Posted on May 31, 2023 by Grant Cummings

This blog has been updated. Previously posted on March 22, 2018 by Rich Powell and Justin Ong

One of the most critical clean energy incentives available today is the 45Q tax credit. Recent modifications raised the incentive for heavy industry and power carbon capture operators from $50 per ton to $85 per ton of CO2 and up to $180 per ton for direct air capture (DAC) – think machines that selectively vacuum CO2 out of the air – sequestration projects. Additionally, the legislation lowered capture thresholds and extended the construction windows for projects looking to take advantage of the tax credit.

The 45Q tax credit now represents the most aggressive policy driver for the deployment of carbon capture, utilization, and storage (CCUS) across the globe. This incentive will further U.S. leadership by accelerating a network of new CCUS projects from existing and new coal and natural gas plants, as well as industrial facilities that produce a range of U.S. products.

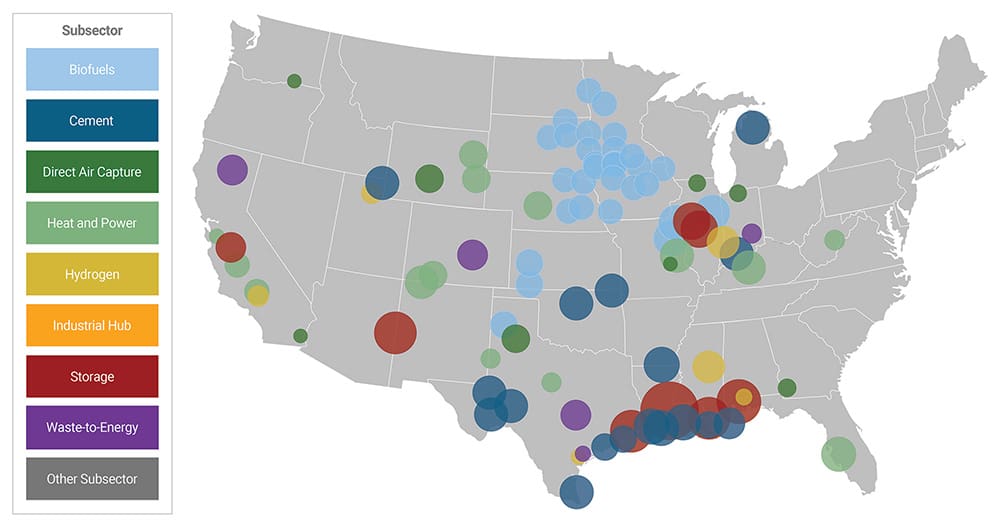

CCUS Projects Are in Development Across the Country

Map: CCUS projects are in development across the country for biofuels, cement, direct air capture, heat and power, hydrogen, heavy industry, storage, and other applications.

For background, Congress first established the 45Q incentive as part of the Energy Improvement and Extension Act of 2008. Over the next decade, it became clear that the incentive was not driving the level of investment and innovation that policymakers envisioned, leading to a bipartisan effort to make the credit more attractive for private investment. In 2018, recognizing that something needed to be done, Congress updated 45Q, increasing the credit value, lowering capture eligibility thresholds, and allowing DAC to be eligible for the incentive. The industry experienced additional gains when the Energy Act of 2020 established the research and demonstration programs for carbon capture that would ultimately be funded by the Infrastructure Investment and Jobs Acts (IIJA). IIJA infused nearly $12 billion to develop the full carbon capture supply chain, from capture to transportation and storage. This was a huge win for American technology leadership. Among other changes, the recent update allowed project developers to elect to have direct pay for the first five years of a project's life, eliminating the need to seek funds from the tax equity market – which can be very costly.

These modifications mean more projects to capture carbon could be developed.

Proposed business models also look at economic opportunities, including utilizing CO2 for enhanced oil recovery (EOR) and, in the longer term, manufacturing commodities such as sneakers, toothpaste, and building materials like cement. Some major energy producers, including ExxonMobil and Occidental Petroleum, estimate that carbon capture, utilization, and storage markets could be worth trillions of dollars by midcentury – an opportunity that can be seized by the U.S. not just domestically but also in helping deploy these technologies abroad.

That includes India, a serious player in global energy and climate change talks but also a country that imports three-quarters of its oil. Captured carbon will help them build a domestic oil supply through EOR. The Middle East – which amazingly still pumps natural gas into the ground for EOR – is also increasingly eager to mimic the U.S. by storing CO2 in underground geologic formations instead. Further down the line, carbon capture could help African nations build out clean energy and supply reliable electricity to the continent.

While the prospects abroad are exciting, we need to perfect the technology here in the U.S. An ambitious implementation agenda is still needed to scale up carbon capture technologies nationwide, drive down costs, and instill sufficient investor confidence.

The promise of carbon capture technology can’t rest on the recent 45Q enhancements alone. In the interim, we need to ensure that regulators are using the $12 billion from the bipartisan IIJA to successfully implement the authorized carbon capture demonstration, large-scale pilot projects, and carbon dioxide transportation infrastructure finance and innovation programs, all while working to assist the EPA to get Class VI permits out the door.

It’s quite a list. The good news is the 45Q enhancements were a major hurdle that was overcome and will be the anchor that drives a lot of new, incredible innovation.