Posted on March 14, 2024 by Jake Kincer and Joey Labrie

Most people think about energy in terms of their own use at home: for heating, lighting, cooking, and more. But, in the United States, residential consumption only represents 16% of total energy use. Commercial and industrial activities use three times as much energy. Power-hungry activities like data center operations and high-tech manufacturing underpin modern technology and must be able to run reliably without interruption. Constant operation means a 24/7 power supply is critical. Industrial processes like steel manufacturing and chemical production, which build cities and help grow food, need large amounts of process heat that is difficult to electrify. Energy is used all around us for more than just keeping our lights on.

Private corporations across various industries aim to achieve this with an even smaller carbon footprint. In the tech sector, companies like Microsoft pledged to be carbon-negative, and Google aims to operate using 24/7 carbon-free power by 2030. Nucor, the largest U.S. steel producer, pledged net-zero production goals by 2050 to provide a fully clean steel product. Building upon these commitments, in March 2024, these companies announced that they are partnering to develop a business model that will allow them to procure clean electricity from new technologies such as new nuclear.

While companies seek reliable and clean energy, utilities are struggling to keep up with exploding demand growth. These pressures drive a new trend — private industry interest in new nuclear energy deployments to power data centers and steel manufacturing.

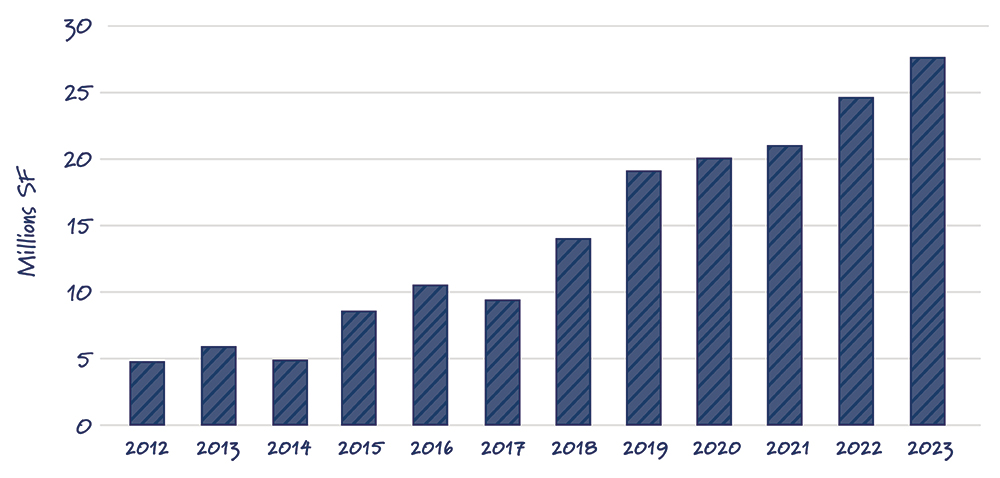

Figure 1: U.S. Data Center Development Pipeline

Source: 2023 U.S. Data Center Market Overview & Market Clusters by Newmark

Sending an email, searching the web or reading this blog requires connecting to a massive cyberinfrastructure, requiring constant power to operate seamlessly. These energy-hungry data centers contain servers that power cloud computing, data storage and novel AI technologies. A single server rack can use as much power as five U.S. homes, and “hyperscale” data centers house thousands of these servers. Data processing is a significant market for the United States: Loudoun County, Virginia, has more data center capacity than all of China. In 2023, data centers represented 2.5% of total U.S. electrical consumption. Today, grid planners expect the demand for energy in data centers to increase 2.5 times, a stat that has grown quickly since the introduction of AI.

Data giants like Microsoft, Google, and Amazon are looking for new, clean, firm power sources, such as nuclear energy, to meet rising demand from data centers. In June 2023, Microsoft partnered with Constellation Energy to provide 35% of the power for a data center in Boydton, Virginia and invested in fusion startup Helion, intending to provide power by 2028. Similarly, Google has invested in fusion research company TAE since 2014, developing research reactors to power its data infrastructure. Amazon acquired a data center park adjacent to the Susquehanna Nuclear Power Plant.

The interest in powering with nuclear isn’t limited just to newer tech companies. More traditional manufacturing companies see promise in nuclear reactors to provide reliable energy and heat for industrial operations in a way other clean technologies do not. Nuclear, like gas or coal, produces electricity by generating heat to boil water. Industrial processes can also use this high-temperature heat, which doesn’t work with non-thermal sources like hydro, wind, or solar.

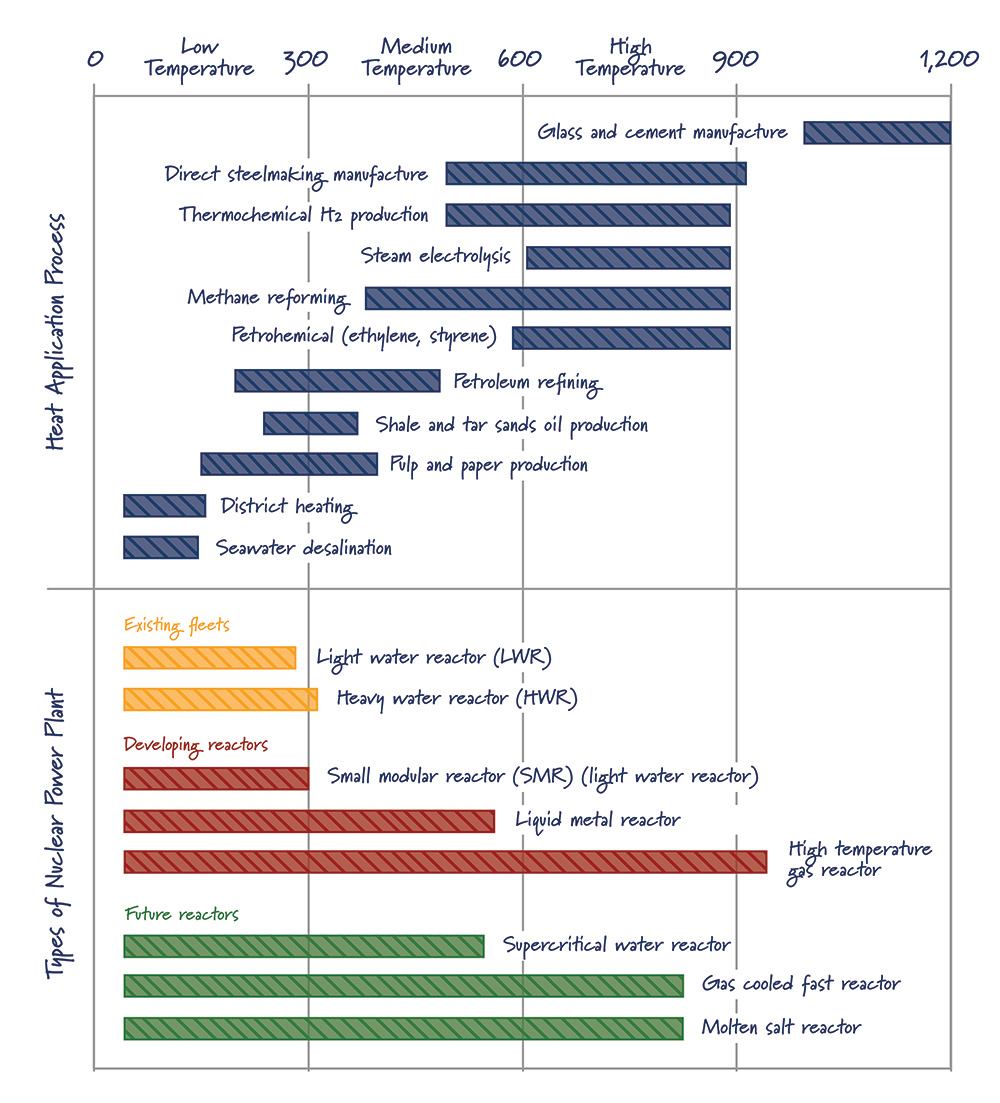

Figure 2 Nuclear Process Heat for Industrial Applications

Existing and advanced technologies can produce heat at temperatures appropriate for various industrial activities

Source: World Nuclear Association 2021

Other traditional industrial manufacturers like Dow promised to reduce carbon emissions by 15% by 2030 and reach carbon-neutral by 2050. Dow and X-Energy, through the ARDP program, plan to build four small modular reactors (SMRs) by 2030 to provide high-temperature process heat and electricity to their Seadrift production site. The proof of concept supported by Dow’s investment will provide reliable energy while reducing carbon emissions by 440,000 MT CO2e/year.

Steel production alone represents 8% of energy end-use demand and 7% of total energy emissions. Nucor has turned to nuclear power to augment its production methods. In a series of investments, Nucor contributed $15 million to bolster the NuScale SMR in 2022 and $35 million to Helion in 2023 to deploy a fusion reactor.

Companies with significant off-grid power needs, such as upstream oil and gas development, are exploring the potential of microreactors. These reactors are small compared to traditional reactors or even small modular reactors (SMRs), but could provide relatively large quantities of reliable power, competitive in off-grid applications. Several microreactor companies are currently working to deploy reactors for these purposes.

Nuclear energy can be a key player in driving rapid growth and decarbonization in the industrial and commercial sectors. Traditional reactors can already provide large quantities of reliable, clean electricity, while several advanced reactors can provide high-temperature process heat or act as mobile generators for off-grid use.

The bottom line is private companies across various sectors recognize the importance of 24/7 clean energy, and the potential role nuclear can play in decarbonizing the industrial and commercial sectors while meeting the challenge of rapid load growth. Traditionally, nuclear energy deployment has been top-down and utility-led, but today, power-hungry private industries may serve as the demand driver for new nuclear power. Targeted federal support will allow these private investments to flourish, ensuring America’s competitiveness in the global marketplace.