Posted on April 15, 2021 by Rich Powell

Below is my testimony before the Senate Committee on The Budget in a hearing entitled, “The Cost of Inaction on Climate Change” on April 15, 2021.

Good morning Chairman Sanders, Ranking Member Graham and Members of the Committee. My name is Rich Powell, and I am the Executive Director of ClearPath.

ClearPath is a 501(c)(3) organization whose mission is to develop and advance policies that accelerate breakthrough innovations that reduce emissions in the energy and industrial sectors. We develop cutting-edge policy solutions on clean energy and industrial innovation, and we collaborate with public and private sector stakeholders on innovations in nuclear energy, carbon capture, hydropower, natural gas, geothermal, energy storage, and heavy industry to enable private-sector deployment of critical technologies. An important note: we receive zero funding from industry.

Given this committee’s vital role in America’s fiscally responsible approach to the global climate challenge and the economic recovery challenges ahead, I will discuss five key topics today:

Climate change is real, industrial activity around the globe is the dominant contributor to it, and the challenge it poses to society merits significant action at every level of government and the private sector.

Lawmakers and businesses across the country are prioritizing investments in climate change adaptation efforts. The Florida state legislature, led by large Republican majorities, just last week advanced a bill to Governor DeSantis’ desk which would require a master plan for the state to deal with sea level rise and flooding, and established a fund providing up to $100 million annually for climate resiliency projects.1 Meanwhile, Louisiana has a $50 billion coastal master plan for coastal restoration in part due to rising sea levels.2

Managing our country’s debt will be another defining challenge of this century. As millions of Americans are handing over thousands of dollars of their hard-earned income on tax day, they are also wondering how it is possible that our national debt recently surpassed $28 trillion.

Since 1980, the United States has spent $1.9 trillion in Disaster Recovery from 290 “billion-dollar events.”3 From 2014 to 2018, the United States has seen an annual average of 13 billion-dollar disasters. This has all been deficit spending. If we don’t better prepare – both with smarter investments in adaptation and by mitigating the underlying problem with global clean energy solutions – we will massively deepen deficit spending. According to the Federal Emergency Management Agency, every $1 spent on pre-disaster mitigation saves on average $6.4

Some of America’s largest publicly owned utilities and major American companies are also taking action against climate change to reduce emissions. The Business Roundtable has been leading on clean energy innovation policy solutions to reduce its members’ carbon emissions. Microsoft Corp, PepsiCo, and General Motors are among some of the largest American-based, multinational corporations that have made ambitious net-zero commitments in recent years. America’s largest electric utilities, including Southern Company, Xcel Energy, Duke Energy, and DTE have also committed to reaching net-zero emissions by 2050. According to the Smart Electric Power Alliance, 68 percent of all electricity customer accounts in the country are now served by a utility with a significant carbon emissions reduction goal, and 19 of the 48 companies setting goals are for net-zero or carbon-free power by 2050.

Xcel Energy, whose territory extends across some of the windiest and sunniest regions of the country, has one of the most ambitious climate goals in the industry – 80 percent clean by 2030 and 100 percent clean by 2050. They have said that even with their first rate access to wind and sun, existing technology today is sufficient to reach only 80 percent clean, but not 100 percent clean.

As the Committee considers the budgetary demands of each of these challenges and the President’s “skinny budget” proposal, it is important U.S. policy synchronizes with the global nature of the climate challenge. Reducing American emissions is essential, and we have seen a significant decline already. Since U.S. emissions peaked in 2005, power sector emissions have fallen by over 33 percent, largely due to the abundance of cleaner natural gas, coal to gas power switching, as well as an increase in renewables.5 But, even if the U.S. somehow eliminated all of our carbon emissions tomorrow, just the growth in carbon emissions from today through 2050 by developing Asian countries (e.g., China, India) would exceed total U.S. emissions today.6

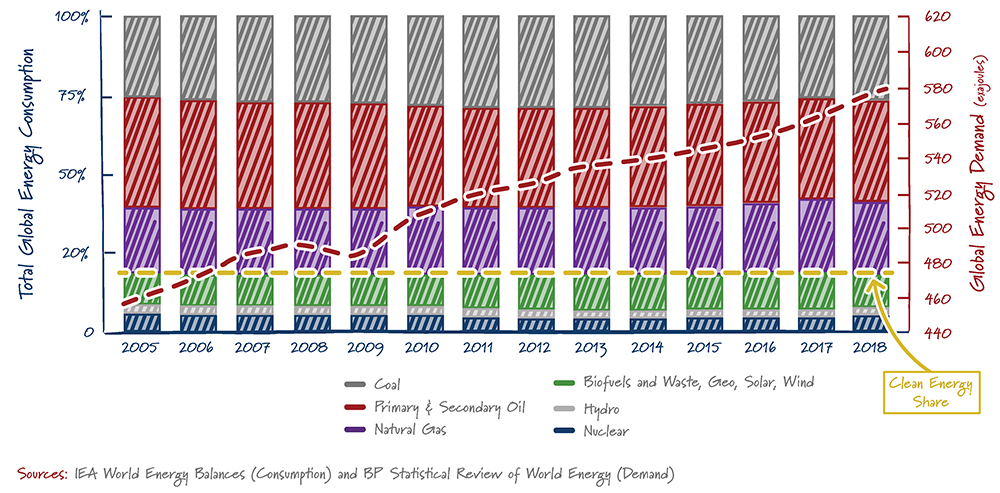

However, clean technology available today is simply not up to the task of global economy-wide decarbonization. As the chart below indicates, the global supply of clean energy has remained stagnant since 2005. We need to focus on breakthrough technologies that can truly begin to make a dent in the problem.

Share of Total Primary Energy Supply by Fuel Type

Sources: IEA World electricity generation mix by fuel, 2020; BP Statistical Review, 2020

Before I started at ClearPath, I was a business consultant at McKinsey & Company. Of all the business philosophy I read and used to help clients, the simplest and most important came from the great Stephen Covey. His second rule for success was elegant, and all important: Begin with the end in mind.

When we confront the problem of a changing climate in a rapidly developing world, the end we must begin with is this: rapidly developing countries choosing to buy and build clean energy technologies over carbon-intensive, traditional energy technologies. If that choice is difficult, they will choose it infrequently. Today, unmitigated Chinese coal plants are cheaper, easier to build, and better performing as an energy system than clean technologies. Some countries might pay a premium for clean development. Others will not. At ClearPath, we would argue that our “end” ought to be making that technology choice easy for developing countries – to make clean energy systems cheaper, better performing, and easier to buy and build than carbon-intensive energy systems.

With that end in mind, we need to evaluate our tools. We cannot spend our way to a solution – the global energy economy and the demands of rising populations around the world are too much even for the mighty U.S. budget to facilitate these decisions around the world. The U.S. also cannot regulate or tax our way to a global solution. Domestic-only approaches may seem well-intentioned, but the U.S. has no magical mechanism to simultaneously regulate other countries’ emissions.

Rather, we need to invest in a set of better mousetraps. You may know the saying, “build a better mousetrap and the world will beat a path to your door.” Ones that will leverage the scarce dollars of U.S. taxpayers into solutions that the global economy will pick up on their own merits, not because we are controlling their domestic policy. This kind of investment is the very definition of a market-based solution to climate change, one that makes markets themselves the force for change in distributing clean energy, instead of the force we work against.

In the U.S., our clean energy budget policy debate is often caught between two extreme perspectives. On one side, some prefer a laissez-faire capitalist approach with a very limited scope of federal dollars used in the electricity sector, regardless of whether that approach is sufficient to reduce the risks of climate change. On the other, some argue for a Green New Deal, and a government-controlled power sector, regardless of whether that approach will produce globally relevant clean tech breakthroughs.

To the first point — many people ask why shouldn’t energy companies be the ones to invest in research and bring new energy technology to market, aka Silicon Valley innovation? Unfortunately, advanced nuclear technology isn’t Uber and can’t be created by two people in their garage, and the clean energy benefits won’t immediately be rewarded. Energy innovation requires massive scale, sometimes taking decades to get from lab to market. And even then, the market is not as simple as going to a store and buying your new favorite gadget off the shelf – the power industry is a highly regulated commodity market that is structurally discouraged from bringing new technologies to market due to the way utilities are regulated or wholesale power markets are structured.

Given these dynamics, new energy technologies would not and have not happened without investments from the U.S. Department of Energy (DOE). Two of the most important breakthrough clean energy technologies that have been responsible for carbon emissions reductions have been hydraulic fracturing and solar. Both followed the same pathway to success. Early government R&D targeted outcomes, and were built alongside partnerships with private industry and tax credits to facilitate commercialization. To best leverage taxpayer dollars, this government support, while useful, should expire as technology matures and becomes commercially viable.

Energy research is a multi-billion-dollar opportunity to find the next hydraulic fracturing-like technology breakthrough. But without federal support, even a superior energy technology – a truly better mousetrap – won’t be able to break into the market because the incumbent technologies have the scale and supporting infrastructure of a 50-year head start.

To the second point, on permanently funding a few already commercialized technologies such as wind or solar — America’s clean energy policy needs a technology-inclusive approach. If the recent Texas blackouts taught us anything, we need a diverse portfolio of resilient clean energy technologies to maintain system reliability and affordability. Supercharging innovation and financing first-of-a-kind projects, such as the carbon capture projects in Nebraska, Louisiana or North Dakota, or the X-energy small modular reactor in Washington, are real-world answers to a clean, reliable energy future. Some upcoming energy breakthroughs already have received important help from the DOE. Others still need much more to get to scale. Then, the new technology can succeed or fail on its own merits on a level playing field.

That’s the governmental role we need, and it’s neither a command-and-control approach that defines market outcomes, nor a do-nothing-and-hope-for-a-miracle approach. The potential returns of such investment are world-changing.

To reduce global emissions as quickly and cheaply as possible, better, cost-effective clean technology is necessary so the developing world will consistently choose those tools over the higher-emitting options they are choosing today. And our Department of Energy and national lab system – the leading technology incubator of the world that has catalyzed such life-altering creations such as nuclear power, LED light bulbs, and sequencing the human genome – can bring forth those breakthroughs. With the U.S. as the world’s innovation center, chances remain high that the new generation of miracle technologies will be created in an American laboratory in collaboration with the U.S. private sector. These low-cost, high-performing technologies will be the backbone of efforts particularly targeting rising carbon emissions in the developing world.

The exciting news? At the end of 2020, Congress passed one of the biggest advancements in clean energy and climate policy we’ve seen in over a decade with the monumental Energy Act of 2020, which was part of the bipartisan omnibus appropriations law and COVID relief package.

The bipartisan law refocuses the DOE’s research and development (R&D) programs on the most pressing challenges — scaling up flexible, 24/7 clean energy technologies. Refocusing and modernizing key research, development, and demonstration (RD&D) programs is essential to securing our nation’s role as a global technology innovation leader while facilitating a cleaner, more reliable, and affordable domestic electricity supply for the American public.

Specifically, it launches initiatives to support:

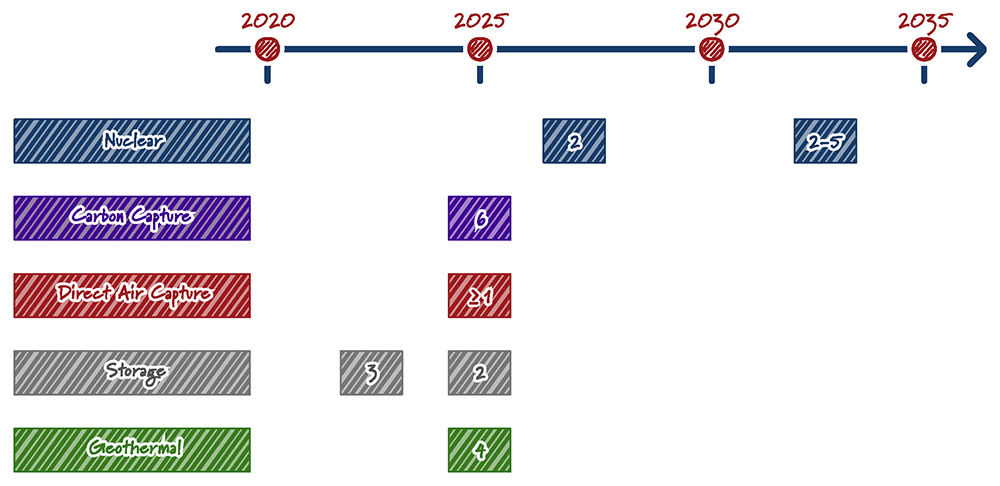

Commercial Demonstrations at DOE

The moonshot technology RD&D investment goals in the Energy Act of 2020 will provide enhanced flexibility to the electric grid, including deploying demand response and energy storage technologies at scale.

As we begin with the end in mind, let me share a few examples of what an outcome looks like with the support of smart investment – in other words, why simply more spending and subsidies will not catalyze the innovation we need.

DOE has been most successful when it has set long-term, aggressive milestones to develop and stand-up new technologies at price points and performance levels that are meaningful for private markets. Its legacy work on unlocking shale gas, the Energy Efficiency and Renewable Energy Office’s work on SunShot to radically decrease the cost of photovoltaic solar, and the Joint Bioenergy Initiative on lignocellulosic biofuels at the Lawrence Berkeley Laboratory are all strong examples. When DOE has clear, well understood and shared goals, combined with strong innovative leadership, clear organizational accountability owning results, and steady investments against that goal over multiple administrations, the Administration tends to produce breakthrough results.

Another technology with great potential: energy storage. We believe energy storage technologies have the potential to modernize and harden the U.S. electricity system, and ultra-cheap renewables with long duration storage will be major contributors to low-cost, high-performing clean energy systems. Across the country, utilities are deploying lithium-ion batteries to meet short-term, several hour storage potential, but that technology has limitations. The future grid will need a suite of different storage technologies that have not yet been commercialized. This is why the DOE’s RD&D programs are so important.

Currently, energy storage R&D at DOE lacks the organizational accountability needed for breakthrough success. The programs are spread across DOE in four offices from Electricity to EERE to Science to the Advanced Research Project Agency-Energy (ARPA-E). Many of these offices historically were primarily focused on transportation rather than grid-scale storage. The Fiscal Year (FY) 2020 budget took a major step in the right direction by proposing a “launchpad” hosted at the Pacific Northwest National Lab (PNNL) focused on developing, testing and evaluating battery (and potentially other) materials and systems for grid applications.

In January 2020, DOE launched the Energy Storage Grand Challenge (ESGC), a comprehensive program to accelerate the development, commercialization, and utilization of next-generation energy storage technologies and sustain American global leadership in energy storage. DOE invests about $400 million per year in energy storage-related RD&D, yet the Department has never had a complex-wide energy storage strategy — until now. This framework was cemented into law with passage of the Better Energy Storage Technology (BEST) Act as part of the Energy Act of 2020. We’re heading in the right direction with this crucial technology.

Perhaps nothing has illustrated the smart investment strategy more than the shale gas revolution. It took bold and visionary R&D, tax incentives and other federal help to lead to what has unquestionably been an economic windfall that will continue for many decades, and has been the primary emissions reducer for the U.S.

But this all started in 1977 when the Department of Energy demonstrated hydraulic fracturing in shale. DOE invested $500 million in applied R&D with the private sector – in particular, a long-term, public-private partnership with Mitchell Energy to demonstrate the technologies. And then between 1980-2002, the government offered $10 billion in tax incentives. The Gas Research Institute contributed another $100 million of voluntary commitments from the private sector. This concentrated applied R&D and public private partnership unlocked a remarkable, market-driven transition in the U.S. power sector such that gas is now the largest source of electricity generation. We have significantly decreased U.S. power emissions and electricity system costs, and now have become virtually energy independent, radically rebalancing global energy diplomacy.7

When goal-oriented energy R&D is smartly invested for the country, it pays back exponentially. The shale gas revolution contributes an estimated $100 billion to consumers every year, and has been the main driver behind reducing power sector emissions in the past decade. And thankfully, we are applying a similar R&D and tax incentive formula that we used for shale gas now toward advanced nuclear, carbon capture and, to a growing extent, energy storage.

As we reimagine our energy grid using exciting new technologies, permitting modernizations must keep pace with the transition to a clean energy economy. The transition will require tens of thousands of miles of new pipelines carrying hydrogen and captured carbon dioxide from power plants and industrial facilities, new transmission infrastructure to carry electricity around an increasingly electrified country, and new power plants sited everywhere.8 This will be the largest continental construction project in history, and every one of those projects will begin with a permit.

Making the permitting process more efficient is essential for two reasons: one, stewardship of taxpayer resources, and two, scaling clean energy rapidly. Streamlining and accelerating project permitting should focus on the following four steps:

At ClearPath, we believe all of this can be done by improving the process without changing any of the environmental protection laws. Let’s remember that streamlining NEPA, or the administration of NEPA, changes nothing requiring a project to comply with the Clean Air Act, the Clean Water Act, the Endangered Species Act, or other pillars of our nation’s environmental protection policy. And, we believe such reform can be done without introducing more regulation or new taxation, or revoking the public’s opportunity to be involved in the review process.

Finally, how can we build on recent bipartisan support for all these exciting opportunities for more clean energy innovation? In addition to the bipartisan authorizations in the Energy Act of 2020, the most recent FY20 & 21 appropriations bills are great successes, and I applaud the critical programmatic direction and eagle-eyed investments in advanced nuclear, carbon capture, grid-scale storage and other clean energy technologies included.

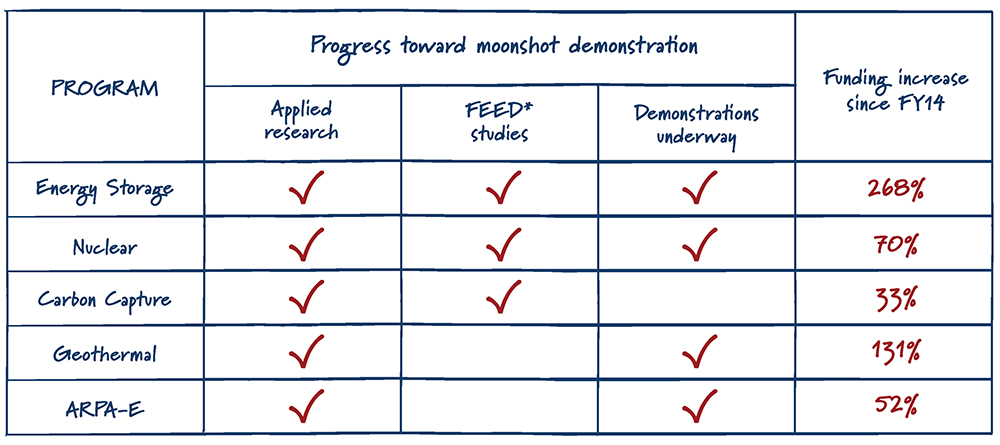

In fact, from FY14 through FY21, Congress significantly increased federal funding for clean energy R&D on breakthrough technologies in a number of applied offices – 268 percent for energy storage, 70 percent for nuclear energy, 52 percent for ARPA-E, and 33 percent for carbon capture and fossil energy.

While these investments are impressive, your strategy to make this less about the money and more about clear objectives in the programs is even more important. Money should follow those clear objectives and demonstrations through public-private partnerships, which is an essential step towards fulfilling our goal of America providing affordable clean energy technology to the rest of the world. In the cases where you have set moonshot goals and driven applied R&D, there are multiple instances that have led to front-end engineering design studies and in some cases – actual demonstrations are underway.

With these efforts and the Energy Act of 2020, Congress sent an undeniable message that lawmakers are serious about keeping the U.S. in the top tier of countries pursuing clean and reliable energy breakthroughs. While steady and sufficient funding is essential, providing important direction and reforms to the DOE to make sure that dollars are well spent is equally as vital to spurring clean energy innovation.

Making investments in these programs will greatly impact the acceleration of clean energy innovation, and we are very much looking forward to continuing that wonderful momentum.

Again, we must think globally when approaching this challenge. Partisan, economy-wide spending efforts will not pass the political sustainability test needed for climate solutions. Likewise, halting pipelines or placing moratoriums on oil and gas drilling on federal lands also has little to no impact on actual carbon dioxide emissions in the U.S., let alone the rest of the world. We agree, the cost of inaction on climate is high, and finding bipartisan common ground on clean energy innovation policy is priceless.

Thank you again for the opportunity to provide remarks. ClearPath is eager to assist the Committee in developing innovative policies, identifying opportunities for investments instead of spending, tracking successful outcomes around the new moonshot energy technology goals outlined above, and building cleaner faster. We applaud the Committee for taking on this important task to help ensure the appropriate investments can be made to modernize and facilitate the research, development, and demonstration of cutting-edge energy technologies in the service of a stable global climate.

View more of Our Take and let us know what you think at jaylistens@clearpath.org.