Are you aware of how many minutes you spend on your phone each week? On average, adults spend more than 3 hours a day on a smartphone, but have you ever paused to think about what your cell phone is made of? Sure there is a glass cover, some metal and plastic, but what about the battery?

Cell phones weigh ~7 ounces, and the battery is 1/5th of that1. Most phones rely on a lithium-ion battery, which uses less than one gram (3/100ths of an ounce) of lithium as the “medium” for energy storage2. As the lithium creates ions they flow between anode and cathode to create a charge. Pretty cool, right!

But, for that tiny trace of lithium we need to be able to text Mom, the supply chain to get it is really complicated.

Lithium-ion batteries are not only in our phones — they are actually at the center of our clean energy transition. Other materials like graphite which is also used in batteries; and tellurium, used in next-generation solar cells are important, but lithium is definitely driving the battery storage market. Pretty much everything — from your phone, to electric vehicles, to utility-scale storage solutions — is finding applications for lithium.3

Perhaps you’ve read about the new lithium-ion battery that Tesla is working on with Chinese battery maker Contemporary Amperex Technology Co. Ltd. (CATL) that is said to last for more than 1 million miles and would have an earth shaking impact on battery technology4. But there is one huge question: where does the lithium, and other critical materials come from? Today, the answer is — not the United States

U.S. national security is weakened if the ability to build in the United States depends on materials and exchanges far outside U.S. control.

In 2018 the U.S. Department of the Interior published a list of 35 critical minerals: minerals that are “critical to the economic and national security of the United States.”5 These minerals are essential to the operation of key sectors like aerospace, defense, energy, electronics, and transportation, but have supply chains that are easy to disrupt6. For one thing, these minerals can be found in the earth’s crust, but are only mined or processed in concentrated geographic locations. Components of some lithium-ion batteries, like graphite, lithium, cobalt, and manganese, are on this list as well.

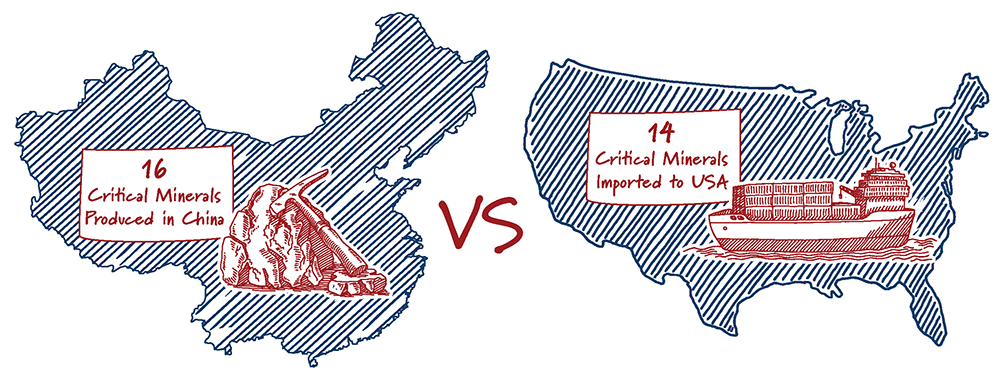

The U.S. imports most of these critical minerals in varying quantities. Although the U.S. is a leader in producing beryllium and helium, it relies entirely on imports for 14 of the minerals, including bauxite, the primary source of aluminium, and tantalum, which is a capacitor in some electronics.By contrast, China is by far the leading producer of critical minerals, dominating production of 16 of them.7

So what? Let’s look at batteries as an example. Many lithium-ion batteries use cobalt in their cathode. Despite being so widely used, over 90% of cobalt is produced as a byproduct of extracting other resources, making its production dependent on factors besides the demand for batteries. What’s more, over 65% of global production is concentrated in the Democratic Republic of the Congo, a country in which the United Nations still maintains a peacekeeping presence.8,9 Thus not only is the world dependent on one country for its supply, but that supply could feasibly be cut off by a geographically-specific or unrelated event. Although merely an investor in many cobalt mines, China controls 70% of the capacity to convert cobalt ore into cobalt chemicals for the battery industry, giving them additional control of the supply chain.

Like many of these critical minerals, lithium faces the same challenges. Although abundant, lithium is hard to extract and process. Most lithium mining is concentrated in Latin America and Australia, while China controls most of the processing capability; Australia alone boasts five of the ten biggest lithium deposits in the world, and over 60% of lithium processing occurs in China10,11. Production of lithium chemicals and end-products spans countries like China, Japan, and South Korea. Even when trading with allies, the lithium supply chain is truly global. The U.S. ability to manufacture batteries relies on factors outside its control — global trading prices, foreign mining and processing capabilities, or even a pandemic that limits international trade. As the U.S. looks to bring more critical minerals production home, let’s trace lithium from the ground to our pockets as a case study.

Lithium is mined from different sources: brine and hard rock, with others like clay under exploration. About half the world’s lithium comes from groundwater brine, water rich in lithium salt. Groundwater brine is most commonly mined in South America. Accessing this lithium involves pumping the water to the surface and letting it sit in huge ponds for months or years until the lithium concentration is high enough. Lithium can also be mined from hard rock in the ground in a traditional mine. These minerals are how most lithium is obtained in Australia and was the most important source of lithium before the discovery of the South American lithium reserves12. Each of these types of mining faces environmental issues: brine for its water use and footprint, and traditional mines for their footprint and leaching of chemicals.13

After it’s out of the ground, the lithium compound must be processed into a usable product. Lithium chemicals, not lithium alone, are used in batteries and other products. This means that the lithium is processed from one compound into another that can be used14. These processing facilities are highly specialized, as different customers require compounds with specific compositions and purities.15 The processes are also quite energy-intensive, adding an embedded carbon footprint when the processing facilities are located in high-emitting countries. Most lithium processing facilities are in China, which produced over 60% of the world’s lithium in April 201916. This means the supply chain of a lithium battery truly depends on global trade, even if the manufacturing facility for the battery itself is in the United States.

A surprising element of this supply chain comes with manufacturing the battery, although lithium processing faces similar concerns. Making a lithium-ion battery is an energy-intensive manufacturing process as well. Often this energy comes from carbon-emitting sources, and when it does, that energy accounts for half of a lithium-ion battery’s carbon footprint. Transportation also factors in; shipping lithium from Chile to China to Japan or South Korea adds a not-insignificant greenhouse gas footprint; just transporting completed battery cells from South Korea to Michigan adds a 4.1 kg CO2e/kWh footprint.17

Now we have the pieces in place, let’s look at one lithium-ion battery that’s been in the spotlight: that in a Tesla car, the semi truck iteration of which was recently delayed due to battery production constraints. An electric car needs a massive amount of lithium; the battery pack in a Tesla Model S needs 140 pounds of lithium, the amount in 10,000 cell phones.18 Tesla sources lithium from Australia’s Kidman Resources Mines, a hard rock mine; the company recently partnered with SQM, a Chilean company, to develop the Mt. Holland Lithium Project in Western Australia to add more mining capacity for Tesla. The rock is then sent to China’s Ganfeng Lithium for processing into lithium hydroxide, the chemical Tesla uses in its batteries. That chemical is sent to Tesla’s manufacturing facilities in New York, Nevada, California, and Shanghai to be made into a battery. So even though many Model 3 electric vehicles are manufactured in Fremont, CA, that manufacturing relies on a web of companies, processes, and chains that circle the globe. Even Tesla’s planned solar-powered Gigafactory, already the highest-volume battery factory in the world, only brings that final manufacturing element of the battery supply chain to the United States.

Making this process more complicated is that each step – mining, processing, and finally manufacturing end use – is inherently linked to demand at the end of the supply chain. The Mt. Holland project depends on Tesla wanting more batteries. Battery chemistry is fragile, meaning a lithium mine and processing facility must be able to reliably produce consistent lithium chemicals; a project to produce more lithium is thus driven by having an off-taker. The price of lithium depends on the global market, meaning the risk of embarking on a new project without a customer in mind is insurmountable.19 This can create a chicken-and-egg problem:it is almost impossible to build a mine without an off-take partner, and it is difficult to get such an agreement without first establishing commercial-scale capabilities.20

If the U.S. wants to enable a domestic lithium supply chain, it thus has many different stages and processes to build up, as well as manufacturing, environmental, and economic factors to contend with. Fortunately, high demand from the exploding growth of electric vehicles, serious geologic potential, and a manufacturing-experienced workforce give the U.S. fertile ground on which to build. Now we understand the process behind a lithium-ion battery, let’s turn back to the U.S.

`Currently, the U.S. has low capabilities but high promise: significant lithium deposits but only a handful of operations. One U.S. company, Albemarle, has facilities in North Carolina, Tennessee, and Nevada. Today Albemarle’s Nevada site is the only active lithium mine in the U.S., extracting lithium from brine using evaporation ponds. The company also historically mined hard rock at its North Carolina site; Albemarle currently runs a chemical conversion plant in North Carolina and is investigating the potential to restart the North Carolina mining operation.21 Additionally, Canadian company Lithium Americas is developing the project Thacker Pass, which will be the second-largest lithium mine in the world upon commissioning. The project is set to begin production in 2022 and will use an open-pit method to mine clay.22

The U.S. Is Ripe With Potential to Develop

More of the Lithium Supply Chain

At the Salton Sea geothermal field in California, Controlled Thermal Resources is trying to kill two birds with one stone: generating power from geothermal heat while extracting lithium from its brine. Conventional geothermal plants generate heat from reservoirs of hot water near the surface; when this brine has significant concentrations of lithium, that lithium could hypothetically be extracted as from any other lithium brine. This technique is called direct lithium extraction. A main benefit of this method is its environmental footprint — it uses less space and less water than traditional brine extraction, is closed-loop by returning the brine to its source, and is powered by renewable energy on-site. The process also extracts lithium in hours, not months.23 By designing the system from the ground up to incorporate lithium extraction, in an area with extremely high lithium concentrations, Controlled Thermal Resources hopes to create a domestic source of lithium carbonate by 2023 for electric vehicle manufacturing.24

In south central Arkansas, Canadian company Standard Lithium is taking direct lithium extraction to existing infrastructure in partnership with German chemical company Lanxess. Currently the Lanxess Project covers 150,000 acres and 10,000 leases to pull out brine, which is then piped to three processing plants to extract bromine. In 2019, Standard Lithium began exploring extraction of lithium from the brine before its reinjection into the ground. In the southwest of the state, Standard Lithium is partnering with Tetra Technologies to explore extracting lithium from the waste brine from oil and gas production. Like the Salton Sea project, these projects would use a closed-loop system that reduces both the environmental impact and time of the lithium extraction process.25 These projects also offer potentially huge cost savings by tapping into existing infrastructure, providing a lower-cost way to get lithium in the United States.

Some are looking to innovate even further. Scientists at the University of Texas at Austin recently developed a new filtration technique that could significantly reduce the time it takes to extract lithium from brine. In tests, the lithium recovery rate is up to 90%; this means more efficient resource recovery and a better environmental footprint for lithium extraction.26 As the U.S. looks not only to secure a domestic critical mineral supply, but also improve the lithium extraction process, such progress will rely on key innovators like these.

For some of the other critical minerals, another solution could be found on the ocean floor near U.S. coastlines. The potential of deep-sea mining could offer higher mineral yields and far less toxic waste than traditional critical minerals mining. Multinational company DeepGreen has explored deep-sea mining of “polymetallic nodules” containing nickel, manganese, and cobalt, all of which act as a cathode in the most common electric vehicle battery setup, as mentioned.27 Massachusetts Institute of Technology (MIT) has also looked into this process to help stakeholders develop the process.28 Deep sea minerals could assist in the scale of battery deployment as our hunger for electrically-charged everything grows.

Given the existing challenges in the supply chain and the global hunger for batteries, U.S. policymakers have looked for ways to incentivize domestic development of critical mineral supply chains. To date, the biggest initiative to spur domestic critical minerals production is the Department of Energy’s Energy Storage Grand Challenge. Broadly, the Challenge aims to innovate, produce, and deploy energy storage solutions entirely in the United States in order to possess a robust storage portfolio by 2030. A significant part of this effort focuses on securing a domestic manufacturing supply chain for critical minerals, involving technological advances, scale up of innovation, and reliable sourcing of materials 29. Achieving this goal will require detailed exploration into the capabilities of the United States and development in much of the supply chain.

On the legislative front, the bipartisan American Mineral Security Act (S.1317) was introduced in 2019 and is currently part of the American Energy Innovation Act. The bill directs the federal government to develop tools to better assess mineral deposits in the United States. It also authorizes research and development for the processing and recycling of critical minerals30. A successful program for U.S. mineral production relies on accurate information; this bill could provide that necessary foundation for future mineral production efforts.

More targeted in scope, Senator Ted Cruz’s ORE Act (S.3694) aims to reduce dependence on China by bolstering U.S. production of rare earth minerals. The bill includes tax deductions for the cost of constructing rare earth mines and demand-side incentives to use domestically produced minerals31. From 2019, Senator Marco Rubio’s RE-Coop 21st Century Manufacturing Act (S.2093) would authorize a coordinating body to oversee development of an integrated rare earth supply chain. Over 80% of rare earth elements are imported from China — even minerals mined in California’s Mountain Pass are shipped to China for processing — so bringing the supply chain home could reduce dependence on China32,33.

In the U.S. House of Representatives, Reps. Michael Waltz (R-FL) and Paul Gosar (R-AZ) recently introduced the American Critical Mineral Exploration and Innovation Act of 2020 (H.R.7061), which establishes a framework for expanding critical mineral security. The crosscutting bill does this through expanded resource assessment, research and development in advanced critical minerals technologies, and workforce development initiatives. Viewing critical minerals security from ground to industry helps lay the groundwork for a realignment of U.S. critical mineral policy that encourages a domestic supply chain.

Another option to reduce dependence on China is recycling. Today, less than 5% of lithium-ion batteries are recycled, primarily because the process is unattractive: it’s energy-intensive, produces toxic byproducts, and struggles to recover a significant amount of lithium material. Only one U.S. company, Retriev Technologies Inc34,35. recycles lithium metal and lithium-ion batteries at its facilities in British Columbia and Lancaster, Ohio., The Battery and Critical Mineral Recycling Act of 2020 (S.3356) and the Department of Energy’s Lithium-Ion Battery Recycling Prize of 2019 aim to improve recycling R&D and incentivize creation of domestic recycling centers36,37,