Posted on July 24, 2025 by Jake Kincer and Bryson Roberson

It’s no secret that U.S. electricity demand is skyrocketing. New manufacturing, electrification and data centers are driving this growth. U.S. power demand is expected to increase 78% by 2050. This contrasts with the North American Electric Reliability Corporation’s (NERC) forecasts, which predict an 18% winter peak demand growth and 15% summer peak demand growth over the next 10 years. This dramatic increase represents a significant shift from the last two decades of relatively stagnant demand, fundamentally shifting the paradigm for utilities. Nationwide, power providers must quickly build new generation and transmission assets to meet this demand while maintaining affordability, reliability and energy security. Dominion Energy, for example, faces a particularly daunting path as the demand growth in its service area is growing, at nearly 6% annually, due to Virginia’s status as the data center capital of the world.

To deliver affordable, reliable and secure energy, utilities develop comprehensive integrated resource plans (IRPs), which outline how they intend to build energy infrastructure and meet the needs of ratepayers. Utilities must excel at forecasting energy needs to avoid the costly mistakes of building too little or too much generation capacity. In today’s era of fast-paced growth, an all-of-the-above approach strategy is necessary to bring enough new generation online to keep up.

To put this into perspective, Dominion Energy’s energy demand forecasts jumped from an annual growth rate of 1-1.4% in its 2020 IRP to nearly 7% in its 2023 IRP and are now projecting 5.5% in its 2024 IRP. This signals that forecasting energy demand is turbulent, especially when facing evolving laws, retiring generation assets and demand.

The passage of the Virginia Clean Economy Act (VCEA) in 2020, which mandates a transition to 100% carbon-free electricity by 2045, is a factor that Dominion must address in its IRP development. The VCEA encourages significant deployment of clean, firm power sources like nuclear energy to ensure grid reliability and meet growing demand. The VCEA has made it challenging to continue operating and developing new natural gas or coal projects, leading to the forced retirement of several operating fossil fuel plants by 2045, which collectively provide more than 4.5 GW of baseload energy generation. This loss of reliable generation is a central hurdle for Dominion, making clean, firm power critical to ensure grid reliability and affordability.

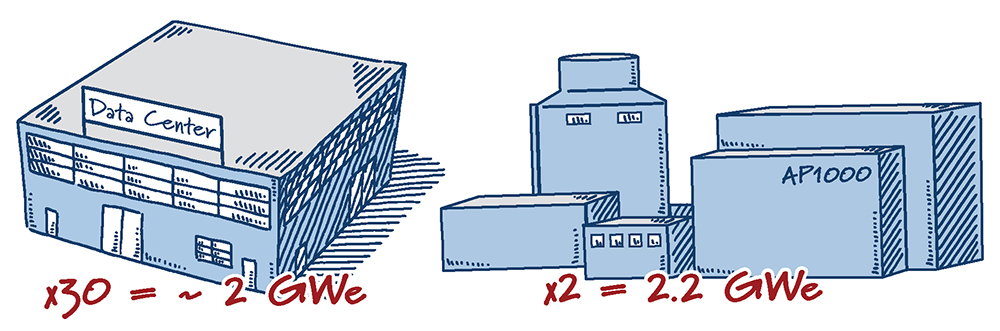

The U.S. needs to be focused on energy addition, not subtraction. Focusing on data centers alone, in 2023, Dominion connected 15 data centers to the grid, with 15 more in 2024, adding nearly two GW to the grid. This additional demand is roughly the size of two advanced large reactors, such as Vogtle units 3 & 4 in Georgia. This demand will not slow anytime soon and will be the main driver of the 183% increase in unconstrained demand by 2040, according to a study conducted by the Joint Legislative Audit and Review Commission (JLARC), the Virginia General Assembly’s oversight agency.

In a “show me the money” moment reminiscent of Jerry Maguire’s Rod Tidwell, Dominion is significantly increasing its five-year capital expenditure plan, now totaling approximately $50.1 billion through 2029, up from a previous estimate of $43.2 billion. This is an enormous capital investment, and it is only one utility in one state. Dominion is also:

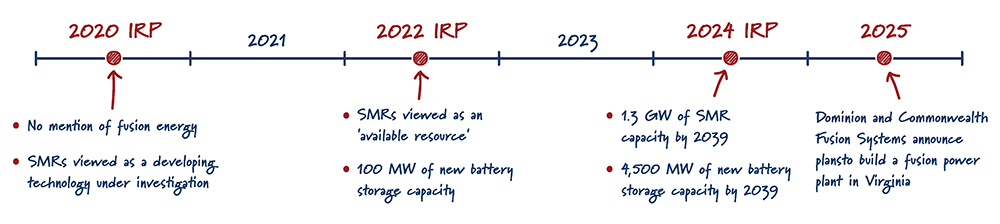

Fusion energy was not even mentioned 5 years ago in Dominion’s 2020 IRP or subsequent updates until 2023. SMRs were not viewed as an “available resource” for deployment until the 2022 IRP. Prior to that, in the 2020 IRP, SMRs were only discussed as a developing technology under investigation. Now, plans call for significant new SMR capacity, such as the 1.3 GW proposed by 2039 in the 2024 IRP. Battery storage also shows a striking increase in Dominion’s plans. While the 2022 IRP called for approximately 100 MW of new battery storage capacity, the 2024 IRP now projects as much as 4,500 MW of battery storage by 2039.

As utilities like Dominion Energy face the monumental task of building new energy infrastructure, getting projects online sooner is an imperative. The multi-year wait times for permitting are a significant bottleneck, which is why modernizing the U.S. permitting system should be a bipartisan priority. Robust support for innovative technologies like advanced nuclear and fusion energy is equally vital. Tech-neutral clean electricity credits like 45Y and 48E support quicker scale-up of new generation. Programs such as the Advanced Reactor Demonstration Program (ARDP), which aims to demonstrate new nuclear technologies, and the Loan Program Office (LPO), which provides much-needed financing for early-stage scale-up, are essential for providing the financial backing these innovative projects need to reach commercialization. Addressing these challenges head-on can ensure a more reliable, secure and affordable energy future.