Posted on October 1, 2020 by Rich Powell

Below is my testimony before the House Select Committee on the Climate Crisis on, “How to Achieve Clean, Reliable, Affordable and Exportable Energy in the U.S.” on October 1, 2020.

Good afternoon Chair Castor, Ranking Member Graves and members of the Committee. My name is Rich Powell, and I am the Executive Director of ClearPath.

ClearPath is a 501(c)3 organization whose mission is to develop and advance conservative policies that accelerate clean energy innovation. We support solutions that promote a wide array of clean energy technologies – including next-generation nuclear, hydropower, fossil fuels with carbon capture and grid-scale energy storage. Our core mission advocates markets over mandates and bolstering technological innovation while easing regulatory bottlenecks. ClearPath provides education and analysis to policymakers, collaborates with relevant industry partners to inform our independent research and policy development, and supports mission-aligned grantees. An important note: we receive zero funding from industry.

We believe this Select Committee plays an important role in America’s response to the global climate challenge. I commend Chair Castor and Ranking Member Graves for holding this important hearing on reducing the risks of climate change.

With this in mind, I will discuss a few topics today to help achieve clean, reliable, affordable and exportable energy in the U.S.:

First, the elephant in the room: Climate change is real, industrial activity around the globe is the dominant contributor, and the challenge it poses to society merits significant action at every level of government and the private sector. It is too important to be a partisan punching bag. Climate change deserves a pragmatic and technology-inclusive agenda to make the global clean energy transition cheaper and faster.

Earlier this month, the Commodity Futures Trading Commission issued a report, Managing Climate Risk in the U.S. Financial System, that finds climate change could pose systemic risks to the U.S. financial system.1 While it notes that significant uncertainty remains in the climate projections and their potential effects on our financial system, it argues that prudent economic management calls for “err[ing] on the side of caution if we are to maintain the relative stability and proper functioning of our market economies.”

For example, analysis from the Risk Center at the Wharton School recently demonstrated how the federal mortgage finance system will face multiple challenges due to climate risks. According to Wharton, mortgage-backed securities insured by the federal government through Fannie Mae, Freddie Mac, or FHA/VA programs account for more than 60 percent of the outstanding residential mortgage debt in the United States, totaling $6.7 trillion.2 This is up from $2.5 trillion in 2000.

According to the National Oceanic and Atmospheric Administration (NOAA), this accumulation of financial risk is occuring in the face of 14 individual weather and climate events doing at least $1 billion in damage in 2018, totaling $93.5 billion in total damages.3 Additionally, a 2017 report by the Inspector General found that only 42 percent of the Federal Emergency Management Agency’s (FEMA) flood maps correctly identified flooding risk at this point.

In some jurisdictions prone to flooding, exacerbated by sea level rise, private insurers have already largely withdrawn leaving the public options – either the National Flood Insurance Program or FEMA emergency spending, as an ever growing public liability.4

This trend will likely continue to worsen. As climate-related exposure continues to increase, those impacts will be felt in securities backed by the federal government, with higher costs passed on to Americans as a result. This also subsidizes the risky choices of those remaining in harm’s way. In other parts of the country, excessive regulation of home insurance is leading to unsustainable mandates to maintain coverage of fire risk, for example, impeding accurate pricing and risking a further withdrawal of private insurers and an inevitable demand that more federal dollars subsidize the vulnerable. This system is unsustainable.

The harsh reality of global climate change is that the global atmosphere responds the same way to a ton of greenhouse gases regardless from where it is emitted. A ton from the United States today has an identical effect as a ton from Nigeria, India, Indonesia, and China today, or in the years to come. This makes combatting the risks from climate change necessarily a global issue. No country can single-handedly mitigate global climate risk. Indeed, the United States, while a major historical contributor, now emits 15 percent of global emissions, and our share is dropping as those of rapidly developing countries rise.

This must never be taken as an excuse for inaction. Rather, the key to mitigating the risks of global climate change is designing U.S. policy responses keyed towards global emissions reductions – a massive innovation challenge discussed below. As well, the U.S. must be wary not to drive emitting industries across our borders and to other jurisdictions in developing countries with cheaper inputs and lax environmental controls – a phenomenon known as emissions leakage that risks increasing global emissions. Nor should we risk policies that are so harmful to our own markets and financial systems that they do more harm than good to our economy.

Even as we pursue a strategy of global climate risk mitigation via clean technology diffusion, state and local jurisdictions can do much to lessen climate risk with smarter adaptation and resilience policy.

Since 1980, the United States has spent $1.75 trillion in disaster recovery from 258 “billion-dollar events.” From 2014 to 2018, the United States saw an average of 13 billion-dollar disasters every year. This is all deficit spending. If we don’t better prepare, we will further increase deficit spending. According to FEMA, every $1 spent on pre-disaster mitigation saves on average $4.

The current, tragic wildfires in California, and some of the proposed policy responses, present a potential example of how these mitigation and adaptation priorities can be conflated and risk doing more harm than good. While a global response to climate change will eventually reduce the risk of uncontrollable wildfires in California, the absolute near-term priority in the state must be on better climate resilience and adaptation policy – a huge step up in forest and vegetation management – if large portions of the state are to remain livable. Calls for tripling down on mitigation policy within California’s borders as a near-term fire risk reducer, as some have suggested,5 risk providing citizens with false hope and distracting from the essential local task of reducing the massive accumulated fuel load ready to burn across the West.

Louisiana’s Coastal Protection and Restoration Authority master plan is a great example of long-term resilience efforts at the local level. In Fiscal Year 2021, they plan to spend more than $950 million as part of their 50-year, $50 billion master plan for hurricane surge risk reduction and coastal restoration projects.6

To have a debate about climate change rooted in political and technical realism, as well as economic competitiveness, we need to understand the needs of the rest of the world. Developing countries have an insatiable energy appetite.

As populations and economies grow, they are demanding more and more affordable energy options. Let’s take a look around the globe – hundreds of millions of people in Asia and Africa continue to lack basic necessities for human development and public health linked to clean electricity, like lights in their hospitals and clean air to breathe. India has some of the dirtiest air and one of the largest populations without reliable electricity access in the world. Despite tremendous progress, India still has 178 million people without reliable electricity and is home to 22 of the world’s 30 most polluted cities.

Why does so much of India lack reliable electricity? Ultimately, it costs too much. In 2018, the International Energy Agency (IEA) found when Indians could access electricity, it was on average twice as expensive as in the United States, adjusted for purchasing power. And that’s for electricity far dirtier than U.S. electricity. In the early days of the coronavirus lockdowns, India relied on coal for 72 percent of their electricity, while the U.S. was down to 17 percent – and U.S. coal plants have far more modern environmental controls. This illustrates the significant hurdle we need to achieve on affordability and performance for new zero-emissions technologies.

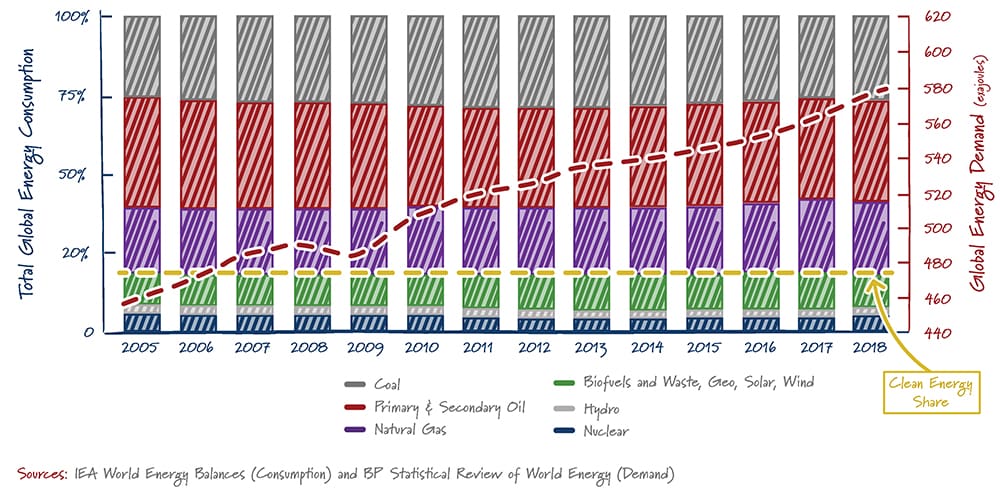

Share of Total Primary Energy Supply by Fuel Type

The current energy choices available to developing nations are simply not up to the task of rapid global decarbonization. Despite significant global renewables deployment, emissions continue to rise. The share of global energy supplied by clean sources has barely increased since 2005. In other words, clean development is only just keeping up with economic development; clean is not gaining ground. Clean technology must come to represent a better, cheaper alternative that is reliable 24/7/365 so developing nations consistently choose it over higher-emitting options. We must remember that developing nations are building energy systems, not just individual plants, and must take into account the overall system costs of new energy sources. For example, a reliable energy system based on variable wind and solar also must incorporate the costs of additional transmission to load centers, along with either over-build in the generation to account for variability given their capacity factors, or short and long duration storage to smooth out that variability, or flexible, usually emitting, back-up generators which increase emissions. All of these add to the costs of a system.

It’s also unlikely that this story will change any time soon unless new clean technologies become market competitive. China built new coal plants roughly 20 percent the size of the entire U.S. coal fleet last year. Despite China’s recent net-zero pledge, they continue to greenlight dozens of new coal power plants without carbon capture today, which will ‘lock in’ emissions for decades to come.7 China’s climate problem is our climate problem, just like their virus problem became our virus problem.

If America does not provide the rest of the world with affordable and reliable clean energy technologies, developing countries will turn to our adversaries, partnering with countries like China and Russia, who view the spread of their technology as a way to expand their power while weakening the United States. In other words, by failing to develop affordable clean energy sources of all kinds, we not only fail to solve the climate issues at hand but also threaten our own national security and geopolitical position.

China and Russia have gained the upper hand in energy exports by leveraging state-owned enterprises to achieve their economic and political interests. The aforementioned Belt and Road initiative that China is pursuing relies heavily on state-owned enterprises to achieve its goals. By project value, as of last October, 70 percent of Belt and Road projects were contracted to state-owned enterprises. These state-owned enterprises seek to achieve the strategic objectives of the initiative: to use economics to promote politics and to combine politics and economics.8 They seek to achieve these objectives with more than just financial backing from China. The Chinese government offers policy, performance evaluation, and risk management and analysis to these companies to make them more effective.

As for Russia, they also utilize state-owned enterprises to achieve their goals. Their state-owned nuclear company, Rosatom, reports that at least 33 plants are currently planned for development. Whereas the United States historically led the world in peaceful and safe nuclear technology exports, Russia has attempted to corner the global market, positioning themselves as the leading exporter with more than a dozen plants currently being built in countries like Turkey, Bangladesh, India and Hungary.9 China is close behind Russia, having increased nuclear exports under the belief that more nuclear energy proliferation will make the world more peaceful while also supporting their economic goals.10

We should also note that our global competitors and their state owned enterprises (who control roughly 90% of known oil and gas reserves) do not fall within the same voluntary corporate governance regimes currently being constructed by the growing number of U.S. and European investors with an ESG focus. While those regimes can helpfully encourage investment in cleaner resources and consideration of the physical risks of climate change in business planning, we should take care that they do not unduly disadvantage or re-direct investment out of higher efficiency, cleaner operating American companies and into the hands of their sovereign-owned global competitors who are subjected to little environmental scrutiny or regulation. For example, the National Energy Technology Laboratory study has found that Russian natural gas exported to Europe has lifecycle greenhouse gas emissions over 40% higher than U.S. liquified natural exported to Europe. Policies that give Gazprom a competitive advantage over U.S. LNG are policies that will result in higher global emissions.11

These examples illustrate both the economic potential and the pitfalls of inaction present in this debate. The markets America could serve are vast, and the trade benefits we can experience are huge, if we are the first to develop truly scalable clean energy solutions and craft a cohesive plan for international deployment assistance. More broadly, continuing an innovation-focused approach to American clean energy dominance will cement our geopolitical gains from the shale revolution, ensuring we continue as the global energy superpower throughout the 21st century.

Given the scale of the climate challenge, we need to greatly increase the pace and ambition of our efforts. ClearPath has laid out four legs to success.

First, we must innovate. That means developing clean technologies the world wants to buy that give America a competitive advantage. Big energy projects can’t be done in someone’s basement with a small angel investor like a new food delivery app. And we must drive progress with public investments in close partnership with the private sector, with very clear accountability at DOE to produce huge cost and performance improvements.

Second, we must limit excessive regulatory hurdles that needlessly slow down clean energy workers. Members of this Committee are supporting important reforms to the National Environmental Protection Act (NEPA), for example. The efficient permitting of projects is essential to effectively using scant taxpayer resources and to scaling clean energy deployment rapidly. We can only build clean energy technologies and put more energy workers back on the job as fast as we can permit the projects.

Ranking Member Graves’ BUILDER Act (H.R. 8333), for example, introduced last week, would remove barriers and accelerate the deployment of clean energy technologies.

Third, we must demonstrate how the technology works. Let’s work with the utility companies and private sector making bold net-zero emissions commitments, not against them. Congress is working on authorizing bills to cost share federal demonstration programs, incentivize demonstrating new technology via tax credits, and smooth the regulatory path to deploying these at scale, driving affordability.

America’s largest electric utilities – with more than 22 investor-owned utilities setting net zero by 2050 goals – include North Carolina-based Duke Energy and Georgia-based Southern Company, which operates the largest grid in the country. According to the Smart Electric Power Alliance, 68 percent of all electricity customer accounts in the country are now served by a utility with a significant carbon emissions reduction goal, and 19 of the 48 companies setting goals are for net-zero or carbon-free power by 2050.12 These electricity producers have been virtually uniform in stating that the technology does not exist today to achieve these goals affordably and reliably, and that Federal policy should focus on identifying and demonstrating affordable, flexible clean energy resources like carbon capture, advanced nuclear, grid scale storage, geothermal and clean hydrogen — along with carbon dioxide removal technologies like direct air capture that could allow them to offset any remaining fossil plants’ emissions by 2050.

Corporate commitments go well beyond the energy industry. Walmart’s “Project Gigaton” is aimed at reducing 1 gigaton of greenhouse gas emissions from their supply chain by 2030 and going carbon neutral by 2040. Microsoft has committed to reducing its emissions to zero — and then some — promising to remove all the emissions it has ever created over its lifetime. These commitments share a need for bold new technology.

Projected Global Energy Production and CO₂ Emission

Fourth, we must export the proven technology and create new clean energy markets. Everything we are innovating and demonstrating must not only have a niche in our own energy sector, but also apply to countries like India, Tanzania or Indonesia that are growing exponentially – and consider what they would be willing and able to buy from us. In turn, we must carefully avoid near-term policies that lock in exclusive investments towards immediately available, higher cost resources because doing so will divert resources from the solutions that are exportable.

America has several levers to ensure our technology offerings are competitive with countries who do not share our interests or values. These include engagement with the international community in financing like the U.S. International Development Finance Corporation (DFC) – created by the Better Utilization of Investments Leading to Development (BUILD) Act of 2018 from the Overseas Private Investment Corporation (OPIC) – and the Export Import Bank, along with bilateral and multilateral engagement on clean energy exports and technology transfer in forums like the Clean Energy Ministerial.

For the past decade, the United States has ceded leadership on international energy development to China and Russia, threatening the climate, our national security and American economic growth. However, on July 23, the U.S. took a massive step towards reclaiming our role as the primary exporter of vital clean energy technologies by lifting the nuclear financing moratorium at the DFC. Financing nuclear projects will open the door for U.S. advanced nuclear technologies to lead the development of clean energy for emerging economies.

Similarly, America needs to work to ensure that restrictions on clean energy projects do not exist at international organizations we participate in like the World Bank. Finally, the continued authorization of the Export Import Bank is key to ensuring the export of energy technologies internationally.

The 115th Congress did not receive appropriate credit for boosting low-carbon technologies. The broadly bipartisan agenda enhanced critical incentives for carbon capture, renewables and advanced nuclear. It invested in the U.S. Department of Energy (DOE) research and development (R&D) at record levels, and it reformed regulations to accelerate the licensing of both advanced nuclear reactors and hydropower. The 45Q tax incentive for carbon capture and storage technology is a perfect example – it was supported by a vast bipartisan coalition from environmental organizations to organized labor to utilities to coal companies. Notably, seven national unions recently collectively re-emphasized the importance of including carbon capture and nuclear in any national clean energy policy. Lastly, the creation of the Development Finance Corporation through the BUILD Act greatly improved the prospects for American clean technologies internationally.

This Congress has a great opportunity before you to pass bipartisan clean energy innovation legislation. The very bipartisan Senate American Energy Innovation Act (S. 2657) may well pass the floor of the Senate this week. The Senate bill starts a suite of moonshots for key clean innovation technologies we’ll need to decarbonize affordably and reliably – including 17 major new technology demonstrations by 2025 of grid scale storage technologies, enhanced geothermal systems, fossil fuels with carbon capture, and advanced nuclear reactors. This could set up a potential conference with a number of the bipartisan measures either passed out of or under consideration in the House Science, Space and Technology committee and the Energy and Commerce committee, such as:

We hope policymakers will work towards a bipartisan solution based on the principle of more innovation and less regulation for clean technologies before the end of this Congress.

Major, lasting energy and environmental policy has nearly always been bipartisan on passage. We believe climate policy that sustainably solves the global challenge cannot be done in a partisan manner. Bipartisan cooperation on climate change is the only chance our nation has if it is going to play a significant role in the global solution.

To address a massive global challenge like climate change, we must develop every tool to achieve clean, reliable, affordable and exportable energy. No country will use a single clean power technology – every country will need to find the right mix given its national circumstances, resource endowments and pre-existing industry.

Thank you again for this opportunity, and I look forward to the discussion.

View more of Our Take and let us know what you think at jaylistens@clearpath.org.