Posted on September 27, 2023 by Jack Ridilla

American entrepreneurs have been busy designing some incredible next generation nuclear reactors. This is very exciting, but there’s a catch: where is the fuel?

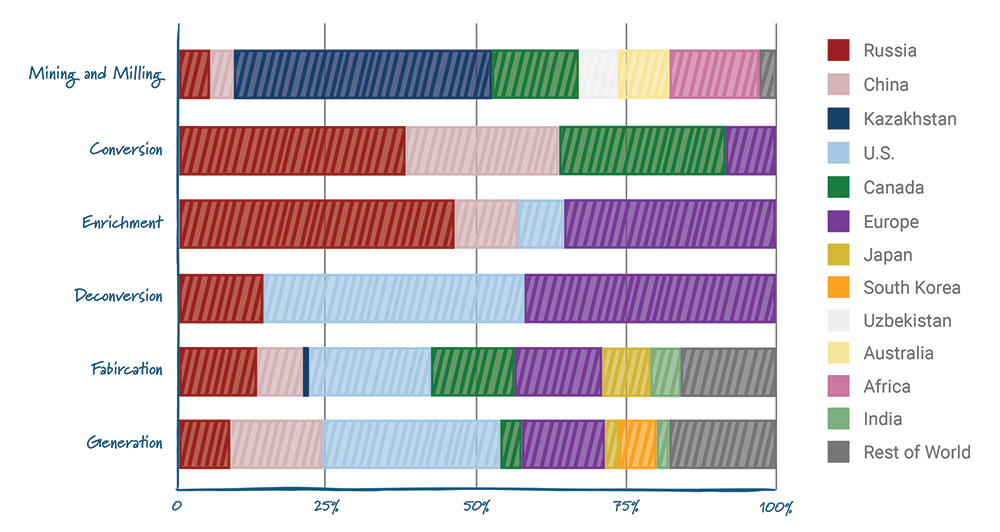

On June 13, the U.S. Energy Information Administration (EIA) released its annual uranium market report, which provides detailed data and analysis on the international uranium markets. The data exposes a supply chain bottleneck in desperate need of diversification, with Russia and China collectively controlling nearly 60 percent of the global supply of enrichment services needed to fuel the next generation of reactors. Geopolitical tensions exacerbated the need for a new global leader in nuclear fuel exports, and the U.S. would benefit from seizing the opportunity. The U.S. is well positioned to do so, but the existing fuel availability program is underfunded and ill-equipped. Additional appropriations and authorization for a revolving fund would enable the U.S. to supply fuel for the next generation of reactors.

Enrichment is a service, like a carwash or a haircut, that helps get natural uranium ready for the next stage of manufacturing. Enrichment is measured in separative work units (SWU). They measure the amount of energy used as an input relative to the amount of uranium processed and the degree to which it is enriched. Under the nuclear fuel umbrella, there are two main types of enriched uranium: high-assay, low-enriched uranium (HALEU) and low-enriched uranium (LEU). HALEU requires more SWU and different infrastructure than LEU. LEU is like a basic carwash or simple haircut, while HALEU is a carwash plus wax or a haircut with a shave. Both start the same way, but the production of HALEU requires additional resources. A sustainable, domestic supply chain requires robust production of both LEU and HALEU. To get there, new enrichment infrastructure is needed.

There is no doubt new nuclear energy is going to play an important role in an American clean energy future. In the U.S., nuclear utilities are calling for 90 GW of new nuclear power by 2050, nearly doubling our nuclear energy capacity in the next 30 years. But the DOE projects the need for 200 GW of new nuclear power by 2050 to meet climate targets. What’s more, the U.S. faces stiff competition from China and Russia, the latter now possessing the highest enrichment capacity in the world. Domestic enrichment capacity is currently limited to Urenco USA and Centrus Energy. Urenco has the capacity to produce 4.6 million SWU, and recently announced it will expand its LEU production capacity to 5.3 million SWU. Centrus, meanwhile, recently announced that it is set to begin production of HALEU in October of 2023. The Nuclear Regulatory Commission gave the greenlight this month.

Russia supplies about one quarter of the low-enriched uranium powering America’s civilian nuclear reactors and is currently the only source of commercially available HALEU. A rough equivalent of 1 in 20 U.S. households were powered by Russian-enriched nuclear fuel in 2022. As the demand for nuclear energy continues to grow globally, it is imperative that there be a reliable, domestic source of nuclear fuel.

The U.S. once had a large enrichment capacity, but following the collapse of the Soviet Union in 1993, an agreement was made involving the purchase of Russian weapons-grade uranium, which was down-blended to lower-enriched reactor fuel. The Megaton to Megawatts program successfully reduced the number of nuclear weapons in Russia, but the U.S. enrichment market never recovered. Between 1985 and 2014, U.S. enrichment capacity fell from 27.3 million to 3.7 million SWU. During the same period, Russia increased its capacity from 3 million to nearly 27 million SWU. As of 2022, Russia held nearly half of the world’s enrichment capacity.

In 2020, the U.S. government reached an agreement with Russia to gradually decrease annual imports of Russian uranium. Still, every year, the U.S. sends more than $1 billion from its utility bills to Rosatom, the Russian-owned uranium enrichment company.

The catch-22 in the HALEU market is well-understood and difficult to remedy. Advanced reactors cannot be developed and deployed without the reliable availability of HALEU fuel, and fuel manufacturers will not invest in production without advanced reactors to purchase their product. A cyclical chicken-or-the-egg style problem has developed, one that smart policy can help solve.

The Energy Act of 2020 directed the Secretary of Energy to establish and maintain the Advanced Nuclear Fuel (HALEU) Availability Program. In 2022, the tax bill designated $700 million for the HALEU Availability Program; however, only about half of that amount went to activities supporting the creation of new HALEU enrichment infrastructure. Although this commitment provides an important market signal, additional investment is needed to spur private investment. At the DOE’s HALEU industry day on August 8, 2023, industry leaders indicated the current funding for enrichment is insufficient to meet program objectives.

In order to help secure project financing, the DOE will act as a secure off-taker of HALEU until demand from the advanced reactor industry is steady. However, the DOE is not authorized to reinvest the proceeds from HALEU and LEU sales of purchased fuel to reactor owners and operators into future DOE HALEU and LEU purchases. This both increases the cost of the program for the taxpayer and increases the amount of up-front appropriations necessary to make the DOE a secure enough off-taker for a private company to finance the project. Authorizing a revolving fund for the HALEU program would help alleviate these issues and would reduce the program’s total cost by 50-70%.

Global Fuel Cycle: Active Supply Chain Capacity

Source: World Nuclear Association, Nuclear Fuel Cycle

The road to an American clean energy future is long and winding. Nuclear fuel policies need to improve in order to meet global emission targets within the desired timeline. The U.S. nuclear energy industry would benefit from the authorization of a revolving fund for the HALEU availability program and limited imports of Russian uranium. A domestic supply of LEU and HALEU can eliminate our current reliance on Russia, create a valuable revenue stream, and improve the efficiency with which we deploy advanced nuclear technology. Given adequate resources and robust international cooperation, the U.S. can become a reliable global supplier of nuclear fuel.