Posted on May 25, 2023 by Rich Powell

Below is my testimony before the House Committee on Financial Services Subcommittee on National Security, Illicit Finance, and International Financial Institutions, entitled “International Financial Institutions in an Era of Great Power Competition” on May 25, 2023.

Watch Rich’s Opening Remarks

Read Rich’s Full Testimony as Seen Below

Good morning Chairman Luetkemeyer, Ranking Member Beatty and Members of the Committee. My name is Rich Powell, and I am the CEO of ClearPath, a 501(c)(3) organization devoted to developing and advancing policies that accelerate innovations to reduce and remove global energy emissions. To further that mission, we provide education and analysis to policymakers, collaborate with relevant industry partners to inform our independent research and policy development, and support mission-aligned grantees. An important note: we receive zero funding from industry. We develop and promote solutions that advance a wide array of low-emissions solutions — including advanced nuclear energy – that need to be brought to bear to achieve our climate and development goals.

It is an honor to speak with this Committee again. When I was last here in September 2019, the world’s energy and climate landscape looked very different than it does today. But if the experience of the past three years taught us anything – through COVID-related disruptions, the Russian invasion of Ukraine, growing tensions with China, and unprecedented energy investments – it is that much of what I said before is even more urgent today. The world needs more energy, and emissions know no borders. America and like-minded countries around the world must work together to solve the dual challenges of climate and energy security.

That’s why I am excited to see this Committee addressing the role that International Financial Institutions (IFIs) can and should play in tackling those dual challenges. This committee is essential to ensuring that financing is available, particularly to the developing world, for the global deployment of clean energy technologies like advanced nuclear. Thoughtful investments enhance energy security, geopolitical stability, and environmental progress. With this in mind, I will discuss four important topics today:

The calls for climate action on the global stage have never been louder, and the effects of the war in Ukraine on international energy markets are lasting, which makes the expansion of reliable, secure and affordable nuclear power more important than ever. The International Energy Agency (IEA) modeled that in order to reach net-zero by 2050, the world needs to double the amount of today’s nuclear energy capacity, or the equivalent of roughly 25 new 1,000-megawatt reactors per year by 2030 with accelerated growth beyond that. From a climate perspective, some estimates suggest that deployment of the next generation of advanced nuclear reactors could unlock the equivalent of up to 0.5 gigatons per year of global emissions reduction potential by 2050.

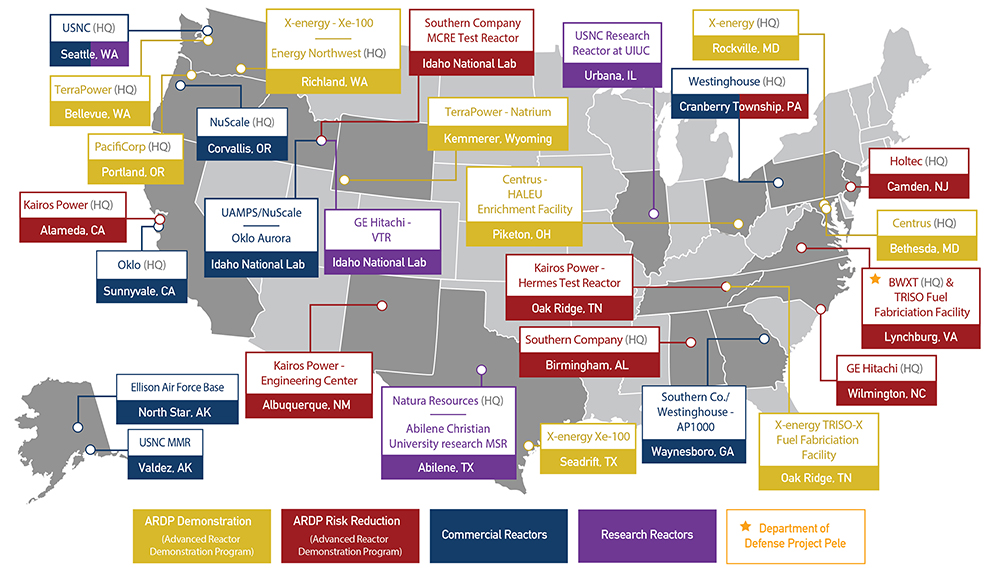

An increase in demand for carbon-free, dispatchable electricity has coincided with unprecedented momentum within the U.S. nuclear industry. Nuclear utilities are calling for 90 GW of new nuclear power by 2050, nearly doubling our nuclear energy capacity in the next 30 years. Currently, there are 15 designs in the application or pre-application process with the U.S. Nuclear Regulatory Commission (NRC). Some of these projects include the NuScale Carbon Free Power Project in Idaho; the TerraPower Natrium demonstration in Wyoming; the X-energy-Dow Chemical high temperature gas reactor in Texas; the GE Hitachi small modular reactor in Tennessee; and GE Hitachi’s unprecedented global deployment consortium with the Tennessee Valley Authority, Canada’s Ontario Power Generation, and Poland’s Synthos Green Energy. These designs are being planned for deployment across North America and overseas.

Advanced Nuclear Companies and Projects in the U.S.

Furthermore, the U.S. military, major data centers, and heavy industrial users are exploring a variety of advanced reactor designs, including microreactors like those being developed by BWX Technologies, Oklo, and Ultra Safe Nuclear Corporation (USNC), to meet their secure power and clean heat needs.

These applications also have significant national security benefits, improving the resilience of critical infrastructure, enhancing servicemember safety, and humanitarian and disaster relief. Institutions of higher learning, like Abilene Christian University (ACU) in Texas and the University of Illinois at Urbana-Champaign, are advancing state of the art research reactors to advance R&D and cultivate our future workforce.

These domestic projects are gaining international attention; at least eight U.S.-based companies have publicly-announced international partnerships to explore deployment in more than 10 countries. For instance, GE Hitachi’s BWRX-300 design for small modular reactors (SMRs) has been gaining traction in Poland with a recent agreement on technical collaboration for development and deployment in the country. Similarly, NuScale Power recently inked a contract with Romania for the first phase for deployment of what would be that country’s first SMR. Another U.S. SMR startup, Last Energy, recently announced power purchase agreements for nearly 3 dozen units of its power plants with industrial partners in the United Kingdom and Poland, representing $19 billion in electricity sales.

Every international sale of a nuclear reactor – whether from the U.S. or a competitor – comes with both economic and geostrategic considerations for the countries involved. Entering into these partnerships can lock in a relationship between the entities involved for up to 80 to 100 years over the lifecycle of the project; from construction through decommissioning. This involves technology partnerships across engineering, design, construction, fueling, operations and maintenance. A network of U.S. nuclear projects abroad can promote our high-standards industrial and safety practices in other countries, while serving as an important dimension of America’s technological and climate leadership around the world.

The economic opportunities that come with nuclear energy projects are also remarkable, with some projections showing the addressable market for U.S. advanced reactors could be roughly $500 billion by 2050. The projects in the pipeline today and the robust U.S. supply chain already in place employ nearly half a million Americans. A person working in the nuclear energy industry makes a higher median wage than any other energy industry and twice the national median wage. Tens of thousands of more high-paying, stable jobs will be created as the nuclear industry continues to grow.

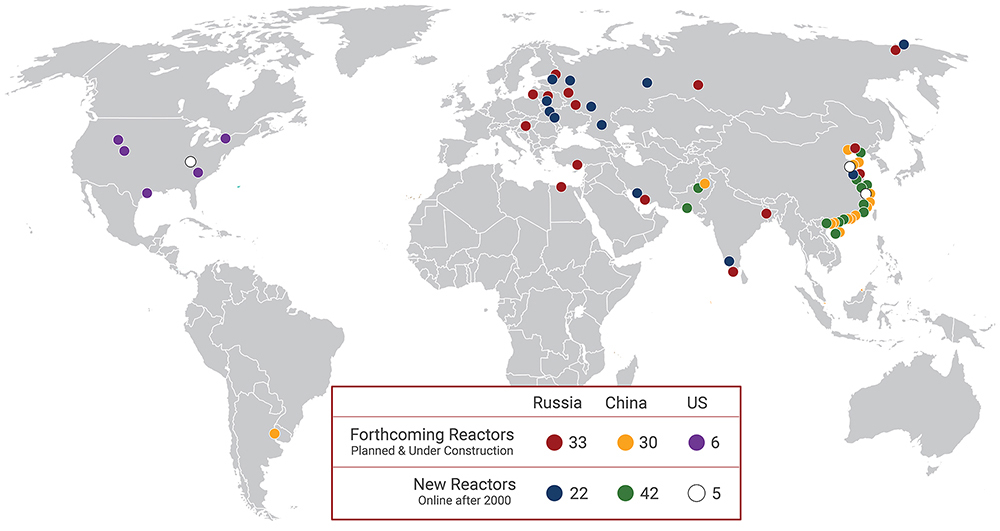

That said, we must be clear-eyed about the intense global competition for nuclear power projects. Over the past two decades, the U.S. and like-minded countries have lost market leadership in this space. Between 2017 and 2022, Russian and Chinese reactor designs captured 87% of all new reactor construction starts globally through their non-market, state-owned enterprises.

New and Forthcoming Nuclear Reactors Worldwide

A recent Columbia University study comparing the financing terms of the world’s major nuclear reactor reactors found that Russia has had a leading position in recent years, in no small part because of their non-market financing offers. For example, Russia signed deals with Bangladesh and Egypt providing financing for 90% and 85% respectively of total project costs, at interest rates well below fair market. Unlike western civil nuclear exporters, China and Russia are not members of a key nuclear arrangement by the Organization for Economic Co-operation and Development (OECD) that places limits on loan terms including minimum interest rates and repayment terms.

Nuclear exports are also a component of China’s Belt and Road Initiative. China is currently building more nuclear reactors domestically than any other country with 55 operable reactors, 23 currently under construction, dozens more in the pipeline, and a policy to “go global” with exporting their nuclear technology. This also gives the Chinese significant sway over the future nuclear supply chain for all reactors globally. Chinese officials have said they could construct up to 30 reactors abroad by 2030, with agreements already signed in Argentina and negotiations underway with Saudi Arabia, Kazakhstan and others. Earlier this year, China and Pakistan marked completion of the Karachi Huanglong One 1.1 GW nuclear power plant, at a cost of only $2.7 billion, which was backed by Chinese financing. This price point is a fraction of comparable commercial U.S. reactor deals. Once China nears completion of its ambitious domestic nuclear buildout, we can expect a sharp pivot abroad and see a flood of Chinese nuclear reactor exports, complete with predatory lending practices and coercive, non-market tactics.

Bipartisan legislation has been introduced to help address some of America’s competitiveness issues. For instance, the International Nuclear Energy Act (H.R. 2938), sponsored by Representatives Byron Donalds (R-FL) and James Clyburn (D-SC), would develop a civil nuclear export strategy to offset Russia and China’s growing influence. In order to do so, it would set a national, strategic plan that promotes partnerships with ally nations and embarking civil nuclear nations to coordinate financing, project management, licensing, and liability. It would also promote safety, security and safeguards which are foundational to a successful, competitive nuclear export program.

And it’s not just the reactors themselves where the U.S. and partner nations face serious competitiveness issues. We need to be serious about addressing our vulnerabilities when it comes to fueling these reactors, specifically with regard to the supply chains for low enriched uranium (LEU), and the nascent subset of high-assay LEU (HALEU). Some projections suggest that by 2030 China and Russia will control roughly 63% of global enrichment capacity. This is not a good position for America — nor our allies and partners — to be in, and we need to move faster if we’re going to have any chance of achieving resource security.

For our part, the U.S. previously recognized this vulnerability and established the Department of Energy’s HALEU Availability Program under the Energy Act of 2020 to create a secure domestic supply of HALEU fuel for advanced reactors. This program has been slow to start, but is one of the most critical enablers of the advanced nuclear industry. Some advanced reactor designs are similar to the reactors today and run on LEU fuel, but designs with new markets (like industrial heat, integrated energy storage, and microreactors) require HALEU fuel. In addition, a domestic supply of LEU is important as Russia will supply almost 25% of our nation’s enriched uranium this year. Uranium is a global commodity; when looking at the global uranium supply chain, 38% of conversion capacity and 46% of enrichment capacity are located in Russia. The 2020 Energy Act also extended the Russian Suspension Agreement to decrease Russia’s percentage of uranium enrichment to 15% of the U.S. market in 5 years, and fully suspend imports by 2040, but the timeline may need to be accelerated further. Securing the nuclear fuel supply chain will require domestic and allied capabilities to both source and process uranium.

It was significant to see the urgency of this issue elevated at the recent G7 Ministers’ Meeting in Japan where the U.S. reached an agreement with Canada, France, Japan and the UK to leverage our collective civil nuclear power sectors to reduce dependency on Russian supply chains. The effort aims to leverage each country’s unique resources and capabilities in uranium extraction, conversion, enrichment, and fuel fabrication. This initiative was reinforced at this past weekend’s G7 Leaders’ meeting, alongside expressions of interest from the U.S., Japan, South Korea and the United Arab Emirates to support Romania’s adoption of advanced nuclear designs. It’s a good first step, but swiftly operationalizing these agreements will be critical.

Since 2000, China has become a dominant player of global energy finance, issuing more than $234 billion in loans for energy projects to some 68 strategically significant nations, roughly 75% of which was directed towards high-emitting coal, oil, and gas development. For perspective, from 2016-2021, China provided more energy project financing around the world than all major Western-backed Development Banks combined, including the IFIs we are here to discuss.

Countries like China and Russia are bringing enormous resources to bear in an effort to dominate energy projects for their own gain. Yet the billions of dollars they are spending on these projects are a small fraction of the trillions of dollars needed to develop and deploy the sheer amount of clean energy technologies necessary to have a meaningful impact on global emissions reductions. Rapidly developing countries that are looking for reliable, low emissions baseload power like nuclear need as many financing and technology options as possible so they don’t need to rely on adversarial nations that don’t have their best interests, nor the climate’s, at heart.

IFI’s can and should play a bigger role in providing alternative, responsible financing solutions to meet those needs. Yet institutions like the World Bank have been slow to respond to the modern energy requirements of these countries and continue to abide by an antiquated, self-imposed ban on supporting nuclear power projects. Reliable baseload energy is absolutely fundamental to the institution’s stated purpose of poverty alleviation. Yet less than 12% of the World Bank’s active portfolio in FY2022 was allocated toward energy and extractive projects, and they haven’t engaged in a single nuclear energy project in over 60 years.

America and the west need to offer more thoughtful opportunities to support developing nations, particularly for their energy needs. As two of ClearPath’s advisors noted in a recent Foreign Affairs piece, at COP27 an Egyptian presidential advisor told us and a group of U.S. lawmakers that countries like hers want dependable energy financing and would welcome our investments, but we haven’t been showing up to meet that demand. That’s why Egypt instead took a loan from Russia’s Rosatom for its new nuclear plant and is now locked into that relationship for the foreseeable future. The World Bank and the west should make more focused and effective use of resources to achieve the outcomes that developing countries need. Perhaps instead of focusing on financing climate change mitigation and adaptation in these countries, those billions of dollars could be better utilized for clean, safe, reliable power projects – like nuclear – that help poorer nations escape energy poverty.

The World Bank and other IFIs should step up their clean energy and climate efforts and do away with their anachronous ban on nuclear power projects. Proposed legislation like Chairman Patrick McHenry’s (R-NC) International Nuclear Financing Act (H.R. 806) recognizes this challenge and attempts to address it. The bill would require the United States Executive Director at the World Bank to advocate and vote for financial assistance for nuclear energy. The bill would also permit U.S. representatives at other international financial institutions – including regional development banks for Asia, Africa, Europe, and Latin America – to push for nuclear projects.

As stated in a memo from the Energy for Growth Hub, another possibility for the U.S. to encourage IFIs to be more engaged on nuclear energy could be the creation of an Advanced Nuclear Technology trust fund at the World Bank. The trust fund could help develop internal expertise and capacity at the World Bank to understand the nuances and implications of new nuclear energy financing, and eventually support clients with technical assistance to make smart energy technology decisions. Congress could direct the Department of Treasury to work with the Department of Energy, Department of State, and other relevant agencies to establish the trust fund at the World Bank, appropriate funds, and encourage the Administration to build a coalition of like-minded partners to participate and contribute.

With this obstacle removed at the World Bank, most other IFIs would follow their lead, representing a potentially transformational opportunity to pool in billions more dollars for clean, reliable, readily-deployable energy as the bedrock for achieving these institutions’ development goals. This would also enhance effective oversight by the U.S. and other western shareholders of these nuclear projects compared with the non-transparent development projects that China and Russia have undertaken.

That said, even if the World Bank and IFIs removed their ban on nuclear financing tomorrow, it’s not guaranteed that would automatically lead to more U.S. nuclear projects abroad, and we need to acknowledge some other challenges Congress would need to think through.

For instance, a recent study by the Government Accountability Office (GAO) found that Chinese-based companies received almost one-third of World Bank-funded international contracts over the past decade. In 2016, China also created a new multilateral development bank of its own, the Asian Infrastructure Investment Bank, as an enabler of its Belt and Road Initiative. At the same time that China is winning all of these IFI contracts and providing development financing to other countries, China remains eligible to borrow from the World Bank for their own development programs.

Russia also continues to be a member of the World Bank, and is the 8th largest shareholder for one of its key lending facilities.

As it stands, lifting the ban on nuclear financing at the World Bank and other IFIs could inadvertently enable the rise of Chinese nuclear exporters unless the U.S. strongly leverages its influence and alternatives. As we consider pressing IFIs to be more proactive on clean energy projects – particularly nuclear – procurement reform at the IFIs needs to be at the top of the agenda, factoring in unsubsidized project costs so that China can’t continue to dominate IFI contracts. We need to factor in these other considerations and hedge our bets. That’s a key reason why America’s own development and export financing capabilities are so important.

The expansion of China’s Belt and Road Initiative and Russia’s 2022 invasion of Ukraine have underscored the enduring need for United States international leadership – including through export and development financing – not only for our own energy security and climate goals, but also that of our partners. Concerted action with our partners and allies in this area can be an essential counterweight to China and Russia.

A recent example of the strategic role that American financing can play for clean energy is the development of Poland’s first nuclear plants. The Trump Administration led a key Intergovernmental Agreement (IGA) between the U.S. and Poland to develop Poland’s civil nuclear power program and industrial sector. That agreement clearly articulated America’s intention to leverage the U.S. EXIM Bank and other government financing institutions for Polish reactors.

Subsequently, the U.S. Trade and Development Agency (USTDA) funded an initial engineering study for Poland to assess the viability of Pennsylvania-based Westinghouse Electric Company’s AP1000 reactor technology. These efforts culminated in November 2022 when the U.S. Government tabled a comprehensive, competitive technical and financing package, and the Polish Government chose Westinghouse’s reactor, in a deal worth roughly $40 billion.

Building on that, in April, EXIM and the DFC signed an agreement to finance up to $4 billion for another Polish project that could support the U.S. export of GE Hitachi’s BWRX-300 SMR. These deals are equivalent to all nuclear investments made in 2021.

These efforts – initiated during the Trump Administration and carried forward in a bipartisan manner – bring geostrategic, economic, and climate benefits to the people of Poland and the U.S., and are made possible – in part – by the backing of American financing.

Unfortunately, this type of coordinated effort across U.S. federal agencies is the exception not the norm. Many of our best levers, such as the DFC, are often disconnected from the rest of the government financing tools and clean energy goals. Although the DFC has expressed interest in the case of Poland, that is a very unique circumstance, and the DFC is yet to robustly engage in supporting civilian nuclear projects abroad despite removing its moratorium on doing so in 2020. This is not an effective way to compete with rival countries where there is far more strategic alignment across agencies and their non-market, state-owned enterprises.

That’s why the U.S. needs to better leverage existing policy tools and build new ones in order to reach our future clean energy and climate ambitions.

In the case of DFC, one limiting factor for engaging in large-scale energy and infrastructure projects, including nuclear power, is the way in which the Congressional Budget Office (CBO) and the Office of Management and Budget (OMB) treat DFC’s equity authority. DFC’s equity authority gives the U.S. government the capability to compete for projects in a more holistic way and facilitate joint investments with partners and allies. However, CBO, OMB and DFC currently “score” the Corporation’s equity investments on a cash basis (i.e. only recording revenue on such investments when the stake is sold) rather than by “net present value,” which is the way in which loans and loan guarantees are scored and accounts for expected returns in the same fiscal year. This has the effect of scoring DFC’s equity investments like grants rather than financing, which requires substantially more budget authorization and discourages the use of the Corporation’s equity authority particularly for larger projects, like nuclear energy.

Another good example of a needed fix is EXIM’s China Transformational Exports Program (CTEP). This program, established during EXIM’s 2019 reauthorization (P.L. 116-94), has a Congressional mandate for EXIM to support U.S. exporters facing competition from China in 10 key Transformational Export Areas. One of those export areas is “renewable energy, energy efficiency, and energy storage.” Conceptually, the program could be a valuable lever for all clean energy technology providers (and the financing needs of foreign customers) facing unfair competition. But unfortunately – to the detriment of our geopolitical, clean energy, and climate goals – limiting this program to renewable energy sources alone leaves out important technologies like advanced nuclear, carbon capture and storage (CCS), and hydrogen. In an all-of-the-above energy competition with China, CTEP deserves a common-sense revision to be more technology neutral when it comes to clean energy if we’re serious about competing and winning on exports and against climate change.

An all-of-the-above clean energy strategy is the only viable path for achieving our global emissions reduction targets, which means the world needs to move much more quickly to deploy clean, baseload energy, like nuclear power. At a time when the United States already finances nuclear energy abroad through the Export-Import Bank – and hopefully increasingly so through the DFC – the World Bank and other international financial institutions should have a comprehensive reassessment of their nuclear energy policies, including opportunities and challenges, rather than simply defaulting to “no.”

Thank you again for the opportunity to testify today. ClearPath is eager to assist the Committee in developing innovative policy solutions to ensure U.S. leadership in international clean energy financing. We applaud the Committee for taking on this important task to help ensure the appropriate action, including policies that will help advance innovative technologies to provide clean, reliable, and necessary energy to our nation and the world.