U.S. Senate Energy and Natural Resources Committee

Below is my testimony before the U.S. Senate Energy and Natural Resources Committee, entitled “Opportunities and Challenges for Deploying Innovating Battery and Non-Battery Technologies for Energy Storage”. on September 22, 2022.

Watch Spencer’s Opening Remarks

Good morning Chairman Manchin, Ranking Member Barrasso, and members of the Committee. My name is Spencer Nelson, and I am the Managing Director of Research & New Initiatives at ClearPath, a 501(c)(3) organization devoted to accelerating breakthrough innovations to reduce emissions in the energy and industrial sectors. To further that mission, ClearPath provides education and analysis to policymakers and collaborates with relevant partners to inform our independent research and policy development. An important point – ClearPath is supported by philanthropy, not industry.

Thank you for the opportunity to be here. It is a privilege to testify before you today after working as Professional Staff for Senator Murkowski last Congress developing the Energy Act of 2020. I have great respect for the work of the members of this Committee and its staff across its entire jurisdiction. While the Energy Act made great progress to advance energy storage, the Committee’s work in this area is far from over. There is great opportunity for supporting new energy storage technologies that bolster both baseload and renewable resources, and American innovation will play a key role. I will discuss four key topics today:

- The valuable role of energy storage on the grid today;

- The long-term limits of lithium and the importance of alternatives;

- Advancing alternative energy storage technology solutions; and

- Building on Federal Policy Wins in the Energy Act of 2020 and IIJA.

1. The Valuable Role of Energy Storage on the Grid Today

America’s power grid is incredibly complex. It must balance hundreds of gigawatts of power demand with supply in real time over thousands of miles, with the potential for sudden disruptions due to weather, mechanical issues, or other unexpected disruptions like cyberattacks. The system relies on an intricate network of transmission and pipelines for the transportation of energy. As the American economy grows, the grid transitions to lower carbon resources, and consumer preferences change energy supply needs, our nation’s grid operators face immense challenges. There are few places where this is more evident than the State of California, where a recent statewide grid emergency was declared to deal with record high energy demand due to blistering summer heat. The need for more firm, flexible electricity generation along with new grid-scale energy storage solutions to maximize reliable, affordable, and clean energy has never been more urgent.

Energy storage is not new to the electric grid. The energy storage technology with the greatest capacity in the United States today is pumped storage hydropower (PSH), in which water is pumped up or down a mountain when electricity demand is low and allowed to flow through a generator when demand is high. The first PSH plants were built a full century ago in the 1920s. PSH has historically been a tremendous asset by providing daily and weekly load shifting for baseload power generators like nuclear and coal power plants.

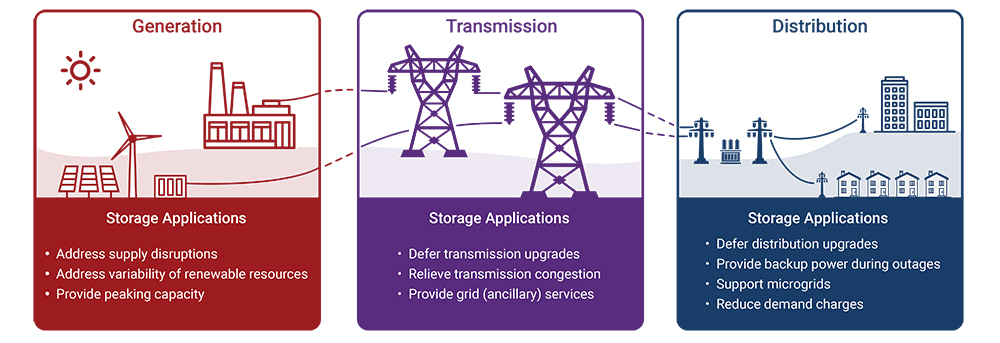

Innovative grid-scale technologies are opening up new roles for energy storage on the modern electric grid. Energy storage technologies now provide a wide variety of market services, including, but not limited to:

- Load shifting/peak shaving when demand is high;

- Reductions in the need for transmission capacity;

- Frequency regulation and other ancillary services for the grid;

- Operational flexibility for electric generators; and

- Reducing the need for overbuilding electric generating capacity.

While PSH remains the largest energy storage technology by capacity in the United States today, lithium-ion batteries are dominating new capacity additions. Boosted by the global development of electric vehicles, the cost of lithium-ion battery packs has fallen 90 percent since 2010, bringing down the cost of grid-scale batteries 75 percent along the way. Lithium-ion batteries have grown tremendously; reaching nearly 7,000MW of generation capacity on the grid, a 920 percent increase since just 2017. Looking ahead, there is 421GW of energy storage in the interconnection queue waiting to be added to the grid, nearly all of which is in the form of lithium-ion battery technology. For context, this is equivalent to 40% of the total U.S. electric grid’s capacity.

The growth of grid-scale battery storage provides real benefits to the grid. During the 2022 California summer heat wave, batteries provided more than 3 GW of power during the hours of peak demand, which helped avoid blackouts. Without the deployment of battery storage technology, outages would have been widespread, at tremendous cost to both California’s economy and the state’s residents.

Elsewhere, storage is being developed as a transmission asset. In places where additional transmission capacity is only needed for a few hours a day, adding storage assets to the grid can help avoid significant costs that would otherwise be borne by ratepayers.

2. The Long-term Limits of Lithium and the Importance of Alternatives

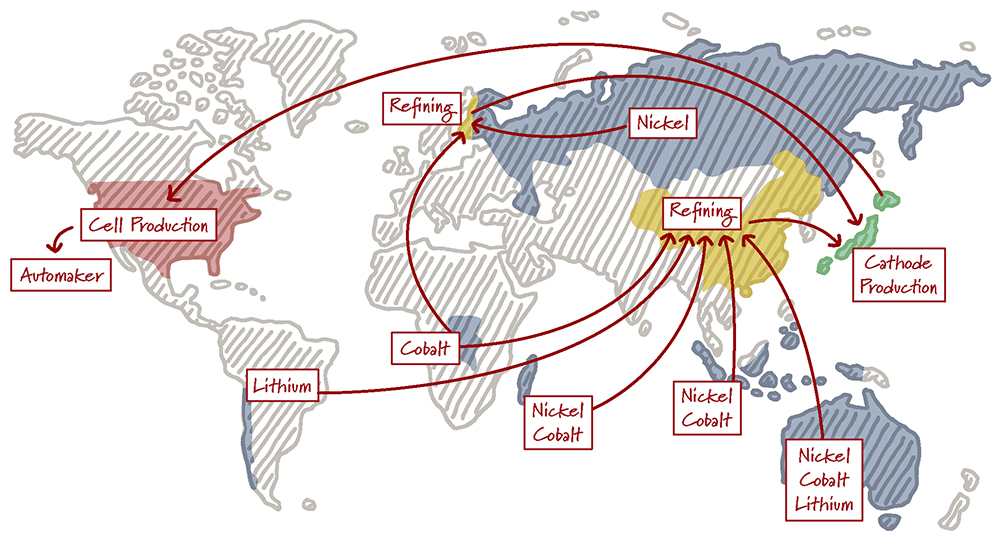

While lithium-ion grid-scale batteries are useful and will likely have a role to play for the foreseeable future, there are several drawbacks to consider. First, the geopolitical implications of lithium-ion batteries are severe and tragic. The current most common form of lithium-ion batteries uses nickel-manganese-cobalt (NMC) cathodes, which rely heavily on a variety of critical minerals that are not readily available in the U.S. The current supply of these materials is concentrated in Australia, Chile, Democratic Republic of the Congo, and Russia, but the majority of processing and manufacturing comes from China. In 2021, China controlled two-thirds of lithium pre-processing facilities, as well as 77 percent of production capacity worldwide. Based on current trends, China will still hold 67 percent of global lithium ion cell capacity in 2030.

Critical Minerals Production and Refining by Country

Source: Bloomberg

Global demand for critical minerals used in battery storage is expected to skyrocket – reaching between 180,000 and 300,000 tons by 2030, compared with 25,000 tons today.

Another challenge with lithium-ion batteries tied to electric vehicles is that as the demand for EVs increases, so does the price of lithium. Prices for lithium carbonate have increased from $5,000 per ton in mid-2020 to $70,000 per ton in 2022 as demand has skyrocketed and supply has flatlined. This cost curve is unsustainable.

Nickel and cobalt prices have also been highly volatile over the last year (due in part to the war in Ukraine), leading many in the stationary energy storage market to begin a transition towards lithium-iron-phosphate (LFP) chemistries, which utilize more earth-abundant minerals in return for lower round-trip efficiency. This shift could offset some of the cost and geopolitical risks of non-lithium critical minerals, but does not solve the overall lithium challenge.

As the share of variable, non-dispatchable energy from wind and solar on the electric grid grows, the reliability of the electric grid will increasingly depend on weather patterns like the sun shining or wind blowing. The Energy Information Administration (EIA) predicts that variable renewables could represent over 36 percent of total electricity generation in the United States by 2050, with much higher shares in some regions of the country. If that is the case, sustained periods without sunlight or wind could occur in areas where solar and wind energy are a major source of energy and present a serious challenge for electric reliability. In those instances, the options include either wheeling high volumes of electricity cross-country to make up for bad weather, greatly overbuilding solar and wind (by up to 4 times as much), or having a seasonal long-duration storage option that could provide many hours or potentially days of energy capacity.

The challenge is that lithium-ion batteries are fundamentally impractical for addressing the need of long-duration energy storage. In a lithium-ion battery system, the power and energy components are combined – meaning power and energy capacity scale at the same time. If you increase energy capacity, you increase power, and vice-versa. While this is a useful property for some applications, this presents a challenge for reducing the cost of long-duration applications for storage. The most common duration of lithium-ion systems currently deployed is four hours, and it is unlikely that systems will get much longer than eight hours anytime soon. Lithium batteries will continue to work for evening demand peaks and for frequency regulation – but will not solve the seasonality problem that could occur at higher levels of variable renewable energy. So what will?

3. Advancing Alternative Energy Storage Technology Solutions

Thankfully, there are alternatives to the narrow technology solution set currently being deployed on the American grid. Technological innovation can both reduce our reliance on foreign battery manufacturers and critical minerals and bolster our electricity grid with solutions that are cheaper and more reliable.

Finding Alternatives to Critical Minerals

In the near term, with the well-established interest in lithium-ion technologies, the U.S. needs to not only increase the direct production of lithium and other crucial materials, but also rapidly scale up its recycling in order to reduce our dependence on foreign sources. Currently, recycling rates for cobalt, copper, and nickel range from 30% to 60% while less than 1% of lithium is retrieved, underscoring the need to establish collection and market infrastructure in advance of projected demand. Recycling of spent EV and storage batteries is expected to reduce the need for new, primary supplies of lithium, cobalt, nickel, and copper by approximately 10%.

China controls more than two-thirds of global lithium processing facilities, and unfortunately controls the vast majority of the battery recycling market as well. We need to find a way to onshore the entire critical minerals mining, processing, and supply chain manufacturing processes in the U.S. $6 Billion in recent funding from the bipartisan infrastructure law will go towards improving this.

While recycling can help, it is not an all-encompassing solution. Longer term, the best way to reduce America’s reliance on foreign sources of critical minerals is to innovate away from technologies that rely on critical minerals that are supply constrained in the United States. For lithium-ion batteries, that means moving away from cathode designs that use minerals like nickel, which is currently controlled by russia, and away from cobalt, which often exploits child labor in the Democratic Republic of the Congo. As mentioned above, the transition to alternative technologies is already beginning in the grid-scale storage market as prices for nickel, cobalt, and other critical minerals skyrocket. The market is naturally selecting more earth-abundant technologies, and we should find a way to source more of those materials from domestic and allied producers.

It is important to note that even if the energy storage sector moves away from reliance on NMC cathodes, there will still be a vast need for lithium itself. Thus, there also needs to be a strong focus on developing domestic sources of lithium, including co-producing lithium from geothermal brines and expanding direct mining, in addition to recycling as much lithium from existing batteries as possible.

Alternative Long Duration Storage Technologies

Even if we managed to develop a supply chain composed solely of U.S. and allied nations for lithium-based batteries in the electric sector, those technologies still would not prove effective for long-duration applications. Since a 21st century grid requires storage options that can last upwards of 100 hours, the public and private sectors should aggressively invest in the demonstration and commercialization of non-lithium technologies.There are a variety of technologies under development — including thermal, chemical, and mechanical — that could both meet long-duration timelines and be cost competitive. Each technology must be assessed against several criteria, including supply security, performance, and price.

By definition, a seasonable energy storage technology is a backstop that would rarely be required to fully discharge its rated capacity. These technologies would only be fully utilized during the worst of weather conditions or periods of intense stress on the grid. As a result, the energy cost of a long-duration technology must be incredibly low to reach significant deployment, likely below $20/kwh of energy capacity – far below today’s energy storage costs.

Thermal Energy Storage

Thermal energy storage takes excess heat energy and stores it in various materials, including rocks, cement, storage tanks, hydrogen, or in liquid air.

These technologies transfer energy into a material that is capable of storing the energy for a longer time frame, capable of maximizing excess energy or arbitraging lower cost energy. There are a number of companies pioneering thermal energy storage in the United States, and the venture capital community has injected millions of private sector dollars into promising start-up companies like Malta and Antora. Another clever thermal energy storage example is TerraPower’s Natrium nuclear reactor, which would couple molten salt energy storage with a nuclear power plant. The nuclear plant would be able to run continuously by storing excess power as heat in the molten salt, and then use that heat to produce electricity as needed. The first commercial demonstration of TerraPower’s novel technology is underway in Kemmerer, Wyoming as part of a public-private partnership via the signature Department of Energy’s Advanced Reactor Demonstration Program (ARDP).

There are additional exciting industry experiments focused on storing excess thermal energy in rocks; these substances store energy at very high or low temperatures, capturing the energy in both forms. Another concept is to develop flexible geothermal energy systems using geothermal reservoirs as heat storage so plants can remove heat stored from the reservoir when it is needed.

Chemical and Electrochemical Energy Storage

Long-duration chemical energy storage options include the production of liquid or gaseous fuels or battery technologies in which the energy and capacity portions of the battery are physically separated to allow longer duration storage.

Hydrogen is an energy storage technology that can be used for electricity generation through a fuel cell or direct combustion. Clean hydrogen can be produced either through electrolysis powered by low-carbon energy or through steam methane reformation of natural gas using carbon capture and storage technologies.

Beyond the production of chemical fuels, several varieties of batteries can be used for long-duration storage. One example is flow batteries, in which the electrodes are dissolved in electrolyte solutions stored in tanks – an anolyte tank containing an anode and a catholyte tank containing a cathode. These are pumped into cell stacks where the reversible reactions occur when the battery charges and discharges. Flow batteries can provide high efficiency, long duration, and high safety levels, but some materials, such as vanadium, can be expensive.

There are also options to develop batteries that use sodium or iron as a cathode, with air serving as the anode. These “reversible rust” batteries, like those being developed by Form Energy, can be long duration and have very low materials costs, meaning they are cheaper as the energy-to-capacity ratio gets larger.

There is also growing international competition in the electrochemical long duration storage space. A recent report from the Boston Consulting Group found that U.S. companies began developing technologies earlier than most countries, but the U.S. now ranks 4th globally in patent volume for flow batteries and metal air batteries behind China, Japan, and South Korea.

Mechanical and Kinetic Energy Storage

Many examples of effective mechanical and kinetic long-duration energy storage technologies exist. As previously discussed, the most classic of these is pumped storage hydropower, which currently represents 80 percent of total energy storage capacity in the U.S.

In many cases, pumped hydropower is used as a form of baseload electricity generation because it is reliable and inexpensive. However, over time it has become much more complex and can be used in various ways to help improve grid stability and act like a “peaker plant.”

In recent years, it has become much more difficult to site and permit new PSH facilities, despite their value to the grid. Some companies, such as Quidnet, are looking to develop alternative styles of pumped hydro by injecting water underground under pressure, which can later be released to generate electricity through a turbine as needed.

Another underground pressured energy storage option is Compressed Air Energy Storage or CAES. CAES stores energy in the form of compressed air in an underground reservoir for use at a later time. CAES systems release the pressurized air by heating it to expand it, turning a turbine, and generating electricity. CAES systems have several benefits, but ideally, they work best in balancing energy for greater integration of renewable energy, and ancillary services for the grid such as regulation, black-start, and grid stabilization.

Each of these solutions has a slightly different niche to fill, but all deserve a chance in the marketplace.

4. Building on Federal Policy Wins in the Energy Act of 2020 and IIJA

The Senate Energy Committee has historically been a leader in energy storage technology development. Some of the most recent actions include the bipartisan Better Energy Storage Technologies (BEST) Act, which comprehensively reauthorized energy storage R&D programs at the Department of Energy (DOE) and was cosponsored by many members of this committee. It was enacted in the bipartisan Energy Act of 2020, alongside several other key energy storage provisions.

Those Energy Act of 2020 storage programs were later funded by the bipartisan infrastructure law, and are now being implemented by DOE.

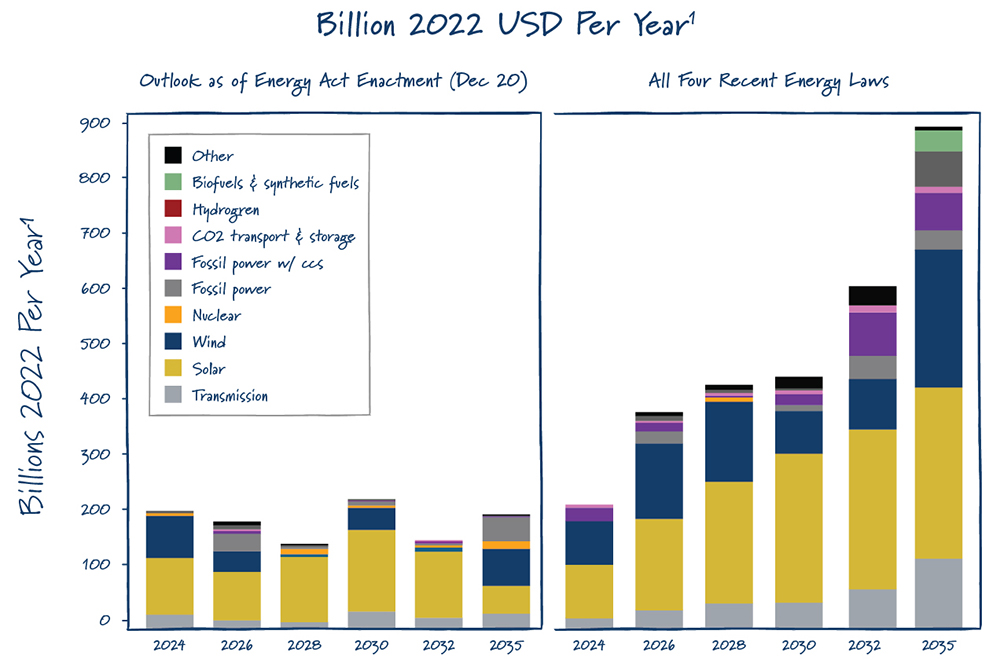

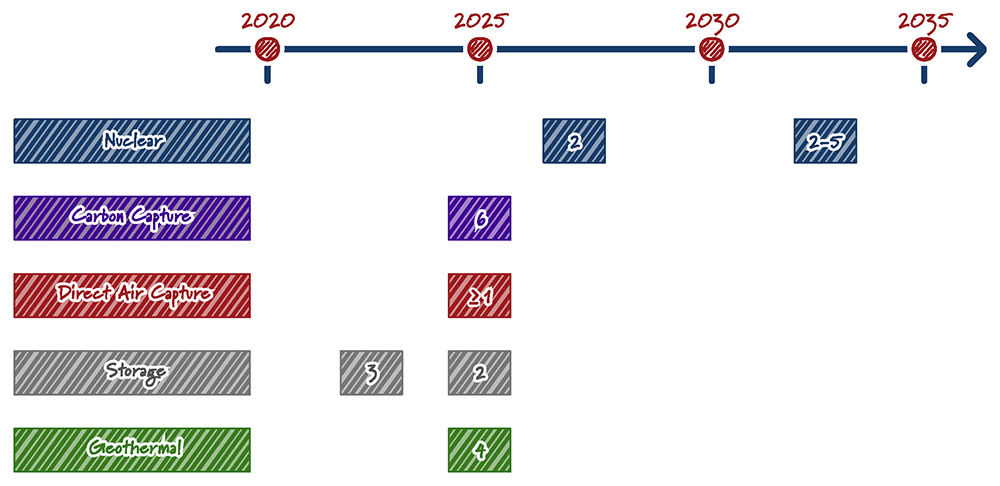

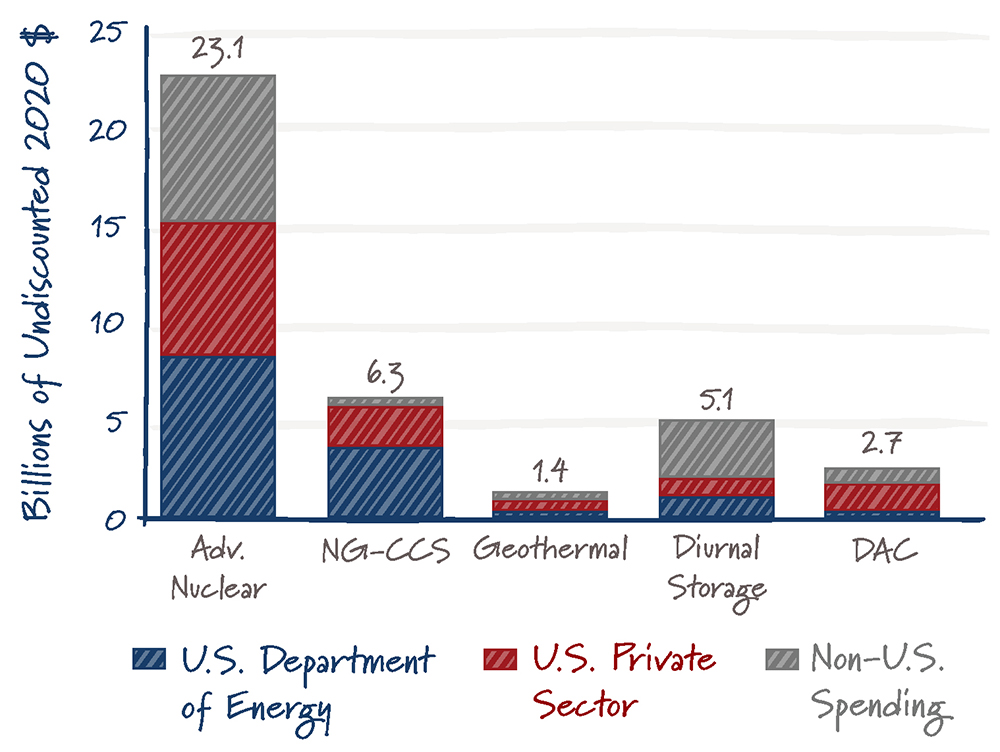

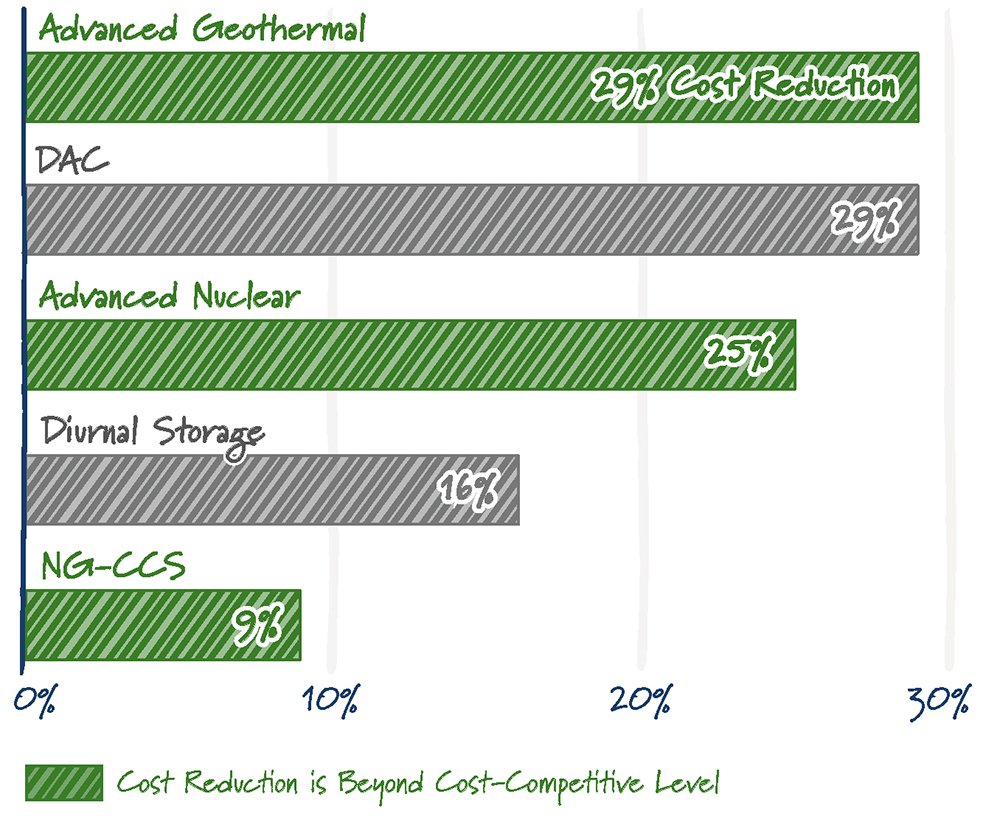

DOE has been supportive of reducing the cost of grid-scale energy storage across a number of programs, most notably through the Trump Administration’s Energy Storage Grand Challenge and its successor program, the Long-Duration Storage Shot. Each of these programs aimed to greatly reduce the cost of advanced energy storage technologies. DOE’s current goal is reducing the cost of long-duration storage by 90 percent by 2035, which would make long-duration options cost-competitive.

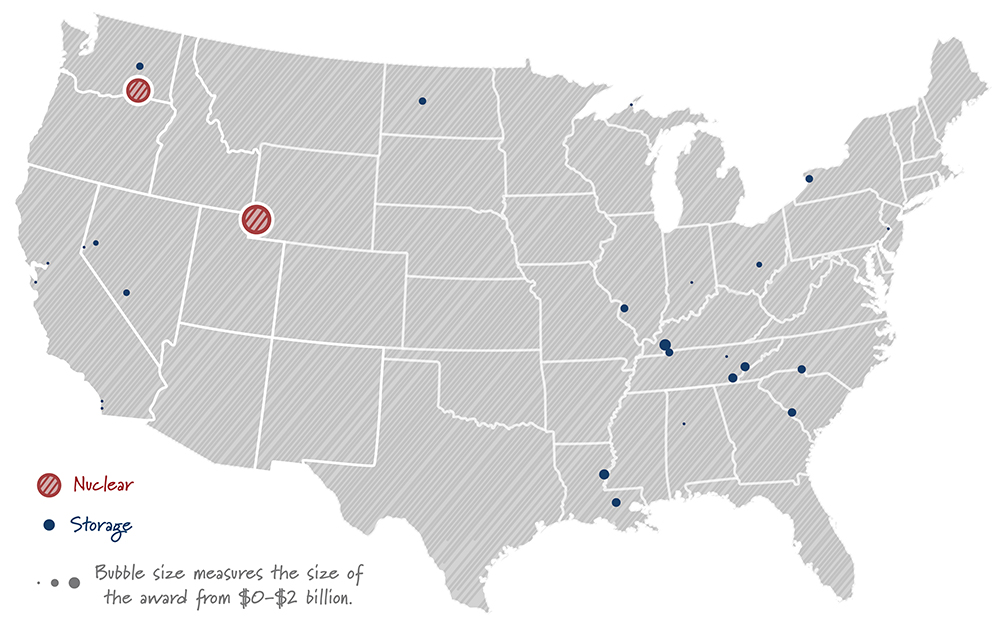

DOE is also beginning to implement a variety of programs originally authorized by the bipartisan Energy Act that were later funded by the infrastructure law. These include demonstration programs for energy storage technologies, as well as programs for battery manufacturing and battery recycling. The battery manufacturing, recycling, and processing programs are in the process of accepting applications for funding.

Going forward, it is crucial that this Committee play an active role in the oversight of these demonstrations to ensure they are implemented according to Congressional intent, support American manufacturers, and include a wide variety of technologies and end uses. While the funding from the bipartisan infrastructure law for energy storage demonstrations authorized in the Energy Act was appropriated in November of 2021, it has been nearly a year and DOE has not yet released any funding to develop new technologies. This means that DOE now has only 4 years remaining to develop these programs.

This Committee should maintain a continued focus on identifying alternative sources of critical minerals and making it easier to develop critical minerals facilities in the United States. The Committee has already passed several bipartisan pieces of critical minerals legislation, but the funding for those programs needs to get out the door at DOE so alternative sources can be developed. Domestic lithium processing facilities are absolutely a priority, as China currently contains two-thirds of the world’s capacity.

Removing barriers to resource and energy development is a must. At ClearPath, we have identified through work with the Aspen Institute that America is currently not on track to meet its clean energy goals unless we make it easier to build cleaner, faster. Aspen’s report identified several key principles for improving decarbonization project development. Additionally, there remain significant barriers for certain varieties of energy storage, such as pumped hydro, that need to be addressed individually.

Thank you again for the opportunity to testify today. ClearPath is eager to assist the Committee in developing policies to support innovative energy storage technologies. We applaud the Committee for taking on this critical topic that will increase electric reliability, lower costs, and reduce emissions.