Posted on March 5, 2025 by Matthew Mailloux

The Trump administration has propelled an American energy dominance agenda poised to cement U.S. leadership in all forms of energy production. As the administration seeks to break down permitting barriers and accelerate the buildout of new energy infrastructure, tax incentives can play an important role in accelerating American innovation, lowering prices and reducing global emissions. With proper incentives in place for innovative emerging energy technologies, America’s private sector will continue to deliver reliable, affordable, clean energy to power our economy.

ClearPath has long supported innovation over regulation, with a strong preference for incentives for new clean energy technologies rather than higher taxes on American energy producers. Public-private partnerships for research and development have catalyzed many world-changing American innovations. The U.S. shale boom is a prime example, where the private sector developed new drilling technology in partnership with the U.S. Department of Energy in the 1980s when the U.S. was struggling to compete with foreign adversaries. Congress then enacted a new production tax credit to scale up adoption rapidly. Once the technology sufficiently matured, the tax credit reasonably expired. As a result, U.S. consumers now have abundant, affordable, reliable natural gas produced through hydraulic fracturing. This private-public partnership has delivered a 10-time return on investment of taxpayer resources. This is just one example of how American innovation not only increases reliability and affordability for US consumers but gives the U.S. a competitive edge in the global market for energy exports. The same success story is already playing out in Europe, as countries like Poland and Romania look to the U.S. for advanced reactor technology.

Today, there is a similar dynamic at play as the U.S. experiences unprecedented energy demand growth related to data centers, artificial intelligence and an American manufacturing resurgence. These factors could push U.S. energy demand up by as much as 18% over the next decade, according to the latest data from the North American Electric Reliability Council. To meet rising demand and preserve grid reliability, the U.S. needs to rapidly deploy 24/7 reliable power, like advanced nuclear, geothermal and natural gas with carbon capture.

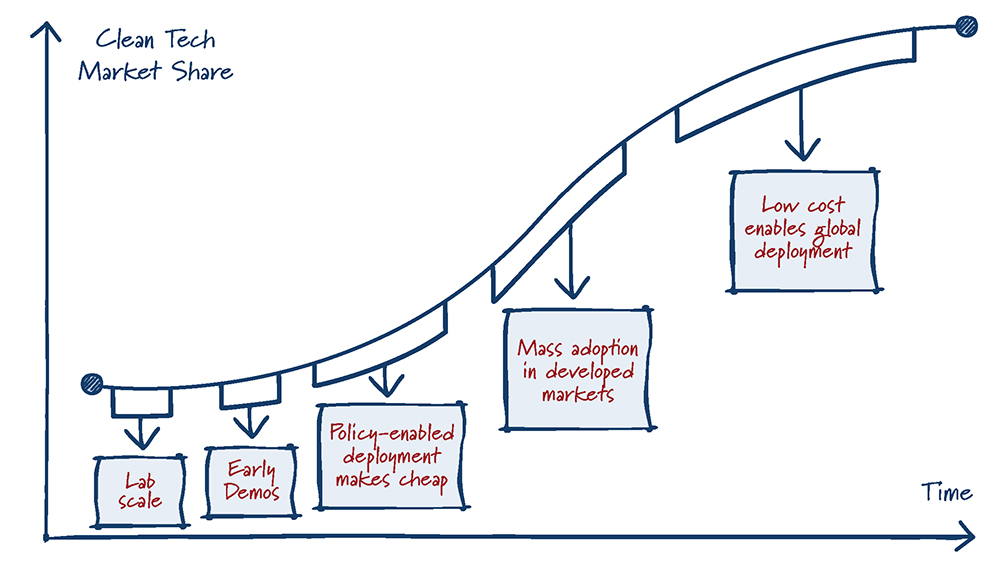

Tax credits can help new technologies overcome initial hurdles and rapidly reduce the cost of deployment. Early support for new technologies can be part of a comprehensive strategy to unlock domestic energy resources and make American manufacturing more competitive globally. Once technologies are proven domestically, they can rapidly reshape the global energy market, just as U.S. LNG exports have. Above all, tax credits should promote the uptake of new technologies as they become cost-competitive and not relied on as a permanent subsidy for uneconomic resources.

Tax Credits Help Push Technologies up the Innovation Curve

As part of a tax policy deal this year, Congress can use targeted policies to best position the U.S. to lead the world in energy production and prevail against China. Many of these credits have received bipartisan support in the past, which is vital to provide durable policy incentives over long investment horizons. Below are three areas for Congress to consider taking action on this year:

To build on President Trump’s goal to make American energy dominant, the private sector needs all tools available, including tax incentives and faster permitting, to meet the goals of increasing power production and lowering costs for consumers.