Posted on March 9, 2023 by Casey Kelly and Spencer Nelson

The combination of new policies and over $100 billion amount of private equity investments in 2022 has marked a new era in America’s industrial innovation characterized by decarbonization. In the past year alone, at least 15 project announcements across industrial subsectors have been made. This deployment of carbon capture utilization or sequestration will total 1,600 million metric tons of carbon dioxide (MMT CO2) per year.

We recently published one of ClearPath’s signature annual reports, “Clear Path to a Clean Energy Future 2022”: tracking America’s power sector, clean technology, and policy trends. This latest edition had three key findings:

This report, however, did not cover one of the difficult-to-decarbonize sectors — industrial. Annual emissions from the industrial sector are expected to exceed those of the power sector by mid-century in America. And, global projections likewise depict the absolute and percentage share of industrial emissions rising in the future.

Most experts agree that industrial emissions reductions will need innovation-focused policy and investment in the near term to greatly reduce the cost of solutions.

An All of the Above Approach to Industrial Emissions Reduction

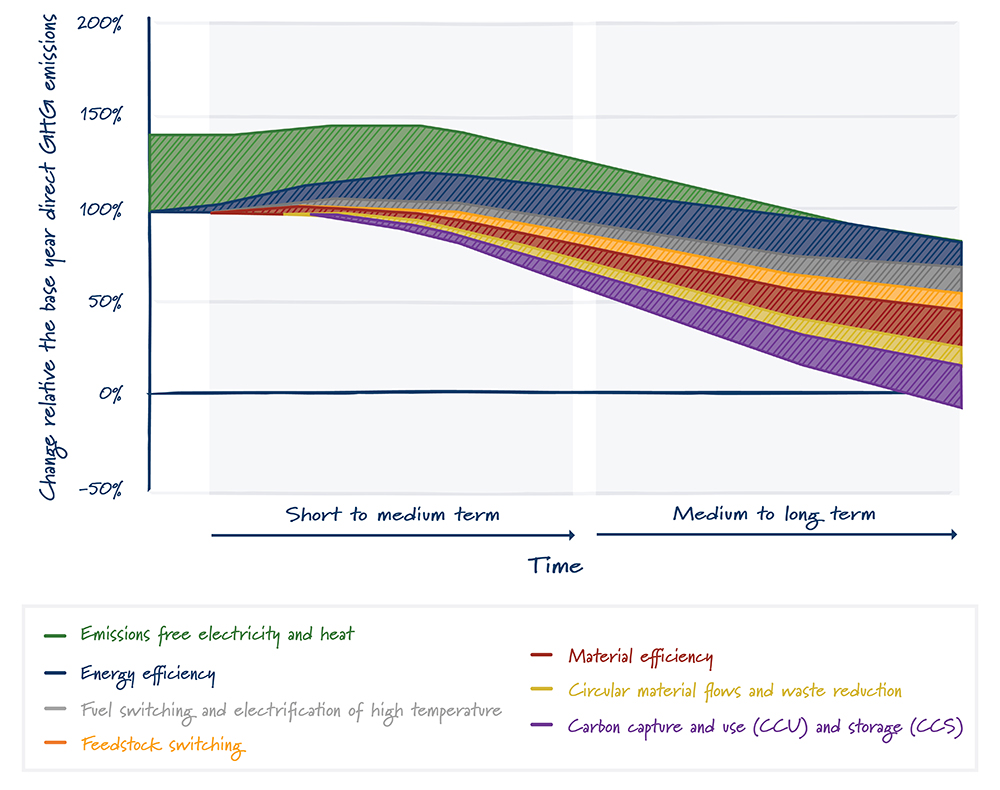

Figure 1. Adapted from the IPCC ARG6 Working Group 3 Chapter on Industry. This graphic illustrates the different levers and their potential for a role in driving industrial emissions to net zero.

In the short term, industrial decarbonization will depend on the ability to deploy technologies such as Antora Energy’s thermal energy storage, which provide clean electricity and heat or improve the energy efficiency of industrial processes, such as through electrification or systems-level energy management optimization. Long-term, significant investments in innovation and deployment of technologies like carbon capture and the production of alternative fuels like hydrogen will be paramount to achieving significant emission reductions.

Industrial decarbonization policy on innovation significantly lags behind other sectors, namely power and transportation, in the volume of targeted investments in innovation and other decarbonization-focused policies. However, over the past two years, a number of bipartisan bills have initiated progress. The Energy Act of 2020 (EAct 2020) included several new authorizations for the U.S. Department of Energy (DOE) to support low-carbon industrial manufacturing and carbon capture projects. This was quickly followed by the passage of the bipartisan Infrastructure Investment and Jobs Act (IIJA), which appropriated over $12 billion to fund these programs. Additional bipartisan industrial decarbonization came in the CHIPS and Science Act that invested $52 billion across numerous sectors and products critical to balancing industrial decarbonization and America’s competitiveness. A prime example is the Steel Upgrading Partnerships and Emissions Reduction (SUPER) Act, which established DOE’s first low-emissions steel research and development program.

Finally, the 2022 partisan reconciliation package, called the Inflation Reduction Act (IRA), includes numerous individual tax incentive provisions and programs that were originally introduced on a bipartisan basis to tackle industrial emissions. Among these, is the carbon capture and sequestration tax credit (45Q) which increased the credit amount across applications, decreased the plant size eligibility thresholds and extended the commence construction deadline to the end of 2032.

Rhodium Group modeled ClearPath-designed scenarios to understand the magnitude of the impact of current policy on future total carbon capture capacity installed and carbon captured out to 2050 across several industrial subsectors: ammonia, cement, ethanol, hydrogen, iron/steel, natural gas processing, and refineries.

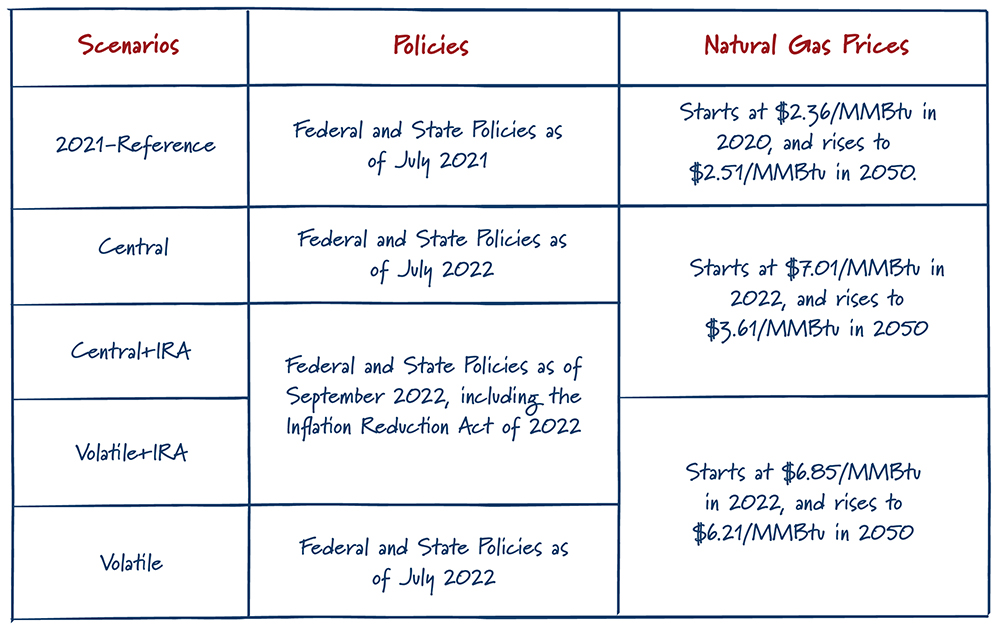

Energy market uncertainty and turmoil driven by inflation from the COVID-19 economic recovery have been further roiled by Russia’s invasion of Ukraine. To understand how energy market volatility impacts the path to a clean energy system, Rhodium Group designed a separate set of fuel price inputs to assess the same policy assumptions. The four scenarios in this analysis are outlined in Table 1.

Table 1. Scenario assumptions were developed by ClearPath and modeled by Rhodium Group.

The economic viability of carbon capture technology is not homogenous across subsectors and at current costs, carbon capture adoption in industrial applications is driven by policy support and is minimally impacted by natural gas prices.

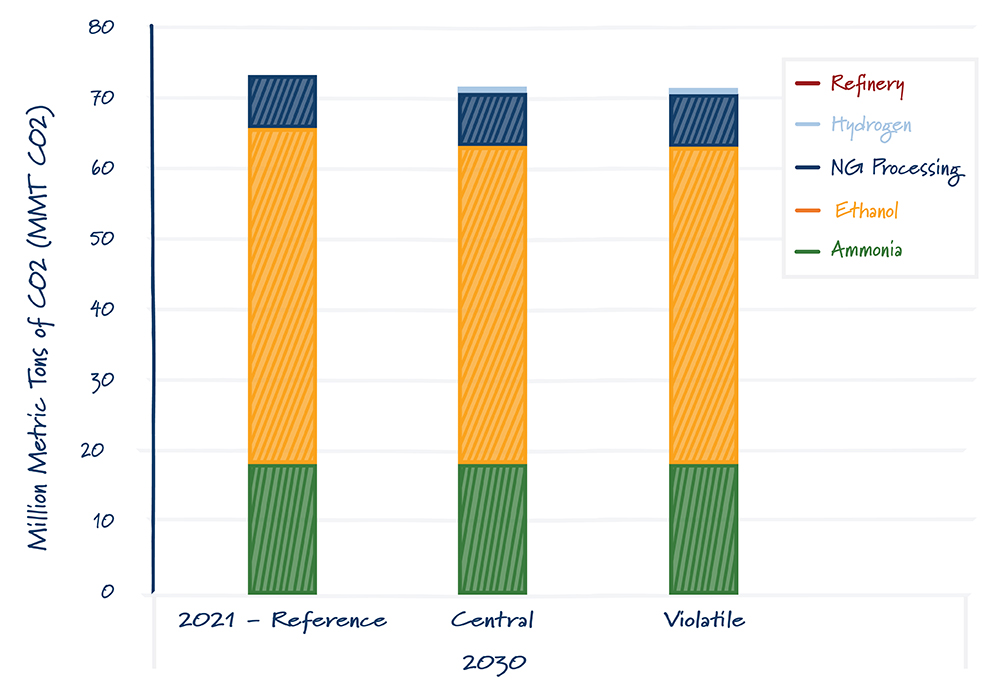

The 2021-Reference, Central, and Volatile scenarios project carbon capture deployment under the previous 45Q tax credit requiring facilities to commence construction before 2026. These findings revealed that carbon capture adoption in the industrial sector ends with the expiration of the credit such that there is no increase past 2030. The Central and Volatile scenarios captured the same total amount of carbon dioxide, 72 million metric tons, but with slight differences across subsectors. Ultimately this represents 1 million metric tons of carbon dioxide (MMT CO2) less the 2021-Reference scenario from our inaugural report. This difference can be attributed to the higher fuel price assumptions, particularly in the near term, for natural gas from this year’s modeling.

Installed Carbon Capture Capacity by Sub-Sector in 2030

Figure 2. Total Installed Industrial Carbon Capture Capacity in million metric tons CO2 (MMT CO2) in 2030.

Notably, the Central and Volatile scenarios projected carbon capture to be installed in hydrogen, a subsector that our previous analysis did not observe any deployment to occur. Funding for hydrogen demonstration programs allocated by the bipartisan IIJA drives the deployment of carbon capture for hydrogen production not observed in last year’s results.

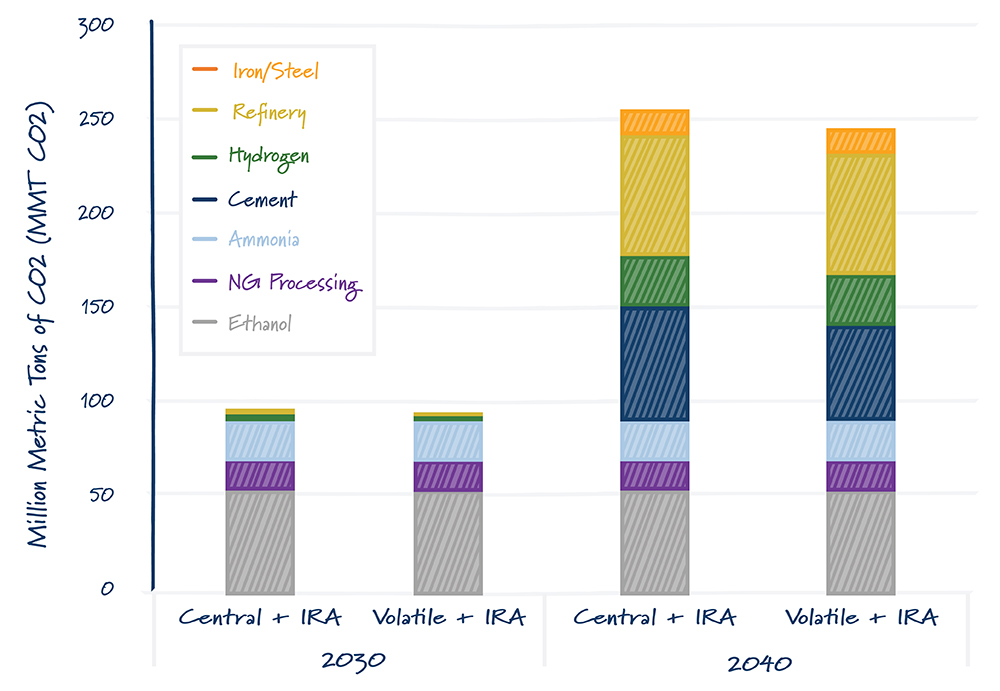

The enhanced value and expanded scope of the 45Q tax credit is projected to increase the economic viability of carbon capture across industrial applications, accelerating its deployment, see Figure 3.

Installed Carbon Capture Capacity by Sub-Sector

Figure 3. Total Installed Industrial Carbon Capture Capacity in million metric tons CO2 (MMT CO2).

By 2030, the enhanced 45Q tax credit drives an additional 25 MMT of capture capacity under the Central+IRA scenario compared to the Central scenario. By 2040, this expands to an additional 160 MMT CO2 installed capture capacity, or the equivalent of U.S. emissions from natural gas systems and the production of cement, iron/steel, and petroleum in 2019. Significantly, expanded policy support for carbon capture unlocks new deployment opportunities in the cement, refinery, and iron/steel sub-sectors. The Central+IRA scenario projected an additional 3 MMT CO2 capture capacity deployed by 2030 and 10 MMT CO2 more by 2040 compared to the Volatile+IRA scenario.

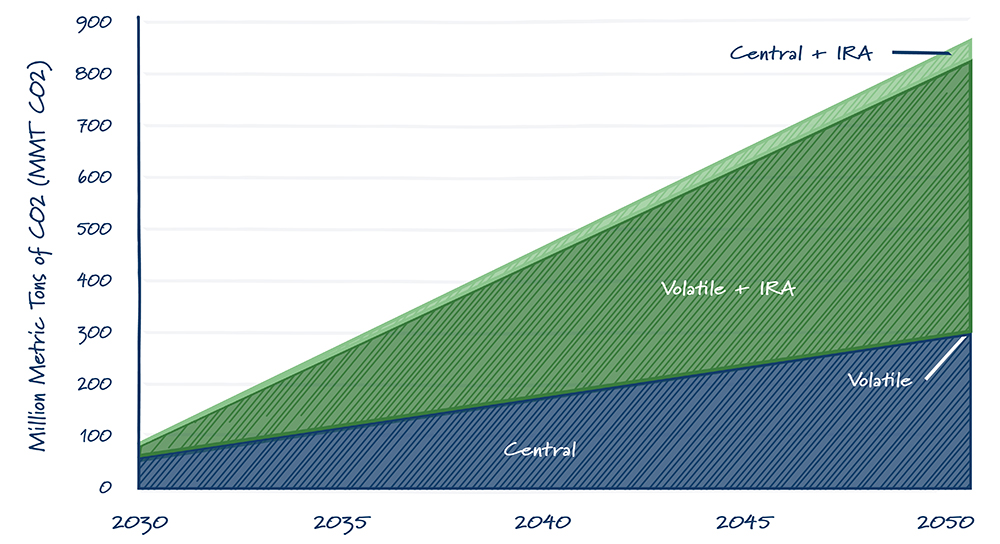

This projected installed capture capacity across the industrial sector will approach one gigaton of captured CO2 by 2050, see Figure 4. Both Central+IRA and Volatile+IRA scenarios lead to nearly triple the cumulative volume of captured carbon by 2050 compared to the baseline cases, respectively.

Cumulative Net Captured CO2 from Industrial

Figure 4. Cumulative net captured CO2 accounts for the utilization factor at a given plant, plus reduces gross captured CO2 to account for emissions attributable to gas and power use for the capture process itself. Volatile captures 1 to 2 MMT more CO2 than 2022-Reference across the projection period.

The industrial sector encompasses a vast array of energy-intensive processes and is the fastest growing source of emissions in the U.S. Therefore, low-carbon innovative solutions that don’t compromise productivity are essential.

The suite of new or enhanced federal programs, investments, and incentives have demonstrably jump-started industrial decarbonization: nearly half a gigaton of captured carbon projected by 2040 under various price assumptions. Bipartisan legislation authorized billions across multiple new programs targeting basic research in, and demonstration of, cutting-edge, pre-commercial industrial decarbonization technologies. As a result of strengthened policy support, new industrial subsectors – cement, refining, and iron/steel – could economically deploy carbon capture for the first time in this analysis.

2022 has marked a new era in industrialization that jump-starts America’s innovation engine to create and commercialize low-carbon products and processes. Decarbonization policies for this trade-exposed sector should now focus on preserving economic competitiveness while also promoting American-led innovation that can be deployed globally to tackle the largest sources of future emissions.