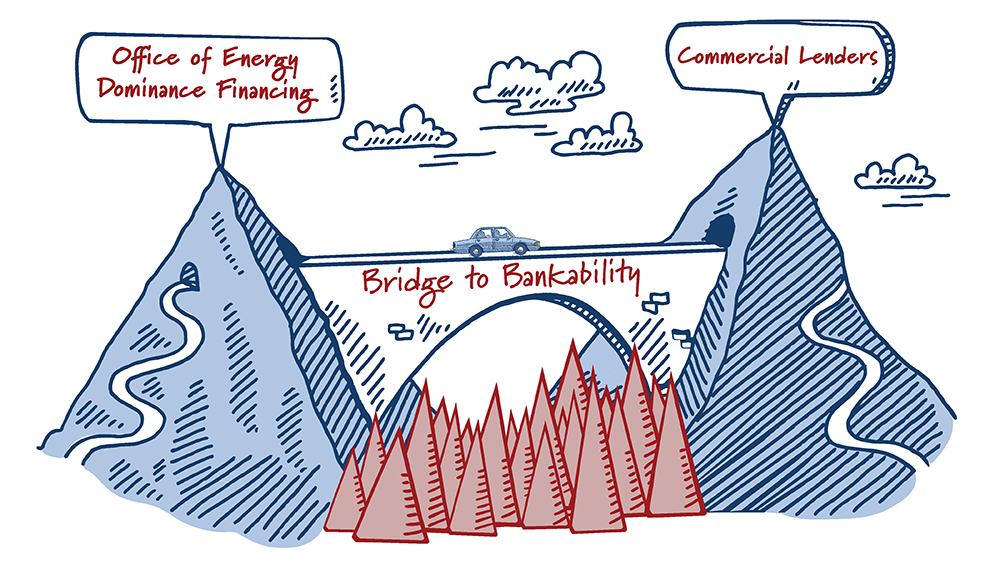

A powerful and unique government financing tool, EDF can bridge the financing gap between early-stage innovation and commercial deployment. If properly mobilized, EDF can serve as a catalyst for American energy dominance, enabling the broad deployment of technologies to keep the U.S. competitive on the global stage.

Purpose

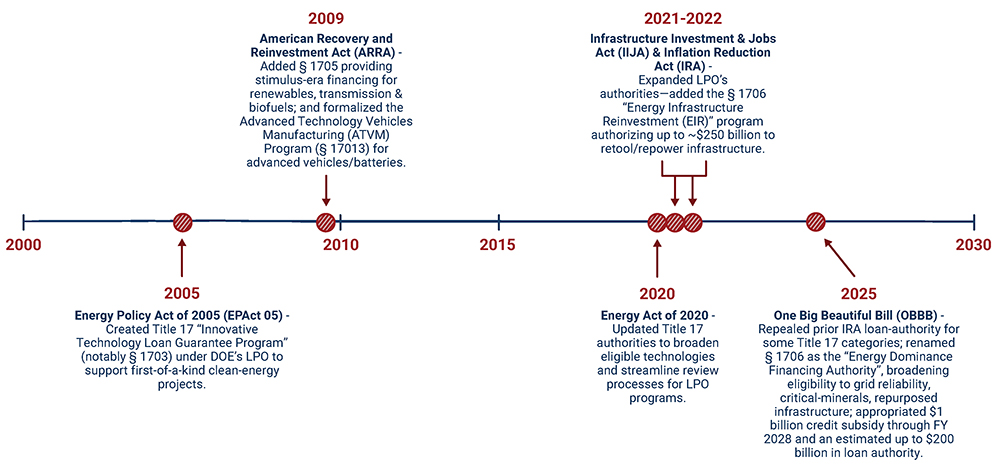

Recently renamed the Office of Energy Dominance Financing, Congress originally created the Loan Programs Office (LPO) in the bipartisan Energy Act of 2005 as a tool to commercialize innovative energy technologies. Attracting early-stage private financing is often difficult for initial commercial deployments and first-of-a-kind (FOAK) technologies, like advanced nuclear reactors and next-generation geothermal systems, because they frequently require large infrastructure investments and do not yet have a track record of success or risk. This “bankability” gap limits access to private commercial lending. EDF provides a solution through technical and financial assistance, enabling promising but unproven technologies to secure financing and scale to commercial deployment.

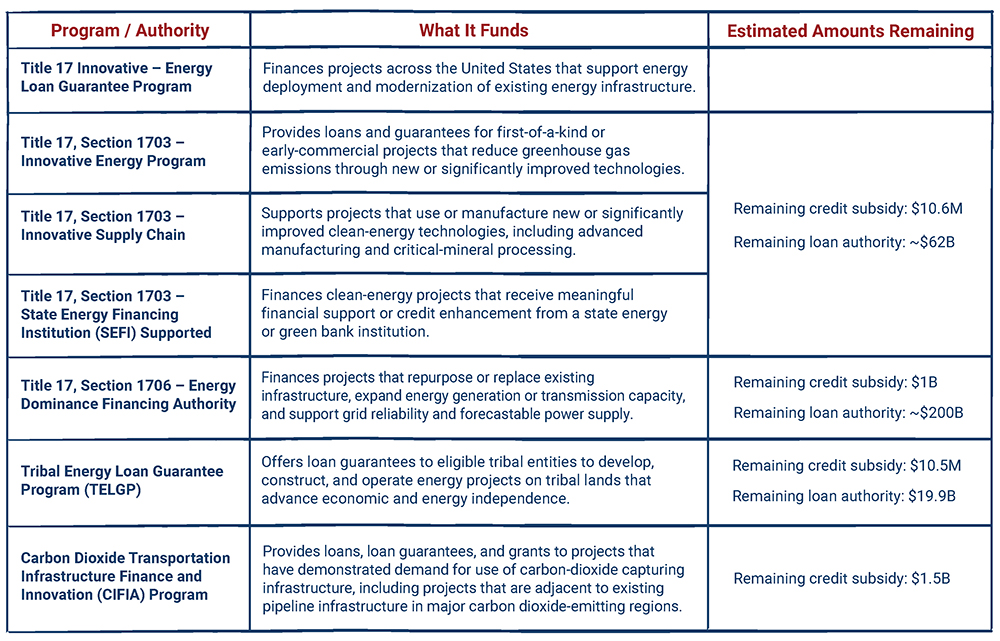

Since 2005, Congress has continuously updated this office’s programmatic authorities and priority areas. Today, EDF is not a single program, but a suite of programs that administer direct loans and loan guarantees for a range of energy technologies. A snapshot of those programs and eligible projects, including those focused on reducing greenhouse gas emissions, scaling innovative technologies, supporting critical minerals development, enhancing transmission, biofuels and others is presented below.

EDF is estimated to have ~$282 billion in remaining loan authority, according to analyses from

ThirdWay, Holland & Knight, and the Foundation for American Innovation.

EDF’s business functions are split into three teams: business development, origination and portfolio management.

Similar to other lending institutions, EDF is staffed with experts across nuclear, fossil fuel, utility, manufacturing, grid and transmission sectors. Unique to EDF is access to the unmatched technological expertise of America’s national laboratories and DOE scientists and engineers. This structure enables EDF to confidently underwrite loans that would be unavailable at private financial institutions for innovative commercial energy and critical minerals projects.

EDF helps finance energy and infrastructure projects that employ new or significantly improved technologies. Institutionally, EDF retains expert staff and unique financial levers to catalyze commercial-scale tech through the following process:

The two main EDF financial instruments are:

A central feature of EDF is its credit subsidy, which reflects the net present value of all expected cash flows to the federal government. It accounts for repayments, recoveries, fees and risk-related factors, ultimately representing the government’s estimate of potential default cost. This structure allows EDF to make fiscally responsible investments in emerging technologies that strengthen national competitiveness.

As noted earlier, EDF addresses the “bridge to bankability” by helping companies achieve the following key commercialization milestones: 1) first commercial-scale deployment, 2) follow-on deployments, 3) commercial scale-up and 4) debt market education.

Through direct loans and loan guarantees, the federal government helps bridge the “valley of death” between early-stage innovation and full commercial deployment. EDF catalyzes bankability, providing financial options and due diligence where private and traditional lenders often hesitate to invest alone due to uncertain risk profiles.

The EDF addresses the “Valley of Death” – Crossing the Financing Gap

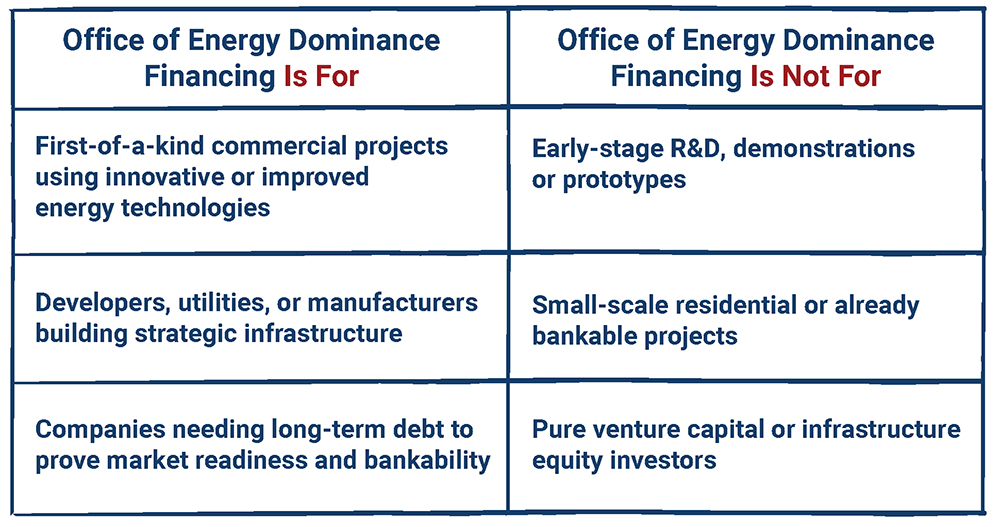

EDF provides debt financing for large-scale (typically $100M+) energy projects that are commercially ready with high technology risk, not R&D pilot projects or run-of-the-mill, nth-of-a-kind infrastructure. While projects that are earlier in their commercial journeys have other DOE funding levers available, EDF welcomes financing applications from energy tech manufacturers, critical minerals developers, regulated utilities, public power entities, independent power producers and others.

The EDF is also structured to provide expert technological and commercial due diligence, and review everything from the business case to the technology readiness and engineering feasibility. EDF is structured to provide “patient capital,” meaning that applicants can engage early in a project’s lifecycle and provide a longer runway, rather than solely focusing on a return like traditional lenders. If an applicant has made it through EDF’s rigorous process, EDF may offer a loan or loan guarantee; however, an applicant is not required to accept the offer. On occasion, companies may choose to engage with traditional lenders after DOE-backed technical expertise quantifies FOAK risk enabling traditional lenders to invest once diligence and data is proven through EDF’s rigorous screening and monitoring process.

EDF generates financial, employment and economic returns. From early support of Tesla, to financing modern nuclear reactor advancements, and support of geothermal energy and critical minerals projects, EDF has greatly benefited the U.S. economy and our global energy standing. In fact, more than 47,000 jobs and 127 million MWh of energy can be directly tied to EDF-supported projects.

As of September 2025, the EDF has issued loan and loan guarantees totalling $94 billion. Of the dollars that have gone out the door, EDF recorded 6.6% in paid interest and 1.1% in losses, generating a net gain for taxpayers. Just like any investment portfolio, some risk is assumed. EDF portfolio companies have seen tremendous successes and also some high profile losses. Many point to the 2011 Solyndra failure and the loss of more than $500 million in U.S. taxpayer dollars. While it’s important to highlight and learn from missteps, it’s also important to note that the EDF catalyzed several of today’s innovative technologies, including advanced nuclear reactors, advanced battery manufacturing plants, and vital support of the U.S. automotive sector following the Great Recession in 2008.

More recently, EDF announced loans to help finance Constellation Energy’s nuclear power plant in Pennsylvania, strengthen grid reliability in the Midwest, support critical minerals development, and restart the Palisades Nuclear Plant in Michigan.

EDF plays a necessary role, assuming technology risks associated with early deployment until the technology has proven its commercial viability and the private sector can invest with greater certainty. In addition to its ability to mitigate risk through technology consultations and expert support, the EDF has been primarily a good and reliable steward of the American taxpayer dollar.

Private industry-led and government-supported innovation has sparked major historic technological revolutions. As China closes the gap in R&D spending, American R&D should maintain our competitive edge through crucial government innovation spending. The EDF is available to act as a bridge between innovation and the next technological revolution.

Over the last 20 years, the DOE’s Office of Energy Dominance Financing has adapted to address some of the biggest challenges facing the U.S. and is prepared to anchor a new era of American energy dominance, powering the technologies that will drive prosperity, ensure national security and promote global leadership in the decades ahead.