House Energy and Commerce Committee Subcommittee on Oversight & Investigations

Below is my testimony before the House Energy and Commerce Committee Subcommittee on Oversight & Investigations, entitled “Growing The Domestic Energy Sector Supply Chain And Manufacturing Base: Are Federal Efforts Working” on May 23, 2023.

Watch Jeremy’s Opening Remarks

Read Jeremy’s Full Testimony as Seen Below

Good morning Chairman Griffith, Ranking Member Castor, and members of the committee. My name is Jeremy Harrell, and I am the Chief Strategy Officer of ClearPath, a 501(c)(3) organization that develops and advances policies that accelerate innovations to reduce and remove global energy emissions.

Thank you for the opportunity to testify today and for holding this important hearing. The United States faces intense global competition. Adversaries like China and Russia are deploying hundreds of billions of dollars around the world to advance their geostrategic interests in order to dominate the energy sector and connected supply chains.

China and Russia have spent decades investing in the dominant position they now hold in the mining – and perhaps more importantly – in the processing of critical materials. China is responsible for the processing of 90 percent of rare earth elements and 60 to 70 percent of lithium and cobalt, often with poor labor practices and disregard for the environmental impact.1 Similarly for uranium, some projections suggest that by 2030 China and Russia will control roughly 63 percent of global enrichment capacity. Meanwhile, in the U.S. it can take up to a decade just to permit a mine. America is on its heels. From project finance to government permitting, the project development cycle must move faster to have any chance of regaining the supply chains underpinning our energy industrial base and become resource independent.

Large-scale energy innovation often needs to bring together private and public investment in order to scale up deployment and bring down costs. This model worked for solar, wind, natural gas and other clean energy technologies. For example, Texas entrepreneur George Mitchell figured out how to break up shale rocks to release the natural gas stuck inside. This process, called hydraulic fracturing, initially got off the ground with support from the Department of Energy (DOE), which cost-shared R&D and demonstrations in the 1970s and 1990s, as well as tax credits from the 1980s to early 2000s.

Fortunately, the past few years has yielded targeted federal energy innovation policy that, if implemented right, could help bring resource production back to America and help build the next success story similar to American shale gas.

The Energy Act of 2020 (EACT), signed into law by President Trump at the end of the 116th Congress, modernized and refocused the DOE’s research and development programs on some of the most pressing technology challenges identified by the International Energy Agency (IEA) as essential to global energy and climate objectives — scaling up clean energy technologies like advanced nuclear, long-duration energy storage, carbon capture, and enhanced geothermal. Subsequently, the bipartisan Infrastructure Investment and Jobs Act (IIJA) invested $62 billion into next-generation technologies, power grid improvement, energy efficiency, and more at the DOE. Importantly, nearly half of that total was slated for the very energy-related research, development, and demonstration (RD&D) programs authorized in the EACT and the relevant infrastructure needed for their broader adoption.

The bipartisan IIJA targeted federal energy research investment, focusing RD&D programs around some of the biggest opportunities to advance U.S. energy security, technological leadership, and global emissions reductions. The DOE is now launching the most aggressive commercial-scale technology demonstration programs in history, with clear permanence and cost goals, to scale up clean energy technologies like the Long-Duration Storage Shot, the Hydrogen Shot, and the Enhanced Geothermal Shot. For example, the storage initiative launched in July of 2021 is oriented around reducing the cost of grid-scale energy storage by 90 percent for systems that deliver 10+ hours of duration within the decade. That specific goal may sound familiar – it mimics the bipartisan authorization from the Better Energy Storage Technologies Act (BEST) enacted in the 116th Congress.

These initiatives present opportunities but also many significant challenges that this Committee is rightly using its oversight authority to explore.

The bipartisan Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act of 2022 was also constructed specifically to go on offense versus China on technological innovation. The package directed $280 billion in investment over the next 10 years, with the majority for scientific R&D and commercialization. Approximately $53 billion is for semiconductor manufacturing, R&D, and workforce development, with another $24 billion worth of tax credits for chip production. The law also added significant new DOE technology transfer authorities, comprehensively reauthorized the DOE Office of Science and established a first-of-a-kind, low-emissions steel manufacturing research program that aims to make American steel production the cleanest and cheapest in the world.

The U.S. has a national security imperative to take on China and Russia in technological innovation and energy exports. A cohesive strategy that syncs our country’s robust research, development and demonstration (RD&D), the American entrepreneurial spirit, targeted free market incentives, and proactive trade policies can leverage the United States’ advantage as one of the most carbon efficient economies in the world. Three examples where the U.S. is leading are natural gas, steel and minerals mining. A life cycle analysis conducted by the DOE’s National Energy Technology Laboratory on U.S. liquefied natural gas (LNG) exports shows that American LNG can be up to 30 percent cleaner than Russian natural gas. While Chinese steel is the third most emitting in the world, American steel is among the cleanest in the world, with the second lowest CO2-intensity of any country. Emissions from mining support services in China, including many minerals required for deploying clean energy at scale, are over 5 times higher than if those activities were conducted in the United States.

Our nation should double down on the public and private sector momentum to produce more and innovate faster, securing a clean, affordable, resilient energy future reasserting global technology and resources leadership, and furthering global emission reductions.

But simply throwing federal taxpayer resources at the problem is not going to achieve that ambitious goal. For the United States to lead globally while creating jobs in new industries here at home, the United States must maximize public and private sector efforts by taking the following actions:

- Strengthen direct investment and foster private investment in U.S. supply chain: The bipartisan Energy Act of 2020, the IIJA, the CHIPS and Science Act, and federal tax incentives must more effectively bolster the U.S. clean energy supply chain and commercialize key technologies. The successful implementation of these programs is critical to ensuring that U.S. companies can demonstrate and deploy their technologies and be able to compete on the world stage. That difficult task means identifying projects that can be delivered on time and on budget, while ensuring the maximum benefit of investment goes to American companies and the industries where the U.S. has a leading edge. To assist with accountability and oversight, ClearPath has developed an interactive dashboard to follow progress across the major demonstration programs led by the DOE from the initial program development stages all the way through to final award selections.

- Modernize Permitting: The single largest impediment to private sector investment is regulatory unpredictability. Unnecessary regulatory hurdles that slow down the deployment of innovative technology and necessary infrastructure, including the critical mineral supply chain, threaten the United States’ ability to significantly reduce our emissions and provide low-cost options to the rest of the world on an ambitious timescale. Right now, developers can only build new energy infrastructure as fast as federal, state, and local governments can permit them – and it simply is not fast enough. Reform must flip the permitting paradigm from one that favors stopping a project to one that expedites the approval process for projects that bring net benefits and comply with the legal requirements meant to ensure clean water and clean air. U.S. leadership requires a system that promotes good outcomes – both economic and environmental – so that the country can build at the pace and scale required to meet America’s energy demand and compete with our adversaries.

- Foster Global Market Opportunities for American Technologies: The economic opportunity for the U.S. is remarkable. A recent report from Boston Consulting Group estimated the Serviceable Addressable Market (SAM) for six key clean energy technologies (clean steel, hydrogen, long-duration energy storage, geothermal, direct air capture, and new nuclear) to be roughly $16.5 trillion through 2050. Getting our domestic policies right, including in many cases getting the government out of the way, will allow us to scale up our clean technologies and drive down costs to meet the energy demands of the developing world with more price-competitive exports of American solutions. At the same time, the U.S. needs to create better trade and financing frameworks to support our exporters. Our country must prioritize market access abroad through removal of tariff and non-tariff barriers, and better leverage agencies like the U.S. Export-Import Bank and International Development Finance Corporation to compete more effectively against our non-market rivals (e.g. Chinese state-owned enterprises).

Further, the following three American industries serve as examples where U.S. government policies, investor interest, and the regulatory environment are incongruent with what is needed for the U.S. to lead globally.

Carbon Capture

China continues to dominate global coal power development, both at home and abroad. Chinese coal power plant construction and new project announcements accelerated dramatically in 2022, with new permits reaching the highest level since 2015. Many of those projects received expedited permitting and broke ground in a few months. This resulted in six times as many coal plants starting construction in China than the rest of the world combined for a total of 106 GW; the equivalent of two large coal power plants per week. While China recently committed to stop financing new overseas coal financing, over the last 10 years, its Belt and Road Initiative financed over 100 gigawatts of coal in at least 27 countries.

Policymakers have a choice – bet that the Chinese and their partners shut down their coal-fired power plants at the expense of economic growth; or develop, demonstrate, and deploy affordable U.S.-based emissions control technologies abroad as we have previously done for acid rain and aerosols. That’s where carbon capture, utilization, and storage (CCUS) technologies come in.

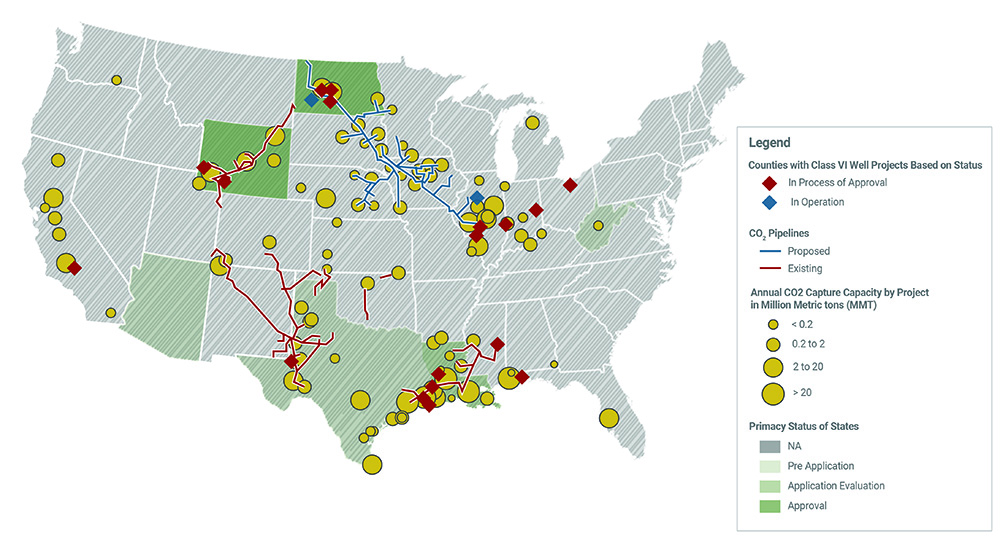

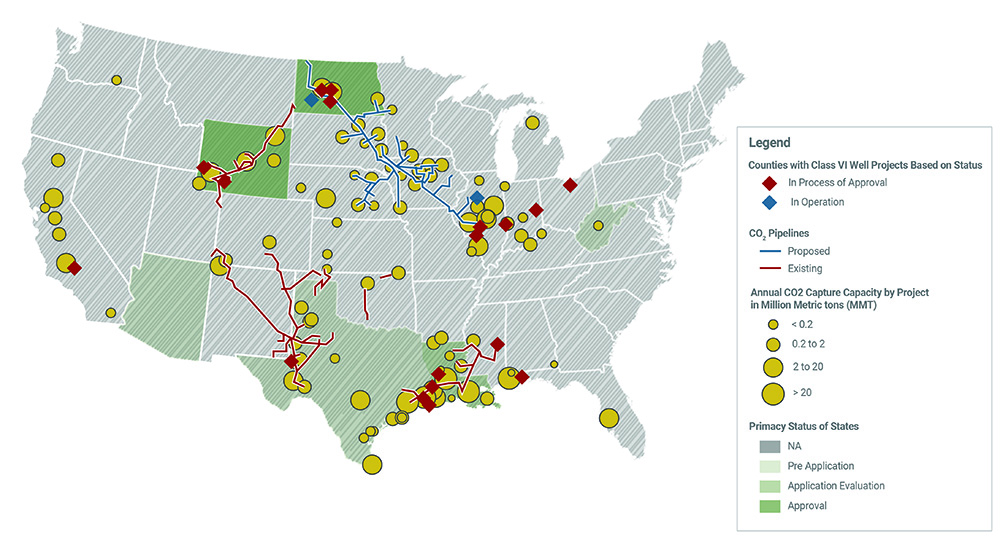

CCUS is on the rise, with 35 projects in operation and over 250 million metric tons of CO2/yr of capture capacity currently in development worldwide by 2030. 40 percent of the capacity in development over that timeline is in the U.S., which is currently the global leader on CCUS technology. While the over 100 million metric tons of capacity announced in the U.S. is significant, it is only scratching the surface of this country’s potential. A recent report from the DOE estimates that getting CCUS technologies on track for climate targets in the U.S. would require capacity to capture 400 to 1,800 million tons of CO2 per year by 2050. This level of development would represent $100 billion of investment by 2030 and $600 billion by 2050. On a global level, reaching net-zero by 2050 likely requires at least 4-7 gigatons of CO2 captured per year, meaning that we currently only have one-half of one percent of the CCUS capacity needed today.

Current and Proposed U.S. Carbon Capture Infrastructure

Sources include ClearPath analysis, CATF US Carbon Capture Map, Rextag CO2 Pipelines, and EPA’s Class VI Well Tables as of March 2023

CCUS technologies allow us to mitigate emissions and also support American jobs. Right now, the U.S. truly has the lead on other countries through a combination of engineering expertise, technical leadership, and recently enacted public policy like the 45Q carbon capture utilization and storage tax credit and the Department of Energy’s Carbon Capture Demonstration Projects Program. Going forward, the U.S. needs to find ways to parlay this leadership edge into the potential to export our expertise to support the development of carbon capture technologies in other countries. The services associated with carbon capture can be significantly higher than the physical investment of the technology itself, meaning we will create jobs at home that lead to lower emissions abroad.

Despite our head start, a lot needs to be done to ensure that the massive CCUS scale up in the U.S. occurs. The U.S. is woefully behind on the carbon dioxide transportation and storage infrastructure necessary to give confidence to private sector investors that they will be able to receive a meaningful return on their investment within a reasonable time. A dramatic increase in the number of required Class VI carbon dioxide storage wells, as well as the ability to build out carbon dioxide transportation pipeline systems, is essential. The U.S. currently only has 3 permitted Class VI wells for carbon storage, when we likely need over 600 or more wells to meet long term climate targets.

Beyond that, the U.S. only has 5000 miles of carbon dioxide pipeline. While this is more than anywhere else in the world, it is concentrated in a few geographic regions and is insufficient to meet the needs of a larger scale carbon capture build out. The proposed Heartland Greenway pipeline and Midwest Carbon Express projects, centered around connecting Midwest producers to permitted CO2 storage sites in Illinois and western North Dakota respectively, are two prime examples.

Without addressing these infrastructure challenges, it’s not possible to see the level of buildout that is needed in the long run. To make this happen, the American supply chain needs significant permitting reform, as well as improvements in the ability of both the EPA and states to authorize pipelines and storage wells. Combining these types of reforms with targeted public-private investments like the DOE Carbon Capture Demonstration Program and the 45Q tax credit is the recipe to ensure U.S. competitiveness, not unrealistic mandates as proposed in new EPA regulations on May 11, 2023. Seizing the moment will deliver energy security, a resilient and reliable U.S. grid, and continue to position the U.S. as the leading supplier of technology for global emissions reductions.

Nuclear Energy

The demand for carbon-free technologies that further energy security has never been higher, and the effects of the war in Ukraine on international energy markets are lasting. This makes the expansion of reliable, secure and affordable nuclear power more important than ever.

The International Energy Agency said that the world needs to double the amount of today’s nuclear energy capacity in order to reach net-zero in 2050. That equates to roughly 25 new 1,000-megawatt reactors per year, every year from 2030 to 2050. While this seems daunting, at least eight U.S.-based companies have publicly announced international partnerships to explore deployment in more than 10 countries, and even more are in the works. In addition, more than 52 countries are projected to have markets for advanced nuclear power in the coming decades, representing a potential ~$380 billion per year market opportunity for the American supply chain.

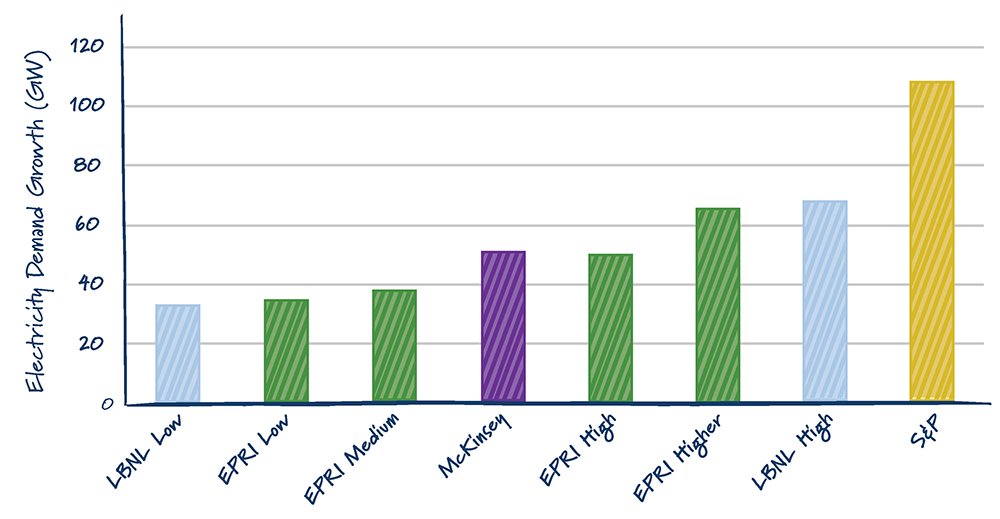

This increase in global nuclear energy demand has coincided with unprecedented momentum in U.S. industry. The U.S. Nuclear Regulatory Commission (NRC) has publicly stated it anticipates at least 13 applications for advanced reactors by 2027. Additionally, American electrical utilities are projecting a need for nearly 90,000 MW of new nuclear power by 2050, essentially doubling the U.S. nuclear energy capacity in the next 30 years.

The nuclear provisions in the EACT and IIJA, as well as the other financial programs like the Loan Programs Office (LPO), can further attract private investment to the sector and accelerate technological innovation that position the American industry to capitalize on a competitive advantage: our abundance of innovative new technologies the global market demands. Today, almost 15 percent of active loan applications at LPO are for nuclear projects. All of these programs prepare the U.S. to be a competitive player in the international market. Concurrently, as we look to develop these new nuclear energy technologies, strong support for the existing fleet is important to energy security today and for the workforce and supply chain of the future.

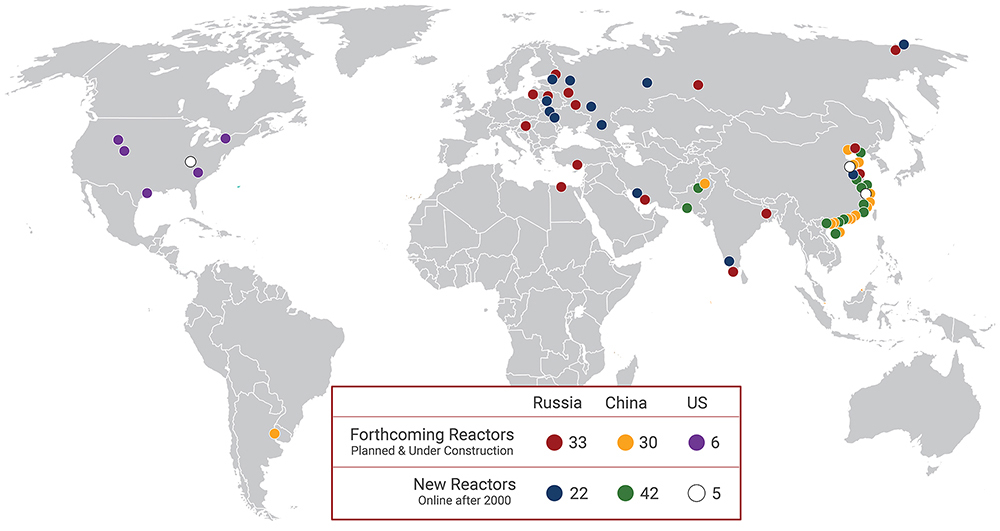

A robust fuel supply chain and competitive financing will require coordination with our allies. Nevertheless, the market is not uncontested. In fact, over the past two decades, the U.S. and like-minded countries have lost market leadership in this space. Between 2017 and 2022, Russian and Chinese reactor designs captured 87 percent of all new reactor construction globally through their non-market, state-owned enterprises.

Reliance on the Russian nuclear fuel supply chain is particularly troubling. This year, Russia will supply almost 25 percent of our nation’s enriched uranium. While the U.S. and our allies have sanctioned and significantly reduced consumption of Russian oil and gas post-Ukraine evasion, the Russian nuclear industry has largely dodged sanctions due to the Russian bottleneck in the uranium supply chain. Uranium is a global commodity and when looking at the global uranium supply chain, 38 percent of conversion capacity and 46 percent of enrichment capacity are controlled by Russia. Securing the nuclear fuel supply chain will require domestic and allied capabilities to both source and process uranium.

With the growing global market for nuclear energy, the U.S. must seize this moment and prove itself as a competitive alternative to Russian and Chinese energy exports. Key strategic allies like Poland, Ukraine, and the United Kingdom are hoping to partner with American vendors rather than those competitors. Romania is a great example. Against a backdrop of growing mistrust of Chinese investments in Europe in 2020, the Romanian government broke a financing agreement with the China General Nuclear Power Corporation (CGN). Since then, Romania has penned a roughly $9 billion deal to build two new reactors in Cernavoda with a $3 billion loan being provided by the U.S. Export Import Bank.

New and Forthcoming Nuclear Reactors Worldwide

The challenge ahead is project delivery. Recently enacted federal policies, like the clean electricity tax credit, NRC modernization legislation, and new public-private partnerships with the DOE, boost the confidence of investors and end-users needed to commercially scale up reactors domestically and internationally.

To go from building a handful of American reactors to building hundreds of reactors, a few critical barriers to lift off must be addressed.

First, the nuclear fuel supply chain must be secured for both the existing fleet and our next generation of reactors. Industry, the DOE, and Congress must work together to enable a private-industry-led, domestic High-Assay Low Enriched Uranium (HALEU) supply chain. HALEU is essential to the success of many advanced reactor projects, including the two recipients of the Advanced Reactor Demonstration Program (ARDP). Today, Russia is the only source of large volumes of HALEU. Concurrently, the U.S. and its allies must also ensure its demand for Low Enriched Uranium (LEU) for our current fleet and future light water reactors can be met without any reliance on Russia. Ensuring fuel security is paramount to American nuclear expansion.

Second, regulatory modernization is critically important as it is the necessary step between the development of these new designs and commercialization. If America is not proactive with licensing the next generation of designs, the U.S. could fail to meet its clean energy needs and continue to lose ground to China and Russia on innovation. While the NRC is working to modernize, attract new talent, and further its technical understanding of new technologies – efforts that I commend them for – the Commission admits it will still struggle to review these new applications in a timely manner. Understandably so – 13 new applications in the next five years is unprecedented. To lead, the NRC must be structured and incentivized to license the next generation of new reactors differently than they have licensed traditional reactors. The review process can be more efficient, effective and not unduly burdensome without any reduction in safety.

And lastly, the U.S. government and industry must work together to aggressively promote orders for our cutting-edge technologies abroad. Recent actions by countries in Europe, Africa, the Middle East and South Asia have shown that advanced nuclear deployment is highly desired. Nations want clean, reliable, and secure energy. The U.S. and its allies should be the ones to establish these new, 100-year international partnerships in place of our adversaries. The U.S. government must develop a robust and effective interagency strategy to proactively build and enhance relationships with partner nations, as well as create competitive financing and technology packages to offset the growing influence of Russia and China.

There are many new American nuclear projects in the pipeline today, and the robust U.S. supply chain that supports it and existing nuclear operations employs nearly half a million Americans. On average, a person working in the nuclear energy industry makes a higher median wage than any other energy industry and twice the national median wage. Concurrently, there is a 30 billion dollar crossover benefit to our national security between the civilian nuclear industry and the U.S. military, focused on shared research infrastructure, workforce, and supply chain diversity. Fostering the growth of the domestic supply chain and going on offense in the global marketplace could yield tens of thousands of more high-paying, stable jobs as the industry grows.

Critical Minerals

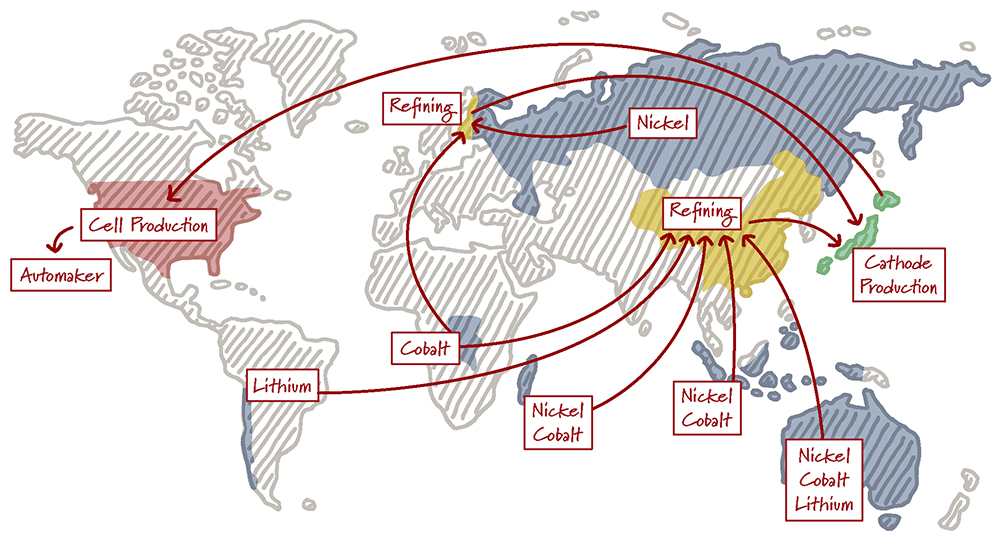

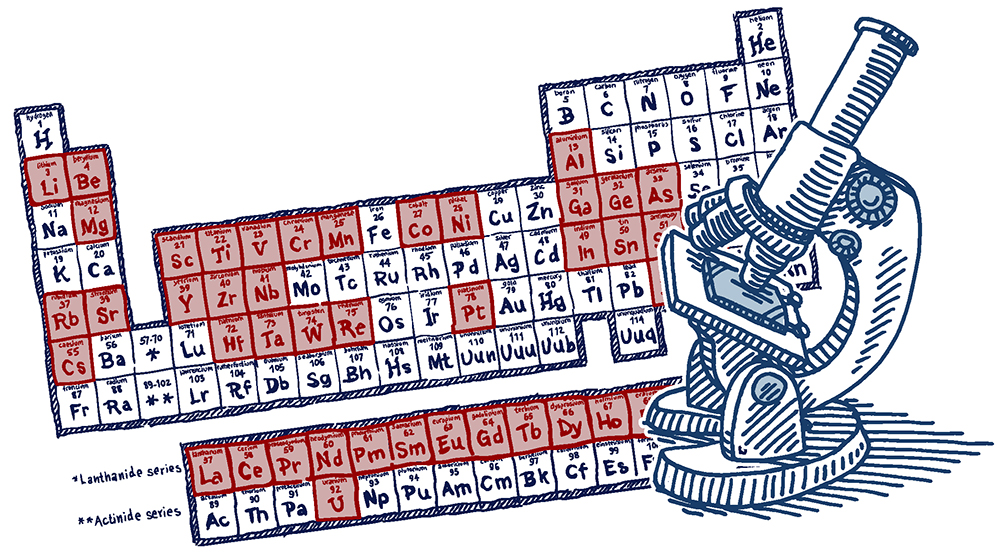

It is difficult to overstate China’s dominance and America’s dependence on foreign supply chains when it comes to critical minerals. According to the 2023 U.S. Geological Survey’s Mineral Commodities Summary, the United States was 100 percent net import reliant for 12 of the 50 individually listed critical minerals and more than 50 percent net import reliant for an additional 31 critical mineral commodities; meanwhile, China was the leading producer for 30 of the 50 critical minerals. Rising demand for minerals will place major stress on global supply chains and undermine the United States’ ability to deploy more clean energy.

In a recent report, the International Energy Agency (IEA) predicts that by 2040, demand for energy-related minerals like lithium, cobalt, graphite, and nickel could grow by 20-40 times.

Regardless of where the minerals are mined, China exerts dominant control over the refining process for each of these critical minerals. According to the IEA, the production of critical minerals used for clean energy technologies is highly concentrated geographically, raising concerns about security of supplies. The Democratic Republic of Congo supplies 70 percent of cobalt today; China supplies 60 percent of rare earth elements; and Indonesia supplies 40 percent of nickel.

Perhaps even more concerning is the fact that the processing of these minerals is even more concentrated. China is responsible for a large majority of the refining of rare earth elements and has demonstrated a willingness to leverage its influence to pursue political objectives. The concentration of mineral supply chains creates risks of disruption from political or environmental events, poor transparency and traceability, and sacrifices the expertise necessary for value-adding innovation and jobs.

While the current Administration has convened a Minerals Security Partnership, along with other regional and multilateral clean energy dialogues with friendly nations such as Australia, Canada, Japan, South Korea and others to address these challenges, both the public and private sector need to do more, faster to ensure reliable and responsible clean technology supply chains.

Absent a clear, predictable, and streamlined process, the U.S. will continue to rely on critical minerals sourced from overseas. These include countries that pose national security risks or those that lack basic environmental and human rights protections. The choice should be clear: producing American resources here at home creates jobs, promotes innovation, increases energy security, and leads to better global environmental outcomes.

Yet, the U.S. struggles to permit projects to unlock these critical minerals. Recent data from Goldman Sachs shows that regulatory approvals for mines have fallen to the lowest level in a decade. This should be the exact opposite because of the substantial demand growth for electric vehicles and other renewable applications. While the Administration has announced awardee selections with a combined total of nearly $5 billion for critical minerals demonstration projects funded by the IIJA or through the Loan Programs Office, there remains one glaring omission in the critical minerals supply chain: only one of these selected projects address our inability to extract new materials domestically.

The House has rightly put permitting reform front and center this year, passing with bipartisan support its signature energy package, the Lower Energy Costs Act, as H.R.1. Provisions in the bill recognize the current system undercuts America’s ability to deploy domestically abundant resources and compete on the world stage. There is real opportunity for this Congress to work on a bipartisan basis to modernize the permitting process and solve this problem.

Conclusion

Thank you again for the opportunity to testify today. ClearPath is eager to assist the Committee in developing innovative policy solutions to ensure a robust domestic energy supply chain in order to ensure a clean, reliable, and affordable domestic energy sector.

We applaud the Committee for taking on this important task to help ensure U.S. leadership of these efforts, including target investments and permit reform here at home that advance innovative technologies to provide clean, reliable, and necessary energy to our nation and the world.