Clean energy tax credits have meaningfully contributed to commercializing innovative clean energy technologies. ClearPath supports energy-related tax incentives to accelerate American innovation and reduce global emissions.

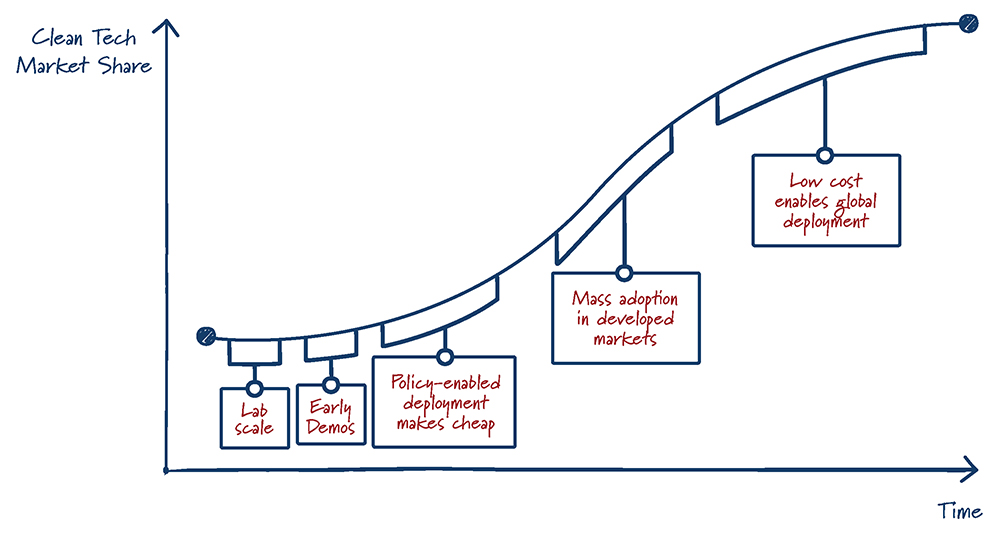

The technologies needed to achieve deep global emissions reductions, like advanced nuclear and enhanced geothermal systems, do not yet exist at scale. Recent analysis shows that half of the emissions reductions needed to reach net zero come from technologies not yet on the market. The U.S. has a world-class innovation apparatus that is uniquely positioned to solve this problem.

The changes to energy tax credits made by the One Big Beautiful Bill Act (OBBBA) preserved incentives for innovative technologies like advanced nuclear, geothermal, hydropower and energy storage, while phasing out incentives for variable renewables like wind and solar.

Tax credits represent the majority of federal support for clean energy deployment over the past two decades. Examples include the enhanced oil recovery credit and the marginal well tax credit to support oil and gas development or the 45J advanced nuclear generation credit to accelerate next-generation nuclear power. Federal tax incentives can play an important role in facilitating early commercial deployment by reducing the effective cost of low-carbon technologies rather than increasing the cost of emitting technologies. Most of these credits are structured either as production tax credits (PTCs) that are determined by the amount of electricity produced or carbon sequestered or as investment tax credits (ITCs) that are determined based on the amount of capital investment for a project.

This approach is important to early commercialization here and to position American technology for commercial adoption across the world. Hence the innovation focus of our vision–America leads the world as an early adopter and tech exporter that contributes to deep global emissions reductions.

These include 45Q for carbon capture and 45Y/48E for tech-neutral clean electricity generation, including nuclear, geothermal and hydropower. Early stage support for innovative energy technologies can spur private sector investment supporting the U.S. economy and reducing emissions.

Changes made to energy tax credits through the OBBBA are designed to promote American innovation and bring American industry back for reliable, clean energy technologies. Republicans in Congress focused their attention on areas of the Inflation Reduction Act (IRA) that were not tied to adding new, reliable energy to the grid to meet rising demand. With the enactment of OBBBA, both political parties in Congress have demonstrated a commitment to support energy innovation through the tax code. It is clear that these changes have settled the debate, offering long-term confidence for investors in clean, reliable energy technologies like advanced nuclear, geothermal, fusion, energy storage, and carbon capture.

ClearPath continues to view tax policy discussion through the following key principles:

Congress has recently enacted or amended several energy-related tax credits including:

45Y/48E – Technology Neutral Clean Electricity PTC/ITC – Congress preserved energy tax incentives for clean, firm power sources like nuclear, geothermal, hydropower and energy storage into the 2030s in the OBBBA. These incentives will catalyze development in the next generation of these resources to rapidly reduce costs and achieve market-competitive prices. Simultaneously, Congress enacted strict phaseouts for variable, nondispatchable energy sources like solar and wind. Additionally, Congress enacted new foreign entity of concern (FEOC) provisions that will apply to all energy sources eligible for the credit.