Posted on October 26, 2023 by Jake Kincer , Nick Lombardo and Justin Williams

Rising geopolitical tensions mark the enduring need for international leadership from the United States, not only for our energy security and clean energy goals but also for U.S. allies and partners. The U.S. has made significant strides toward reducing carbon dioxide emissions while improving its energy security over several decades. However, reducing global emissions and curbing the ambitions of America’s adversaries will require both the deployment of next-generation clean energy technologies domestically and abroad.

U.S. export and development financing are key dimensions of American engagement around the world to address the dual imperatives of energy security and clean energy deployment. To this end, the International Development Finance Corporation (DFC) is a key, independent agency within the U.S. government that works with the private sector to finance projects that address pressing international challenges, including energy and critical infrastructure.

Congress formed the DFC in 2018 with bipartisan support amid growing competition for overseas infrastructure projects. Alongside partner agencies, the DFC brings unique flexibility and capabilities – such as direct equity investments – that are important for U.S. energy diplomacy. The DFC’s upcoming reauthorization in 2025 will provide an opportunity to reinforce and enhance its unique capacity to drive international impact with American-backed energy.

Since its creation, the DFC has made some notable geostrategic clean energy investments. For example, the DFC recently invested in TechMet Limited to develop nickel and cobalt resources in Brazil and approved a $500 million loan to set up First Solar’s India factory, both of which help to diversify clean energy supply chains away from China.

Additionally, in 2020, the DFC removed its moratorium on funding nuclear energy projects. Lifting this ban enhanced DFC’s potential impact by allowing it to support the commercialization of clean, firm energy in strategically important areas and create markets for the U.S. nuclear industry. The DFC has submitted letters of interest to support $1 billion in advanced nuclear projects in Poland and Romania. Although the DFC has expressed interest in these cases, it is yet to robustly engage in supporting nuclear energy projects.

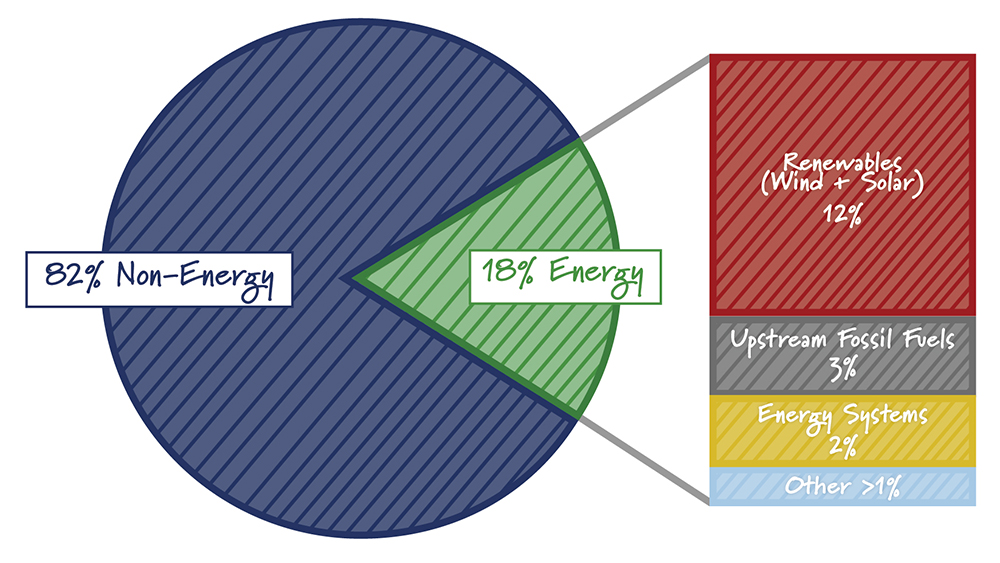

The DFC committed to growing its climate-focused investment to 33% of new investments by fiscal year 2023. However, this will likely require significant expansion of energy investments, which only made up 18% of outlays from 2020-2022.

DFC Energy Financing (2020-2022)

Source: USASpending.gov,ForeignAssistance.gov; Data represents the DFC’s total outlays and does not include political risk insurance.

Energy systems” pertains to projects broadly aimed to improve energy reliability and affordability.

“Other” includes a combination of smaller scale clean energy projects such as a hydrogen project, geothermal project, agriculture project and a critical minerals project.

The DFC is slated for reauthorization in 2025, presenting an opportunity to improve its efficiency and impact. Six improvements that could significantly expand DFC capabilities to promote U.S. national and economic security through energy investments, while retaining its core developmental mandate are:

1. Expand Expertise with Personnel – The DFC could have a greater impact with more geographical and domain-specific expertise. The DFC was originally constructed in teams based around its products. However, the DFC’s leadership has proposed reorganization to focus on sectors like energy. In doing so, it will be important for the DFC to build personnel capabilities in areas such as nuclear power, long-duration energy storage, carbon capture and critical minerals in order to better structure deals and make strategic investments.

2. Investment Scoring Fix – Despite being the only agency with Congressional authorization to make direct equity investments, this critical tool has largely gone unused. This is due, in part, to how the investments are “scored” from a budgetary standpoint. In particular, the DFC’s equity investments are scored like a grant instead of a loan, so it assumes no return on the investments made. Thus, this method of scoring requires significantly more budget authority, especially for larger projects, which limits the ability to invest in such projects. In a recent Senate Foreign Relations hearing, DFC CEO Scott Nathan noted that fixing the equity scoring challenge was his “highest priority.” Senators John Cornyn (R-TX) and Chris Coon (D-DE) recently introduced legislation (S.3005 – Enhancing American Competitiveness Act of 2023) proposing a fix.

3. Contingent Liability Cap – The DFC has the authority to maintain up to a $60 billion project portfolio from the U.S. Treasury. In comparison to the capital expenditure needed for large-scale infrastructure projects, including clean energy, $60 billion in total financing is not adequate. For perspective, since 2000, Chinese state-owned banks have provided over $234B in international financing just for energy sector projects. Expanding the DFC’s liability cap to $100B, as proposed in S.3005, or introducing an automatic inflation adjustment would give significant breathing room to make more impactful investments.

4. Loan Size Cap – Large projects like nuclear power plants, mines for critical minerals and energy supply projects require large investments. The DFC currently has a hard cap of $1 billion for an individual loan or guarantee. Raising this, tying it to a fraction of the portfolio, or removing it entirely would allow DFC greater flexibility to invest in large-scale energy projects.

5. Middle-income country restrictions – The DFC currently requires a waiver to work outside low-income countries. Expanding the DFC’s country eligibility would allow for higher-impact investments in Southeast Asia, South America and Eastern Europe, all aligned with strategic goals. This is relevant for larger economies where global carbon emissions carbon emission reduction potential is greater but still requires significant developmental support.

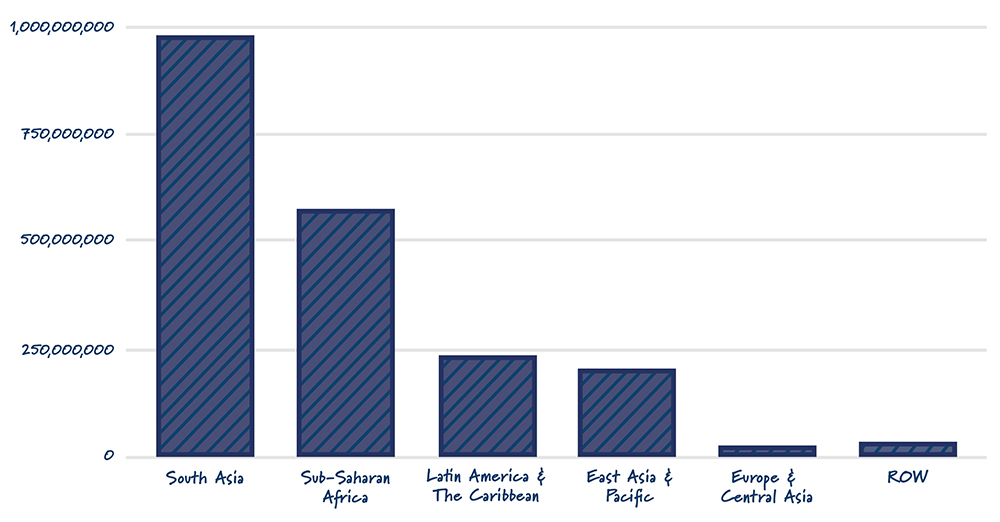

DFC Energy Financing by Region (2020-2022)

Source: USASpending.gov,ForeignAssistance.gov; Data represents the DFC’s total outlays and does not include political risk insurance.

6. Addressing Currency Risk – One of the biggest challenges for developing bankable projects in emerging markets is currency risk (e.g., when the local currency loses value while the original liabilities remain denominated in U.S. dollars). The DFC already has statutory authority to make loans in local currencies but could benefit from additional safeguards. Taking on some currency risk, either by lending in local currency or by cost-sharing risk out of its program account, could make some projects more viable for the DFC.

For a relatively new federal agency, the DFC has already established itself as a key player in the United States’ global strategic and development efforts. To hone the DFC’s capabilities, targeted improvements and enhancements can allow it to make the most efficient use of relevant resources. The 2025 upcoming reauthorization for the DFC is an opportune time to cut bureaucratic red tape and make meaningful changes, empowering the DFC to be an even more impactful player in America’s clean energy strategy around the world.