2026: A Clear Path for American Energy Dominance

Let America Innovate, Build, and Sell

America’s energy landscape is being reshaped at an unprecedented pace. A new wave of energy demand from data centers, advanced manufacturing, LNG exports, electrification and the reality of aging energy infrastructure are driving an intense need for more power. At the same time, global competition is intensifying. To keep energy costs down, reshore American manufacturing and lead the world in an AI-driven future, we must build more and strengthen the energy system to deliver reliable, affordable, secure power. This is essential to our national, economic and energy security.

To win in the new era of energy demand and global competitiveness, ClearPath’s 2026 priorities follow a simple playbook: let America innovate, build and sell.

Scale Innovation and Technology

America’s success is driven by the ability to accelerate innovative technologies from the lab to the market, strengthening energy security at home and around the world. The key ingredients to this success are a robust research and development (R&D) framework across technologies, targeted investments in clean, firm technologies like advanced nuclear, fusion, enhanced geothermal and support for innovation in industrial materials needed for infrastructure. Congress has an opportunity to advance these policies by:

- Enacting comprehensive geothermal legislation that modernizes leasing and permitting frameworks as described in our December 2025 Geothermal Report.

- Reauthorizing DOE’s expiring programs for industrial manufacturing that President Trump signed into law as part of the Energy Act of 2020.

- Providing dedicated DOE RD&D programs to support concrete and asphalt as well as chemicals and refining innovation.

- Enacting next-generation pipeline legislation to support innovations that modernize pipeline infrastructure integrity, efficiency and development.

- Expanding the 45X tax credit to include manufacturing for other clean energy supply chain components, like advanced nuclear fission, fusion, advanced conductoring and geothermal components.

Modernize Permitting and the Grid

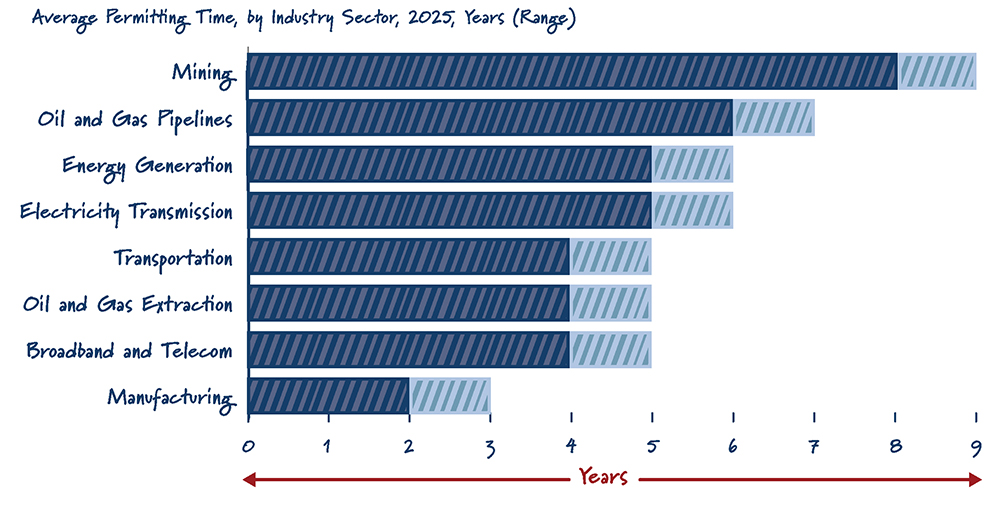

To let America build, we need a permitting process that is predictable, efficient and fair, combined with a strong grid that can meet rising demand with affordable, reliable and secure power.

Comprehensive permitting reform that delivers certainty and speed while preserving environmental safeguards begins with:

- Modernizing the National Environmental Policy Act (NEPA);

- Reforming NEPA judicial review and litigation practices;

- Increasing transparency through digital tools; and

- Providing permit certainty once permits have been issued.

The House’s December 2025 bipartisan passage of the SPEED Act and ePermit Act addressing NEPA and transparency issues respectively is a good first step. Permitting reform goes beyond updating NEPA. Statutes like the Clean Water Act (CWA) should be reviewed to eliminate unnecessary delays, which the House addressed by passing the Permit Act in December 2025. The Senate has the opportunity to build on this progress and deliver a bipartisan deal that clarifies the scope of NEPA, updates the CWA, reduces frivolous project litigation risk and ensures legal certainty to lawfully granted permits.

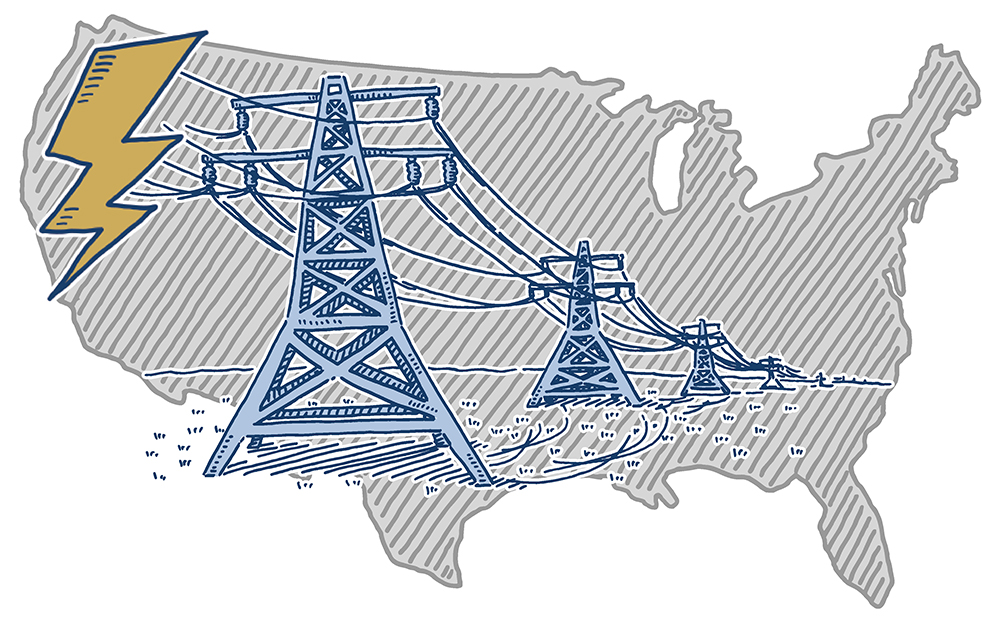

A reliable, affordable and resilient grid is the foundation of our economy, national security and way of life. Investments in the grid are not just energy policy, they are economic and national security imperatives that will drive American growth for decades. Modernizing America’s grid starts by:

- Leveraging Innovation: Deploy new technologies to optimize the existing grid, like advanced conductors, dynamic line ratings and updated software and hardware for grid control. Strategic incentives and more robust information sharing can also help more quickly derisk technology.

- Speeding Up Interconnection: Maximize the use of existing interconnection capacity. Prioritize cost-effective upgrades. Streamline the interconnection queue process by focusing first on areas with reliability needs or existing transmission capacity to enhance efficiency and bring more projects online faster.

- Building More Transmission: Every energy source relies on transmission. Meeting growing energy demand requires improved federal permitting processes, reduced litigation risks and stronger coordination among states on new transmission lines and regional grid planning. A modernized federal backstop authority, used only as a last resort, can help ensure critical transmission projects are completed.

- Ensuring Fair Cost Allocation: Consumers must be protected by ensuring that project costs are paid by those who receive reliability and economic benefits, not by customers who receive little or no benefit.

In addition to ensuring a strong grid, modernized and reliable pipeline infrastructure for U.S. LNG and carbon dioxide transportation is critical to letting American energy move.

Lead in the Global Market

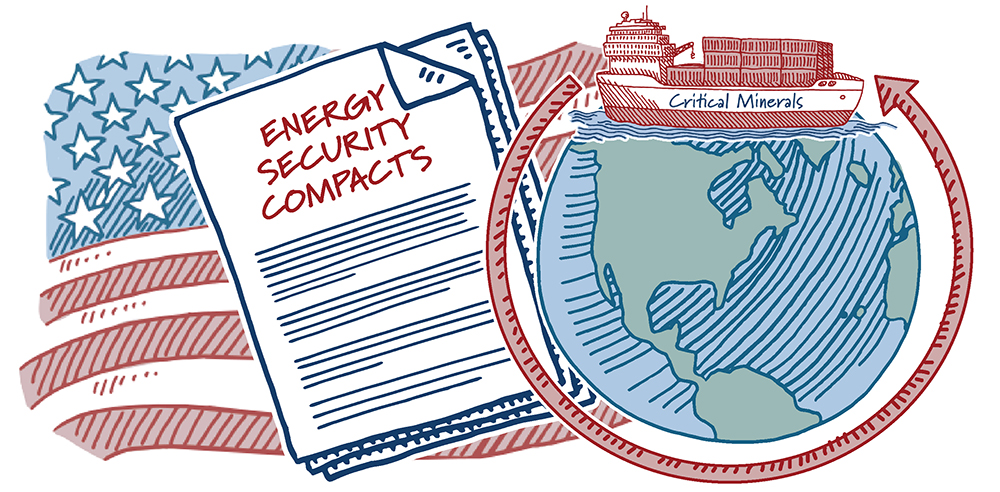

American energy dominance is built on a foundation where U.S. technologies, materials and standards lead in global markets. Congress’ reauthorization of the U.S. Development Finance Corporation (DFC) in the December 2025 National Defense Authorization Act (NDAA) will help unlock private capital for strategic energy and industrial projects abroad. In 2026, Congress can further enhance America’s global market leadership by:

- Reauthorizing and enhancing the Export-Import Bank of the United States (EXIM) to strengthen its ability to pursue large-scale, American-made energy infrastructure projects, including advanced nuclear. EXIM’s charter is set to expire at the end of 2026. Three ways to strengthen EXIM include: establishing a National Interest Account that modernizes EXIM’s risk assessment framework, raising the Bank’s default rate cap and expanding the list of eligible energy technologies under its China and Transformational Exports Program (CTEP) to better focus EXIM’s investments on national strategic objectives.

- Establishing a framework for Energy Security Compacts (ESCs), as proposed by the DOMINANCE Act, to create the coordinated, whole-of-government approach needed to bolster U.S. energy exports, enhance national security and provide alternatives to Chinese and Russian energy investments in strategic partner nations. ESCs would create long-term agreements with clear, measurable outcomes targeting energy security and infrastructure. They would also enhance coordination across federal authorities and multiply capabilities at EXIM, DFC, the U.S. Trade and Development Agency (USTDA), the Millennium Challenge Corporation (MCC) and the Department of Energy (DOE). ESCs could also help foster bilateral partnerships that focus on joint energy and critical minerals security priorities centered on American foreign policy goals.

In order for America to lead the world and strengthen its economy and national security, we need policies designed for speed, certainty and scale. We look forward to working to secure effective, durable solutions to let America innovate here, build here and sell everywhere.