Posted on July 23, 2024 by Jeremy Harrell and Jake Kincer

In April of 2024, the second of two new AP1000 nuclear reactors – Vogtle units 3 & 4 – came online in Georgia. These reactors were an ambitious project, deploying a first-of-a-kind design to provide clean and reliable electricity to Georgia. This is a story of unwavering aspiration and perseverance. Before the reactors were ever even turned on, redesigns, bankruptcies, construction mistakes and more drove the final cost to double what was initially projected, delaying operation beyond the original 2016 and 2017 targets. Despite the challenges, Vogtle is an investment that will pay dividends for decades.

Building first-of-kind anything is hard, and the true story here is about how Georgia persevered through these challenges and secured a major investment in its future. Georgia made a significant investment in the Vogtle expansion, and in return, they will get clean, reliable energy capable of powering 1 million households and businesses 24/7 for decades to come. One evergreen benefit of this energy is its resistance to price inflation, fuel risks, and global economic conditions. The Vogtle reactors are a gift to the next generation in the state, capable of operating for the next 80 or even 100 years. Few, if any, other energy sources can provide this combination of attributes.

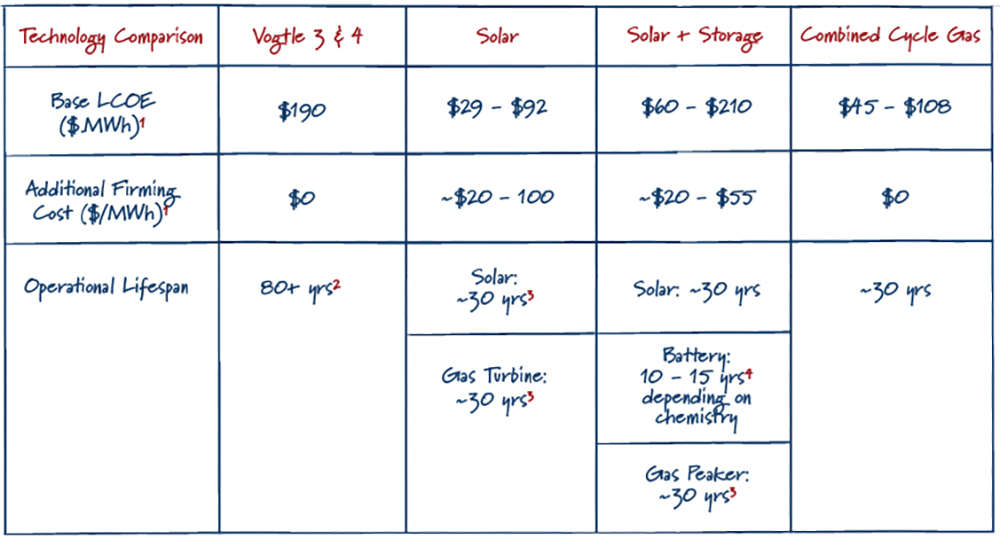

With the doubts in the rearview mirror, let’s look at the deal as a whole, compared to potential alternatives:

1)Lazard LCOE 2) Department of Energy 3) S&P Global 4) Pacific Northwest National Lab

Incremental additions of solar power are cheap, but say Georgia wanted to procure a similar amount of 24/7 clean power using only solar, the storage required would balloon the price quickly. Solar with additional storage is already about twice as expensive as solar alone, but the attached battery storage only averages between one to four hours of output, as longer durations generally mean worse economics. This means Georgia would still need to build additional generation for “firming,” also known as backing up, to meet required reliability needs. However, even with all of these resources, this still “does not represent the cost of building a 24/7 firm resource.”

We strongly support a fully diverse grid — one that uses all energy sources. For those who say we can just use all renewables to power America aren’t looking at the big picture. Wind energy in the Southeastern United States isn’t as prevalent as in other parts of the country for the simple fact that it’s just not as windy. That’s why they are using more solar which makes sense. But, today, the largest percentage of 24/7 reliable power is gas turbines, so if Georgia had to use natural gas to back up solar, they would have needed to build four new combined cycle turbines the size of those at Plant Wansley in Georgia.

Today’s affordable natural gas is an innovation success story and has been a boon for the U.S. economy and deserves credit for a 20 percentage decrease in emissions. Natural gas is also low-cost, dispatchable power. Yet despite its strengths, solely relying on new gas power presents challenges as well. For instance, natural gas power is pipeline dependent and more gas would likely require more pipelines — not an easy lift. Gas is also largely driven by fuel prices, so today’s low prices are predicated on low-cost, reliable natural gas supply. This can create a significant commodity risk, especially over the comparable lifetime of a nuclear power plant.

For example, in Oklahoma, the state finalized a bond that will cost ratepayers $4.5 billion over the next 25 years to pay for gas supply during Winter Storm Uri when prices neared $1,200/Metric Million British Thermal Unit (MMBTU), while today it averages $2-3/MMBTU. In the same storm, Texas paid about $3.5 billion. And of course, to make this important power source low to no emissions, the U.S. must advance innovative natural gas technologies, as well as carbon capture and its associated infrastructure.

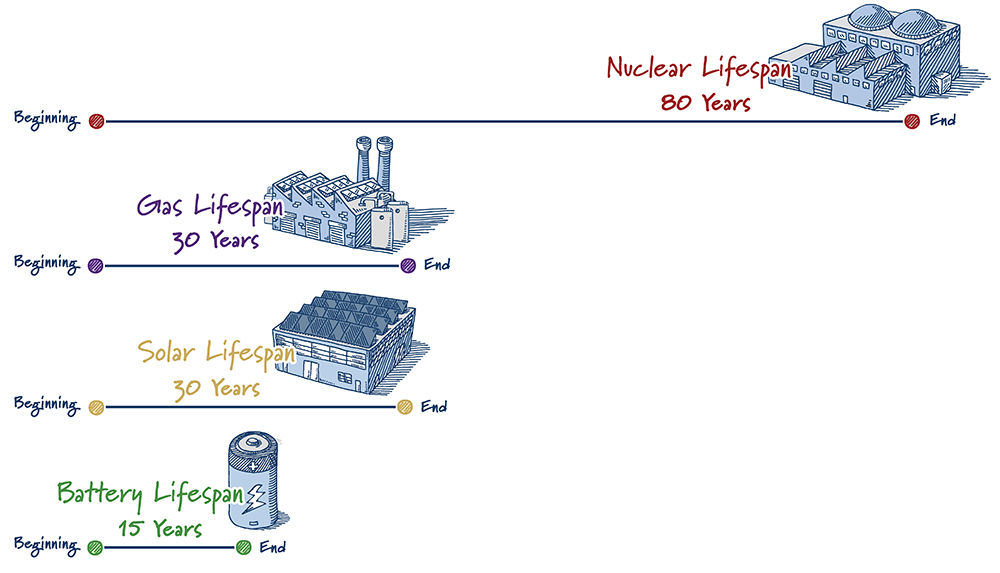

Finally, grid planners must also consider the lifecycle of these projects. A nuclear power plant’s lifespan is more than double that of a gas or solar power plant and many times that of today’s battery technology. To cover nuclear power’s longer operating period, new assets will need to be built, potentially several times over. This exposes future power supply both to normal inflation and significant supply chain risks.

Vogtle isn’t the only example where in hindsight, completing a project turned into a good deal. Millstone 3, a 1260MW reactor in Connecticut, had a famously embattled development process, including delays and at least seven cost increases. Today, that plant provides half of all Connecticut’s power and over 90% of its zero-emissions power. While the upfront cost felt high during a tumultuous construction in the 1980s, today, multiple analyses find that Millstone and other nuclear plants like it bring down wholesale power prices in the region.

Similarly, Georgia paid a high upfront cost to complete the Vogtle reactors. But now that they’re built, the operational costs of a nuclear power plant are relatively small. The fully depreciated costs of existing power plants are about $32/MWh today. Georgia’s power will not just be clean and reliable for the next 80+ years, but also largely immune to price inflation and fuel risk. Like Millstone 3, this may mean keeping future prices much lower. Industry has responded to this: Georgia is experiencing an economic boom, winning a fifth of all new clean manufacturing projects, and the second–most data center capacity under construction in the country. The ability to provide clean, reliable, and affordable power — like nuclear energy — is an economic advantage, and Georgia just made an enormous investment in its future. The Vogtle tale is one of perseverance and success. Further nuclear deployments – while inevitably cheaper than a first-of-a-kind – will require large investments. These are investments in the future and should be seen as such.